- Switzerland

- /

- Electrical

- /

- SWX:ACLN

Will Accelleron's (SWX:ACLN) Reaffirmed Growth Outlook Reshape Its Long-Term Investment Narrative?

Reviewed by Simply Wall St

- Accelleron Industries AG recently reaffirmed its 2025 earnings guidance, expecting constant-currency revenue growth between 16% and 19% for the year.

- This confirmation from management underscores continued optimism about robust demand and the company’s momentum in its key industrial end markets.

- We'll now explore how Accelleron's reaffirmed expectations for strong revenue growth may shape the company's longer-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Accelleron Industries Investment Narrative Recap

For shareholders in Accelleron Industries, the core belief hinges on sustained demand for high-speed turbochargers and marine retrofit solutions, supported by strong regulatory and decarbonization trends. The reaffirmed 2025 revenue growth guidance may reinforce confidence in ongoing sales momentum, though it doesn’t materially reduce the most important risk: a potential slowdown in marine regulatory upgrades or sharper shifts in propulsion technology that could erode long-term service revenues.

Among recent announcements, Accelleron's latest half-year earnings reported in August 2025 showed year-over-year sales and net income growth, an outcome largely enabled by the same robust end-market demand reflected in the revenue guidance confirmation. Together, these updates clarify that the main short-term catalyst, the regulatory-driven marine retrofit cycle, remains intact, but investors are still mindful that long-term growth assumptions depend on technology and regulatory shifts progressing as expected.

Yet, despite this optimism, the potential for accelerated adoption of zero-emission marine technologies could create headwinds which investors should be aware of as they ...

Read the full narrative on Accelleron Industries (it's free!)

Accelleron Industries' outlook anticipates $1.3 billion in revenue and $285.4 million in earnings by 2028. This projection requires 9.1% annual revenue growth and an increase of $115.3 million in earnings from the current $170.1 million.

Uncover how Accelleron Industries' forecasts yield a CHF65.82 fair value, a 5% downside to its current price.

Exploring Other Perspectives

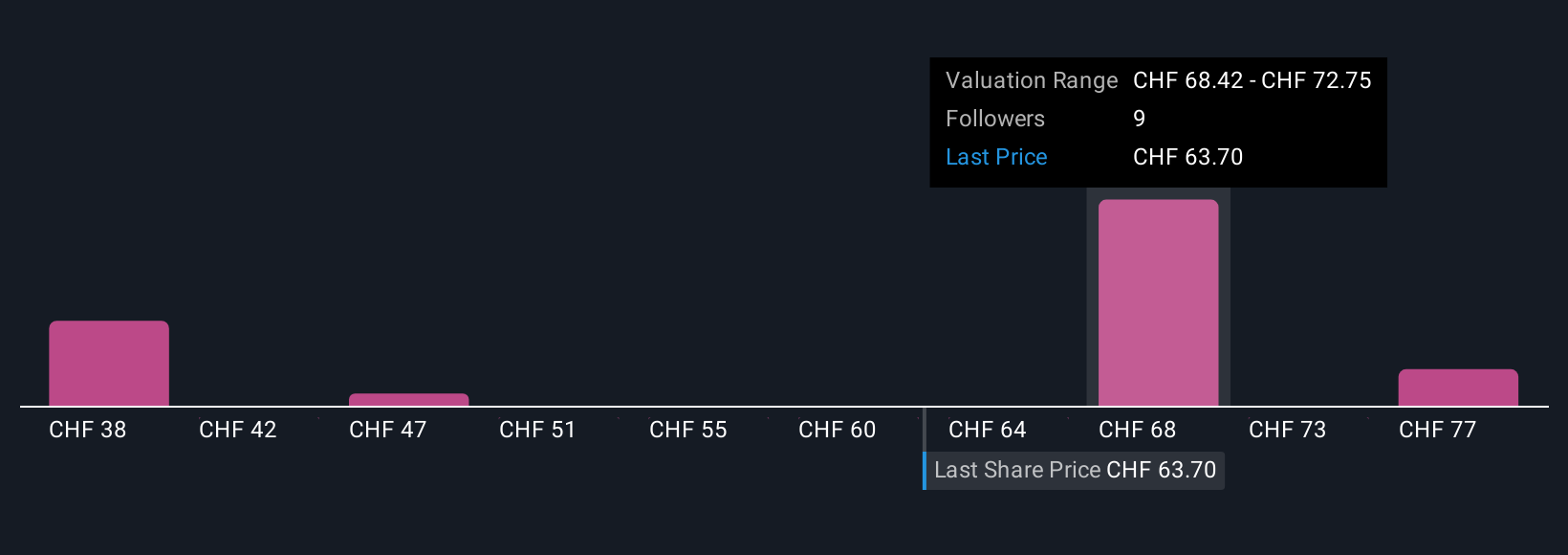

Five community fair value estimates for Accelleron span from CHF41.27 to CHF66.76, reflecting widely differing opinions among private investors on future returns. While many expect future growth to be supported by regulatory-driven demand, there is significant debate about how long those tailwinds can last, consider the implications of changing propulsion standards before making your own assessment.

Explore 5 other fair value estimates on Accelleron Industries - why the stock might be worth as much as CHF66.76!

Build Your Own Accelleron Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accelleron Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Accelleron Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accelleron Industries' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ACLN

Accelleron Industries

Designs, manufactures, sells, and services turbochargers, fuel injection equipment, and digital solutions for heavy-duty applications worldwide.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion