- Switzerland

- /

- Semiconductors

- /

- SWX:UBXN

The Market Doesn't Like What It Sees From u-blox Holding AG's (VTX:UBXN) Revenues Yet

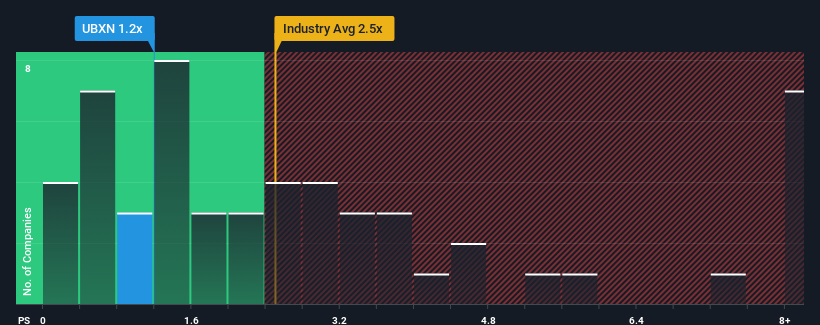

When you see that almost half of the companies in the Semiconductor industry in Switzerland have price-to-sales ratios (or "P/S") above 2.5x, u-blox Holding AG (VTX:UBXN) looks to be giving off some buy signals with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for u-blox Holding

How Has u-blox Holding Performed Recently?

u-blox Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on u-blox Holding will help you uncover what's on the horizon.How Is u-blox Holding's Revenue Growth Trending?

In order to justify its P/S ratio, u-blox Holding would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.5%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 73% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.5% per annum during the coming three years according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 15% per year, which paints a poor picture.

With this information, we are not surprised that u-blox Holding is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On u-blox Holding's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that u-blox Holding maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, u-blox Holding's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for u-blox Holding that you should be aware of.

If these risks are making you reconsider your opinion on u-blox Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if u-blox Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBXN

u-blox Holding

Develops, manufactures, and markets products and services supporting GPS/GNSS satellite positioning systems for the automotive and transport, healthcare, asset tracking and management, industrial automation and monitoring, and consumer markets.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives