Stock Analysis

- Switzerland

- /

- Software

- /

- SWX:TEMN

Swiss Growth Leaders With High Insider Stakes On SIX Swiss Exchange

Reviewed by Simply Wall St

Amidst a generally positive backdrop in the Switzerland market, with recent optimism fueled by anticipated interest rate cuts from major central banks including the Federal Reserve, investors are closely watching how different sectors and companies respond to these macroeconomic signals. In this context, growth companies with high insider ownership on the SIX Swiss Exchange offer a unique lens through which to gauge commitment and confidence from those most intimately acquainted with their operations.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| VAT Group (SWX:VACN) | 10.2% | 20.1% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.7% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9% |

| Kudelski (SWX:KUD) | 37.5% | 106.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Arbonia (SWX:ARBN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arbonia AG is a company that supplies building components across Switzerland, Germany, and other international markets, with a market capitalization of approximately CHF 862.73 million.

Operations: The company's revenue is primarily generated from its Doors segment, including sanitary equipment, which contributed CHF 501.56 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 100.1% p.a.

Arbonia is poised for notable growth, with revenue expected to increase by 9% annually, outpacing the Swiss market's 4.4%. The company is also forecasted to achieve profitability within three years, featuring a significant earnings growth rate of approximately 100.06% per year. However, its projected Return on Equity of 3.8% could be considered low. Despite these promising financial metrics, there has been no substantial insider trading activity in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Arbonia.

- Upon reviewing our latest valuation report, Arbonia's share price might be too optimistic.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG specializes in the manufacture and sale of trains across various regions including Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, and the CIS countries, with a market capitalization of approximately CHF 2.60 billion.

Operations: Stadler Rail AG's revenue is primarily derived from three segments: Rolling Stock, which generated CHF 3.12 billion, Service & Components with CHF 767.55 million, and Signalling at CHF 103 million.

Insider Ownership: 14.5%

Earnings Growth Forecast: 23.1% p.a.

Stadler Rail is set to outperform with its forecasted revenue growth of 7.7% annually, surpassing the Swiss market's 4.4%. Its price-to-earnings ratio stands at 21x, slightly below the market average of 21.5x, suggesting good value. Impressively, earnings are expected to surge by 23.1% annually over the next three years, a rate that exceeds the broader Swiss market's growth of 8.3%. However, Stadler Rail has an unstable dividend track record and lacks recent insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Stadler Rail.

- According our valuation report, there's an indication that Stadler Rail's share price might be on the expensive side.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.75 billion.

Operations: The company generates revenue by providing integrated banking software systems to financial institutions globally.

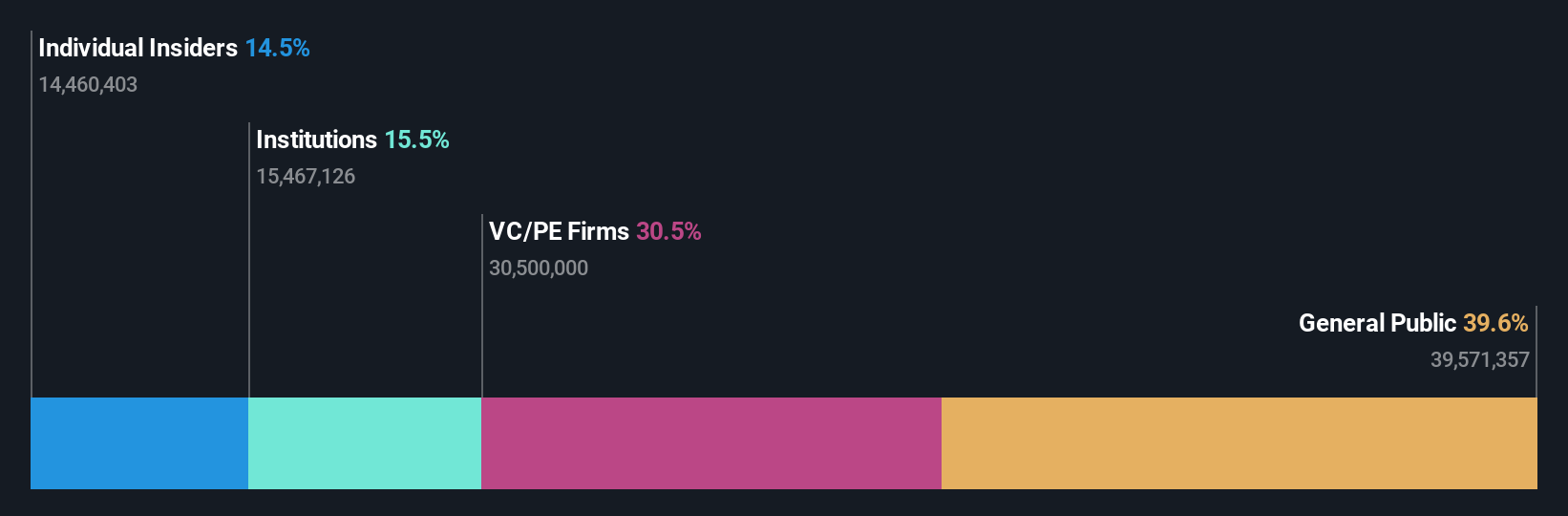

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.7% p.a.

