Stock Analysis

- Switzerland

- /

- Building

- /

- SWX:ARBN

High Insider Ownership Growth Companies On SIX Swiss Exchange In June 2024

Reviewed by Simply Wall St

Over the past year, the Switzerland market has shown a modest rise of 4.1%, with a stable performance in the most recent week and an expected annual earnings growth of 8.2%. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate that those closest to the company are confident in its future growth and success.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

| HOCHDORF Holding (SWX:HOCN) | 20.7% | 103% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's dive into some prime choices out of from the screener.

Arbonia (SWX:ARBN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arbonia AG is a company that supplies building components in Switzerland, Germany, and other international markets, with a market capitalization of approximately CHF 891.86 million.

Operations: The company generates revenue primarily through its Doors segment, including sanitary equipment, which reported CHF 501.56 million in sales.

Insider Ownership: 28.8%

Earnings Growth Forecast: 100.1% p.a.

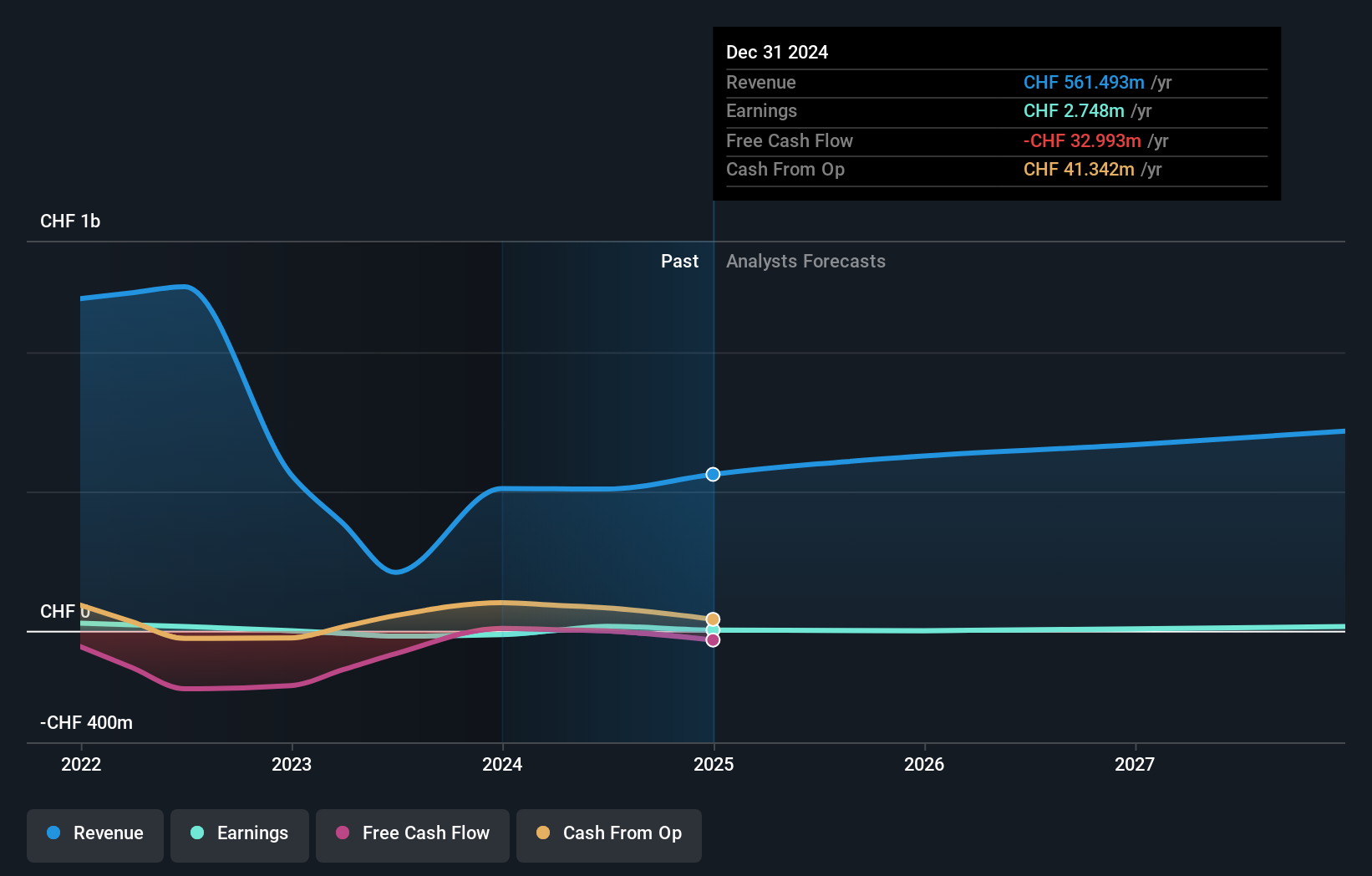

Arbonia is poised for significant growth, with earnings projected to increase substantially at a rate of 100.06% annually. This Swiss company's revenue growth, at 9% per year, is expected to outpace the general market's 4.4%. Although Arbonia is forecasted to become profitable within three years, its return on equity is anticipated to remain low at 3.8%. There has been no notable insider trading activity in the past three months. Recently, Arbonia presented at the Stifel Swiss Equities Conference in Interlaken on June 11, 2024.

- Click to explore a detailed breakdown of our findings in Arbonia's earnings growth report.

- Our expertly prepared valuation report Arbonia implies its share price may be too high.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that specializes in providing integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.42 billion.

Operations: The company generates its revenue by marketing and selling integrated banking software systems to financial institutions globally.

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.7% p.a.

Temenos, a growth-oriented Swiss company with high insider ownership, is expected to see its earnings grow by 14.7% annually, outpacing the broader Swiss market. Despite a forecasted revenue growth of 7.6% per year, this lags behind the more aggressive growth rates seen in some sectors. The company's return on equity is projected to be robust at 25.9% in three years. Recently, Temenos announced a CHF 200 million share buyback program and showcased significant advancements in its cloud-native banking platform's sustainability and efficiency through partnerships with Microsoft Azure.

- Unlock comprehensive insights into our analysis of Temenos stock in this growth report.

- Our expertly prepared valuation report Temenos implies its share price may be lower than expected.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally. The company has a market capitalization of approximately CHF 15.15 billion.

Operations: VAT Group AG generates CHF 782.74 million from its Valves segment and CHF 172.87 million from its Global Service operations.

Insider Ownership: 10.2%

Earnings Growth Forecast: 21.2% p.a.

VAT Group, a Swiss company with high insider ownership, is poised for substantial growth with earnings expected to increase by 21.2% annually, significantly outstripping the Swiss market's 8.2%. Although revenue growth is forecasted at 15.5% per year, slightly below the high-growth benchmark of 20%, it still surpasses the market average of 4.4%. The company's return on equity is also anticipated to be impressive at 39.1% in three years, despite a highly volatile share price recently.

- Delve into the full analysis future growth report here for a deeper understanding of VAT Group.

- Our valuation report unveils the possibility VAT Group's shares may be trading at a premium.

Summing It All Up

- Click here to access our complete index of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Arbonia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ARBN

Arbonia

Engages in the supply of building components in Switzerland, Germany, and internationally.

Reasonable growth potential with adequate balance sheet.