- Switzerland

- /

- Machinery

- /

- SWX:BCHN

These 4 Measures Indicate That Burckhardt Compression Holding (VTX:BCHN) Is Using Debt Safely

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Burckhardt Compression Holding AG (VTX:BCHN) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Burckhardt Compression Holding

How Much Debt Does Burckhardt Compression Holding Carry?

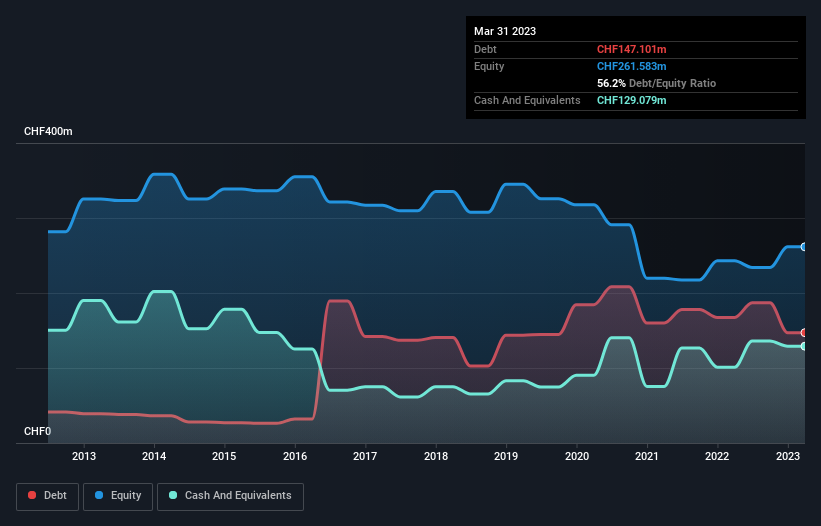

As you can see below, Burckhardt Compression Holding had CHF147.1m of debt at March 2023, down from CHF167.4m a year prior. However, it does have CHF129.1m in cash offsetting this, leading to net debt of about CHF18.0m.

A Look At Burckhardt Compression Holding's Liabilities

We can see from the most recent balance sheet that Burckhardt Compression Holding had liabilities of CHF517.8m falling due within a year, and liabilities of CHF161.2m due beyond that. Offsetting this, it had CHF129.1m in cash and CHF308.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CHF241.1m.

Of course, Burckhardt Compression Holding has a market capitalization of CHF1.77b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Burckhardt Compression Holding has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Burckhardt Compression Holding's net debt is only 0.13 times its EBITDA. And its EBIT covers its interest expense a whopping 46.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Burckhardt Compression Holding grew its EBIT by 50% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Burckhardt Compression Holding's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Burckhardt Compression Holding actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that Burckhardt Compression Holding's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. It looks Burckhardt Compression Holding has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Burckhardt Compression Holding you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Burckhardt Compression Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BCHN

Burckhardt Compression Holding

Manufactures and sells reciprocating compressor technologies worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)