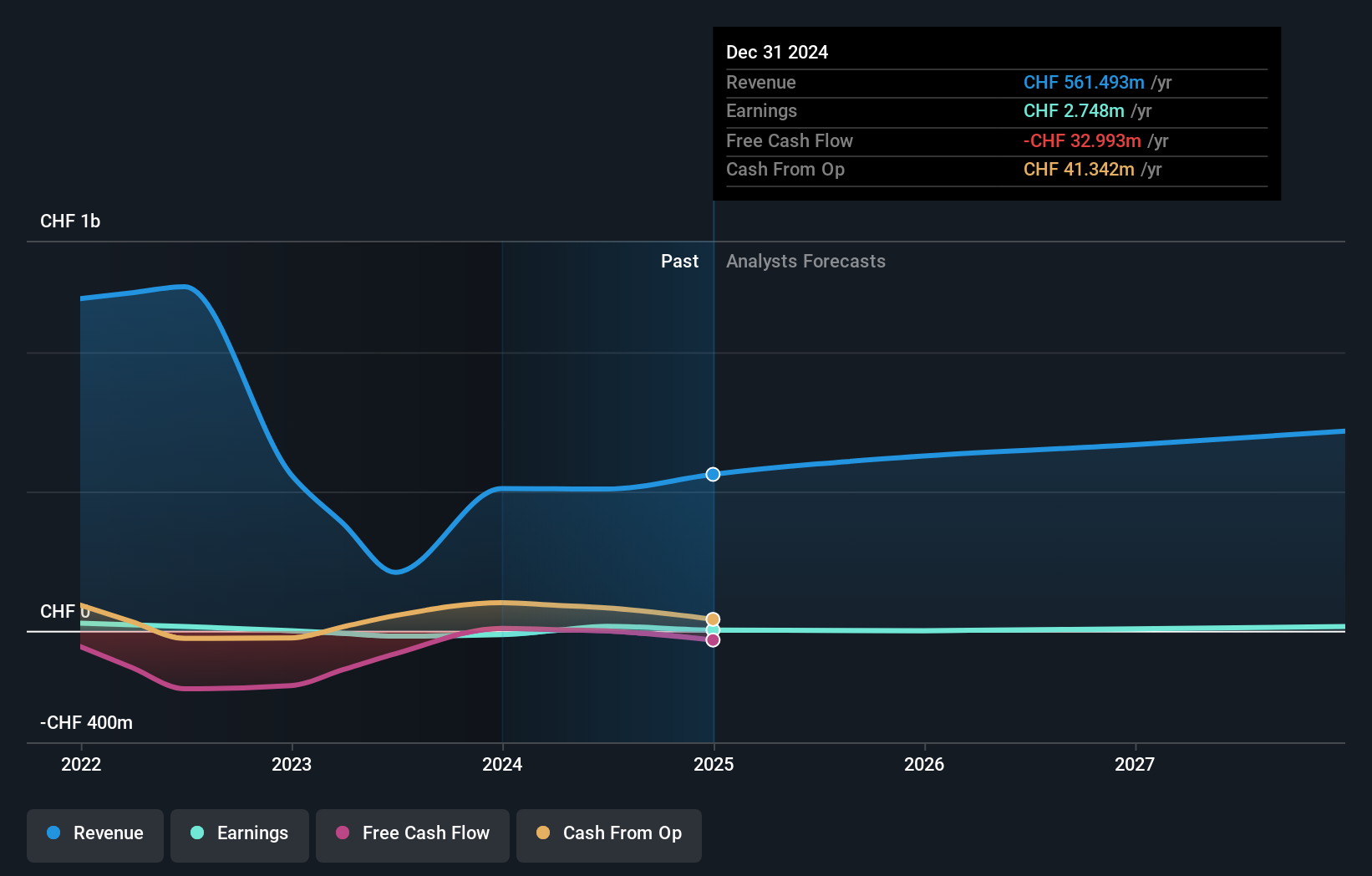

Temenos, a Swiss-based company, is experiencing robust earnings growth with a 16.2% increase over the past year and forecasts suggesting further expansion at 14.65% annually. Despite trading below its estimated fair value by 21.7%, it contends with high debt levels and a volatile share price. Recent strategic moves include significant client acquisitions like Haventree Bank and PC Financial®, leveraging its cloud-native SaaS solutions for digital transformations in banking, which aligns with its revenue growth projections outpacing the Swiss market's average.

- Dive into the specifics of Temenos here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Temenos' share price might be too pessimistic.

Seize The Opportunity

- Reveal the 16 hidden gems among our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Temenos is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide.

Reasonable growth potential with proven track record and pays a dividend.