Stock Analysis

- Switzerland

- /

- Transportation

- /

- SWX:JFN

Exploring Undiscovered Swiss Stocks With Potential In July 2024

Reviewed by Simply Wall St

The Switzerland stock market exhibited a generally positive trend on Wednesday, buoyed by the anticipation of interest rate cuts from major central banks, including the Federal Reserve. This optimism helped the benchmark SMI index to close up by 73 points or 0.6%, demonstrating a robust economic sentiment that could favor further exploration of lesser-known Swiss stocks with potential growth opportunities in July 2024. In such an upbeat market environment, identifying stocks with strong fundamentals and potential for growth becomes particularly compelling.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| Burkhalter Holding | 59.92% | 17.59% | 21.59% | ★★★★★☆ |

| SKAN Group | 3.57% | 40.44% | 22.38% | ★★★★★☆ |

| naturenergie holding | 9.95% | 16.32% | 40.54% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

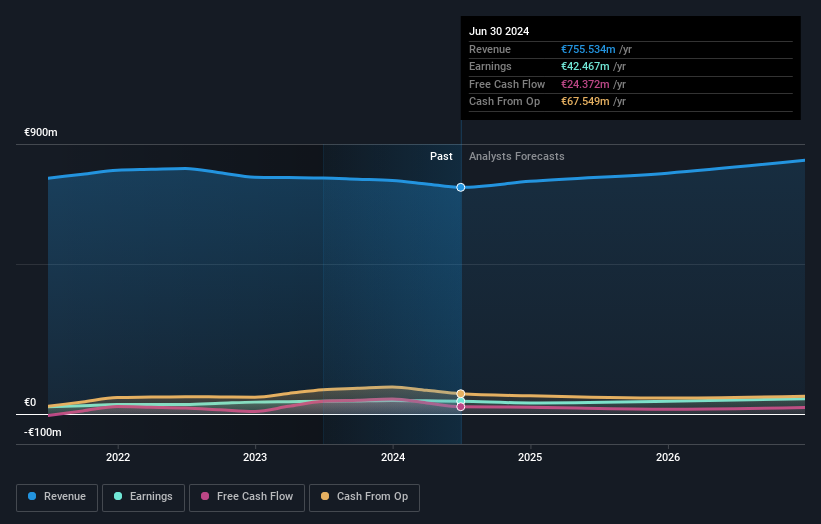

Overview: Jungfraubahn Holding AG, together with its subsidiaries, operates cogwheel railway and winter sports related facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF 1.12 billion.

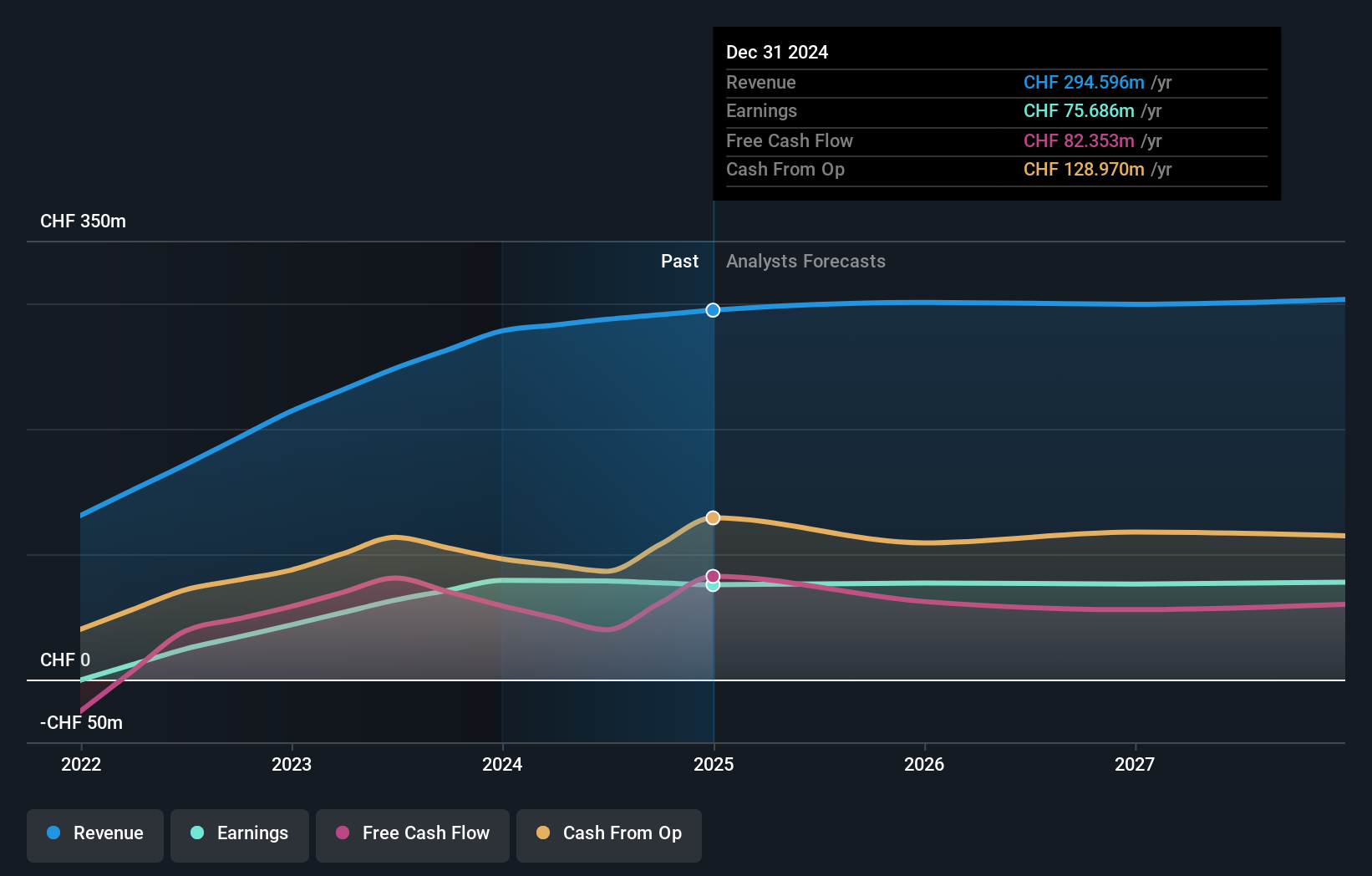

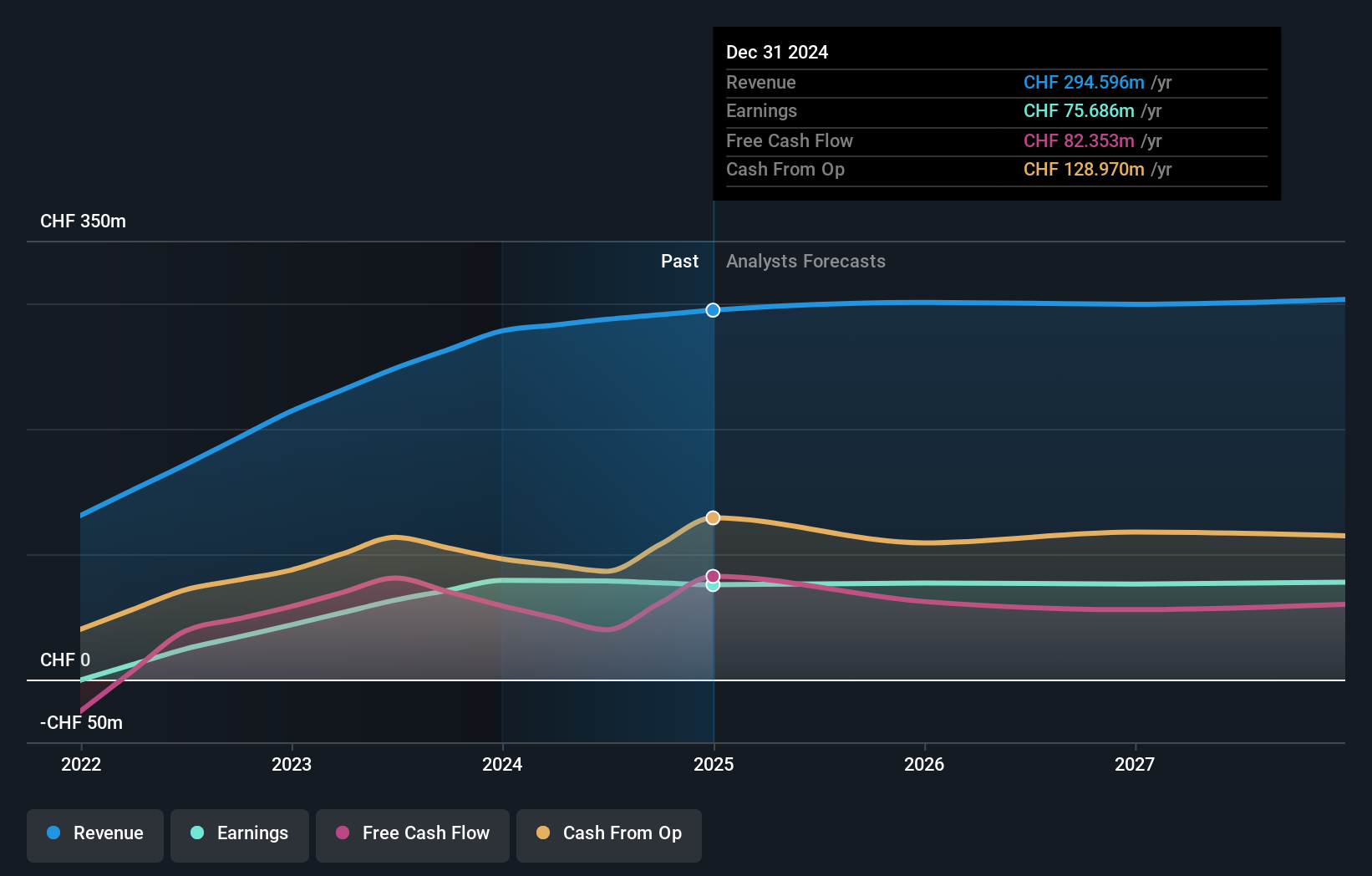

Operations: Jungfraubahn Holding generates significant revenue from its "Jungfraujoch - TOP of Europe" segment, contributing CHF 188.24 million, alongside other key segments like "Experience Mountains" and "Winter Sports." The company's gross profit margin has shown a notable increase over the years, reaching 69.65% by the end of 2023.

Jungfraubahn Holding, a lesser-known gem in Switzerland, stands out with its robust 81.6% earnings growth over the past year, significantly outpacing the Transportation industry's -8.6%. With a Price-To-Earnings ratio of 14.2x—well below the Swiss market average of 21.5x—Jungfraubahn offers apparent value. The company's net debt to equity ratio has risen from 7.4% to 17.7%, yet remains within satisfactory limits at 13%. This financial prudence is complemented by positive free cash flow and an interest coverage that well exceeds obligations, painting a picture of solid fiscal health and potential for sustained growth.

- Unlock comprehensive insights into our analysis of Jungfraubahn Holding stock in this health report.

Understand Jungfraubahn Holding's track record by examining our Past report.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, together with its subsidiaries, operates cogwheel railway and winter sports related facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF 1.12 billion.

Operations: Jungfraubahn Holding generates significant revenue from its "Jungfraujoch - TOP of Europe" segment, contributing CHF 188.24 million, alongside other key segments like "Experience Mountains" and "Winter Sports." The company's gross profit margin has shown a notable increase over the years, reaching 69.65% by the end of 2023.

Jungfraubahn Holding, a lesser-known gem in Switzerland, stands out with its robust 81.6% earnings growth over the past year, significantly outpacing the Transportation industry's -8.6%. With a Price-To-Earnings ratio of 14.2x—well below the Swiss market average of 21.5x—Jungfraubahn offers apparent value. The company's net debt to equity ratio has risen from 7.4% to 17.7%, yet remains within satisfactory limits at 13%. This financial prudence is complemented by positive free cash flow and an interest coverage that well exceeds obligations, painting a picture of solid fiscal health and potential for sustained growth.

- Unlock comprehensive insights into our analysis of Jungfraubahn Holding stock in this health report.

Understand Jungfraubahn Holding's track record by examining our Past report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Naturenergie Holding AG operates in the energy sector, focusing on producing, distributing, and selling electricity under the Naturenergie brand across Switzerland and internationally, with a market capitalization of CHF 1.29 billion.

Operations: Focusing on renewable generation infrastructure and customer-oriented energy solutions, the company generates significant revenue, with these segments collectively bringing in over €2.48 billion. Their business model emphasizes sustainability while addressing market-specific energy needs, supported by a consistent gross profit margin averaging around 20% in recent years.

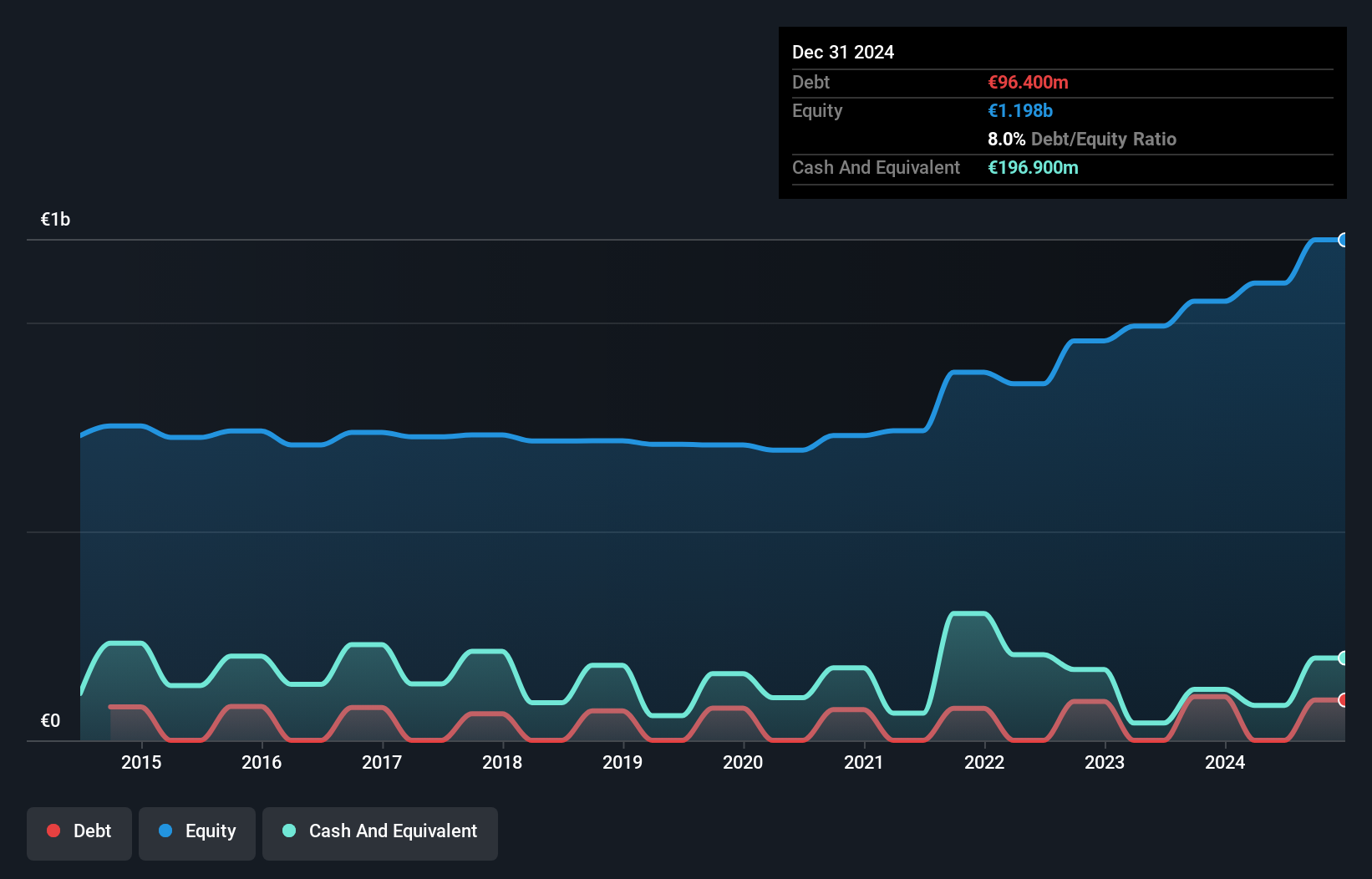

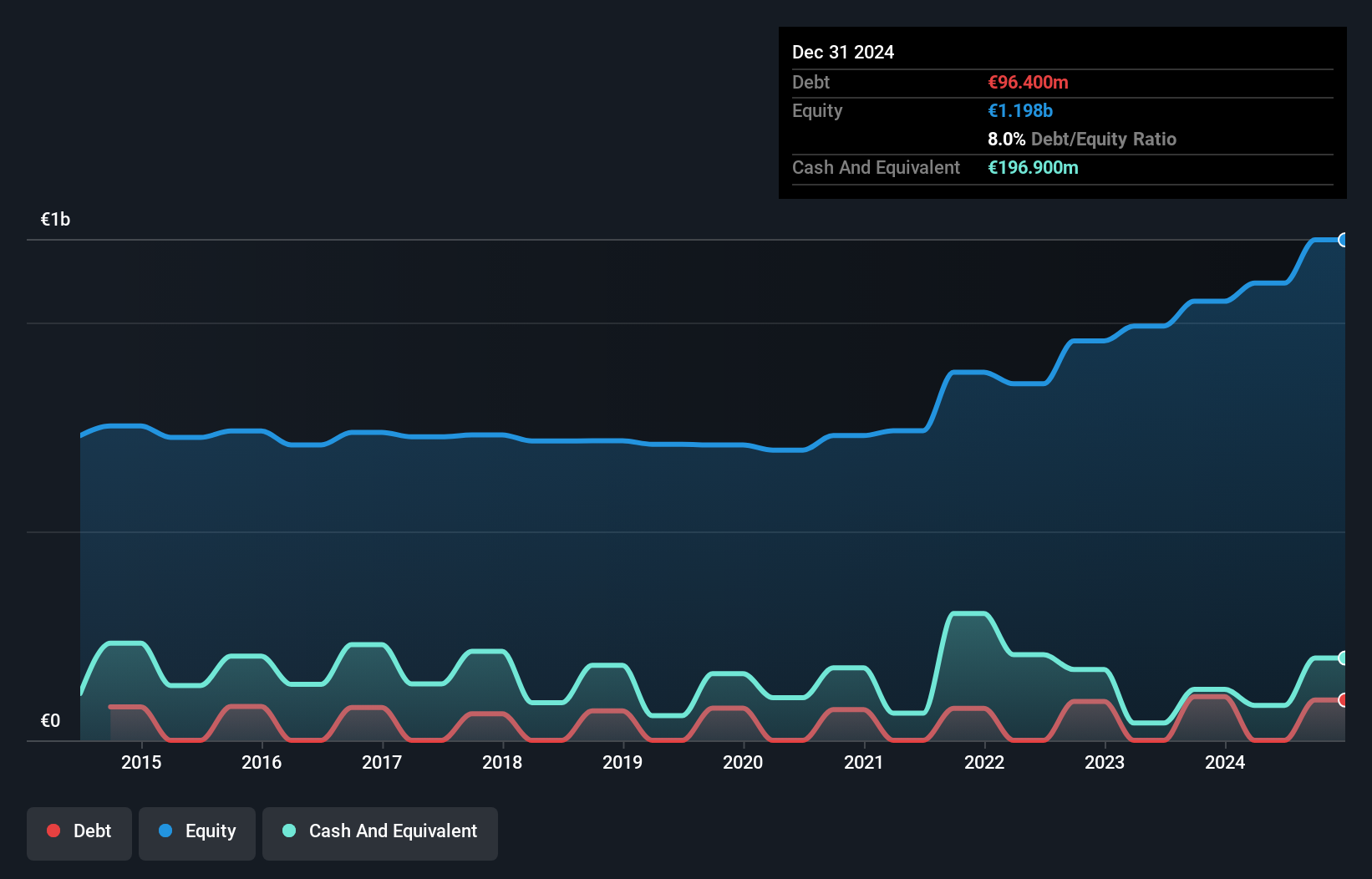

Naturenergie Holding AG, a lesser-tapped gem in Switzerland's energy sector, showcases robust financial health and promising growth prospects. With earnings growth outpacing the industry at 8.1% last year against the sector’s 7.8%, it also boasts high-quality earnings. Impressively, its debt to equity ratio slightly rose from 9.8% to 10% over five years, reflecting prudent financial management. Trading at a striking 69.3% below estimated fair value, NEAG offers significant upside potential amidst its strategic market positioning.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Naturenergie Holding AG operates in the energy sector, focusing on producing, distributing, and selling electricity under the Naturenergie brand across Switzerland and internationally, with a market capitalization of CHF 1.29 billion.

Operations: Focusing on renewable generation infrastructure and customer-oriented energy solutions, the company generates significant revenue, with these segments collectively bringing in over €2.48 billion. Their business model emphasizes sustainability while addressing market-specific energy needs, supported by a consistent gross profit margin averaging around 20% in recent years.

Naturenergie Holding AG, a lesser-tapped gem in Switzerland's energy sector, showcases robust financial health and promising growth prospects. With earnings growth outpacing the industry at 8.1% last year against the sector’s 7.8%, it also boasts high-quality earnings. Impressively, its debt to equity ratio slightly rose from 9.8% to 10% over five years, reflecting prudent financial management. Trading at a striking 69.3% below estimated fair value, NEAG offers significant upside potential amidst its strategic market positioning.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phoenix Mecano AG is a global manufacturer specializing in components for industrial applications, with a market capitalization of CHF 472.75 million.

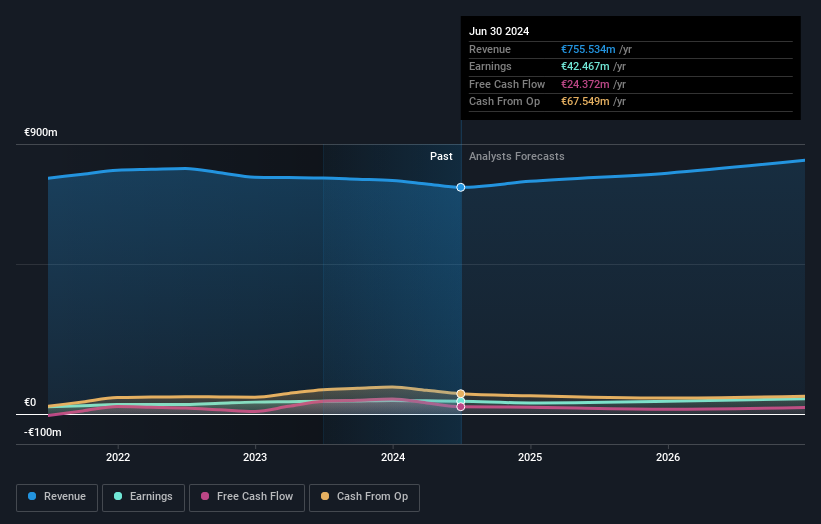

Operations: Phoenix Mecano's business model revolves around three primary revenue streams: Enclosure Systems, Industrial Components, and Dewertokin Technology Group, generating €231.16 million, €223.58 million, and €335.80 million respectively. The company's gross profit margin as of the latest reporting period stands at 52.09%.

Phoenix Mecano, a lesser-known yet robust performer in Switzerland's industrial sector, has demonstrated notable financial and operational strength. In 2023, the company reported a revenue of €778 million and net income growth to €45 million, up from €40 million the previous year. This reflects an earnings growth of 14.1%, surpassing the electrical industry's average decline of 1.7%. Additionally, Phoenix Mecano declared a substantial dividend increase at its recent AGM, with payouts totaling CHF 30 per share. The firm's debt-to-equity ratio rose to 45.5% over five years but is well-managed with EBIT covering interest payments by 34.7 times, indicating strong profitability and financial health.

- Get an in-depth perspective on Phoenix Mecano's performance by reading our health report here.

Explore historical data to track Phoenix Mecano's performance over time in our Past section.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phoenix Mecano AG is a global manufacturer specializing in components for industrial applications, with a market capitalization of CHF 472.75 million.

Operations: Phoenix Mecano's business model revolves around three primary revenue streams: Enclosure Systems, Industrial Components, and Dewertokin Technology Group, generating €231.16 million, €223.58 million, and €335.80 million respectively. The company's gross profit margin as of the latest reporting period stands at 52.09%.

Phoenix Mecano, a lesser-known yet robust performer in Switzerland's industrial sector, has demonstrated notable financial and operational strength. In 2023, the company reported a revenue of €778 million and net income growth to €45 million, up from €40 million the previous year. This reflects an earnings growth of 14.1%, surpassing the electrical industry's average decline of 1.7%. Additionally, Phoenix Mecano declared a substantial dividend increase at its recent AGM, with payouts totaling CHF 30 per share. The firm's debt-to-equity ratio rose to 45.5% over five years but is well-managed with EBIT covering interest payments by 34.7 times, indicating strong profitability and financial health.

- Get an in-depth perspective on Phoenix Mecano's performance by reading our health report here.

Explore historical data to track Phoenix Mecano's performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 19 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Jungfraubahn Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Solid track record with adequate balance sheet and pays a dividend.