- Switzerland

- /

- Chemicals

- /

- SWX:CLN

Ascom Holding And 2 Other Top Dividend Stocks On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market shrugged off a mild mid-morning setback and moved higher on Tuesday to eventually end the day's session on a firm note. Investors digested a batch of earnings updates from Swiss companies and looked ahead to some key global economic data, and policy announcements from the Federal Reserve, the Bank of England and the Bank of Japan. In this environment, dividend stocks can offer stability and income potential for investors. This article will explore Ascom Holding and two other top dividend stocks listed on the SIX Swiss Exchange that may be worth considering.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.20% | ★★★★★★ |

| Compagnie Financière Tradition (SWX:CFT) | 4.21% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.34% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.43% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.39% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.79% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.41% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.29% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.66% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Ascom Holding (SWX:ASCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ascom Holding AG, with a market cap of CHF226.28 million, offers healthcare ICT and mobile workflow solutions globally through its subsidiaries.

Operations: Ascom Holding AG generates revenue primarily from its Wireless Solutions segment, which accounts for CHF297.30 million.

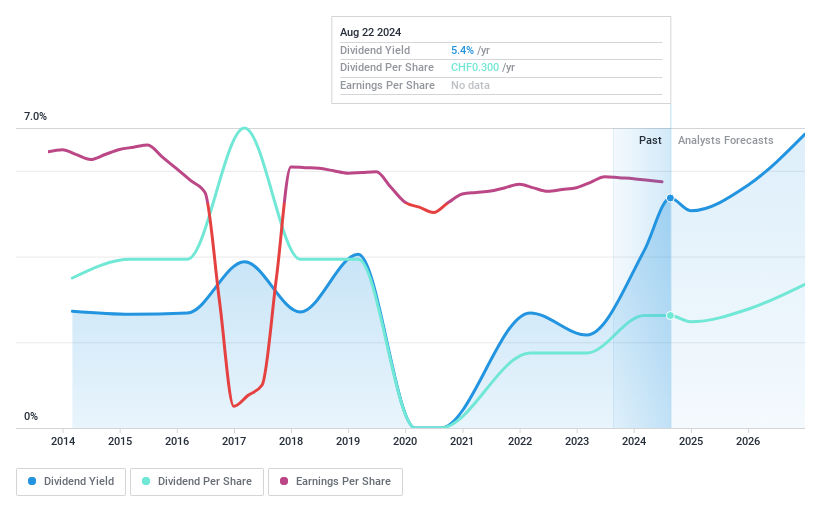

Dividend Yield: 4.8%

Ascom Holding's dividend yield of 4.76% places it in the top 25% of Swiss dividend payers, but its dividends have been volatile and declining over the past decade. Despite this, the company's recent earnings growth of 58.2% and reasonable payout ratios (earnings: 61.9%, cash flows: 66.1%) suggest dividends are currently sustainable. The launch of Ascom Activity Monitoring aligns with its strategy to capture market share in long-term care solutions, potentially supporting future profitability and dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Ascom Holding.

- The analysis detailed in our Ascom Holding valuation report hints at an deflated share price compared to its estimated value.

Clariant (SWX:CLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clariant AG is a global company involved in the development, manufacture, distribution, and sale of specialty chemicals, with a market cap of CHF4.39 billion.

Operations: Clariant AG generates revenue from three main segments: Catalysis (CHF1.00 billion), Care Chemicals (CHF2.32 billion), and Adsorbents & Additives (CHF1.06 billion).

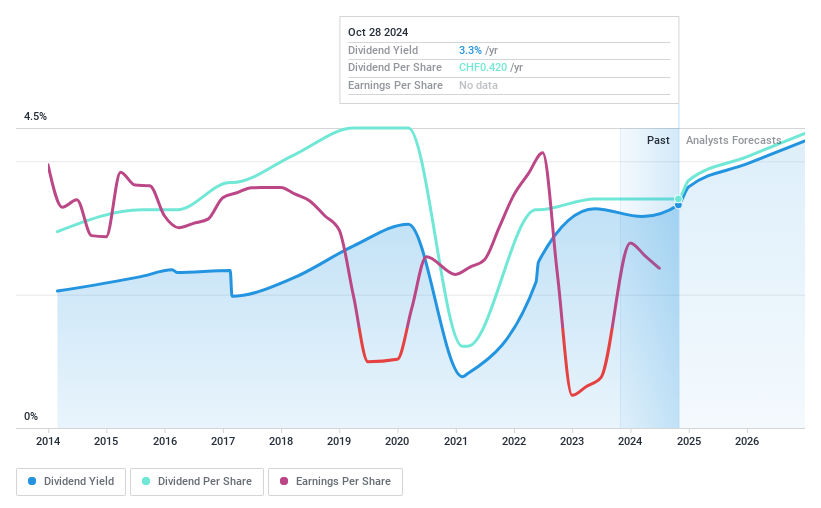

Dividend Yield: 3.1%

Clariant's half-year earnings showed a decline, with sales at CHF 2.07 billion and net income at CHF 176 million. The company expects flat to low single-digit sales growth for 2024. Despite an unstable dividend history, Clariant's dividends are covered by earnings (82.2% payout ratio) and cash flows (64.2% cash payout ratio). Its P/E ratio of 26.2x is below the industry average, indicating good value, though its dividend yield of 3.14% remains lower than top-tier Swiss payers.

- Navigate through the intricacies of Clariant with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Clariant shares in the market.

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to the local population and small to mid-sized companies in the Cantons of St. Gallen, with a market cap of CHF2.62 billion.

Operations: St. Galler Kantonalbank AG generates revenue primarily through its banking products and services targeted at residents and small to mid-sized enterprises within the Cantons of St. Gallen.

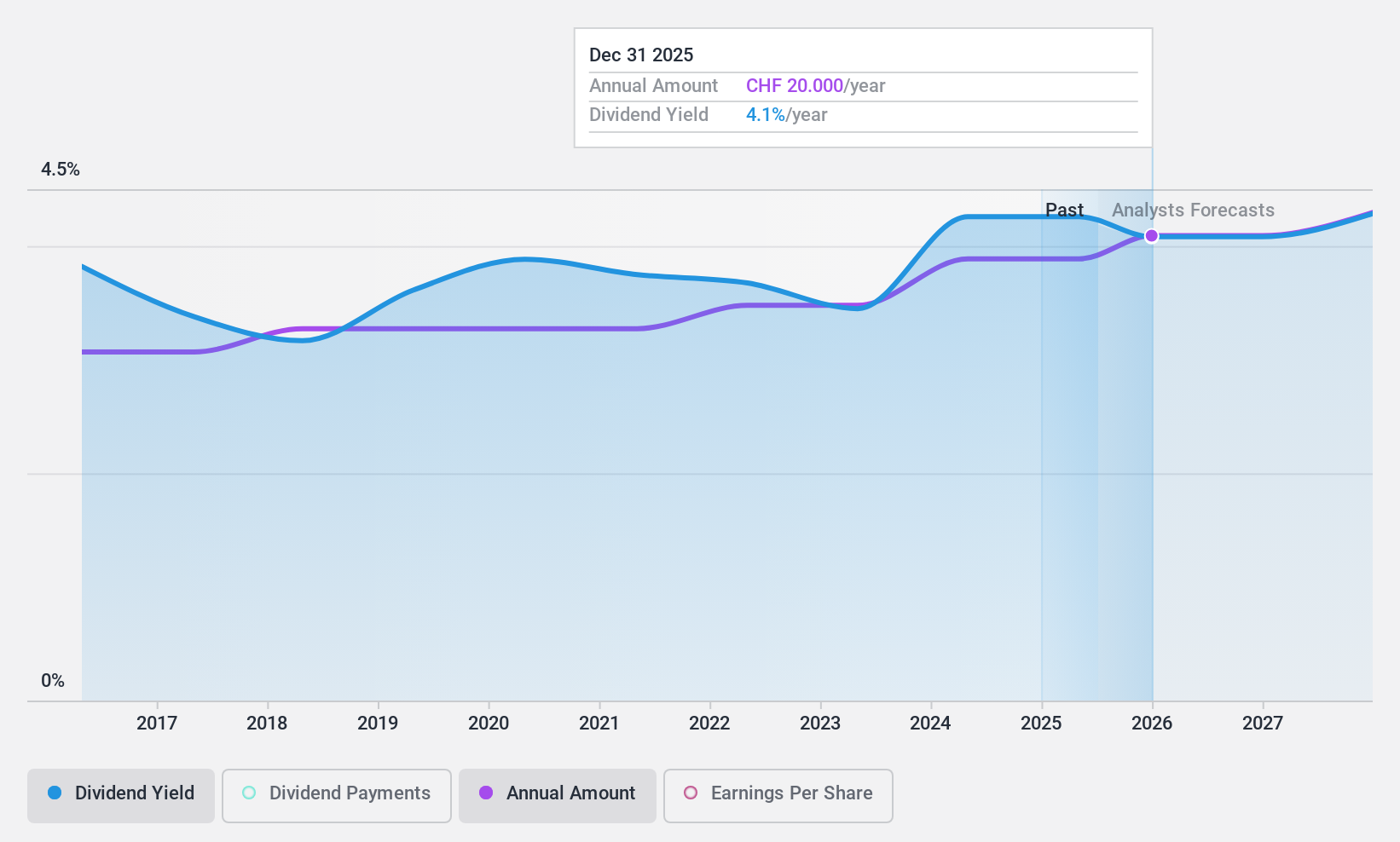

Dividend Yield: 4.3%

St. Galler Kantonalbank's dividend yield of 4.34% ranks it among the top 25% in the Swiss market. Its dividends have been stable and growing over the past decade, with a current payout ratio of 54.9%, ensuring they are well covered by earnings. The bank's earnings grew by 12.8% last year, and its stock is trading at a significant discount to its estimated fair value, enhancing its appeal for dividend investors seeking reliable returns.

- Delve into the full analysis dividend report here for a deeper understanding of St. Galler Kantonalbank.

- Our comprehensive valuation report raises the possibility that St. Galler Kantonalbank is priced lower than what may be justified by its financials.

Next Steps

- Click here to access our complete index of 26 Top SIX Swiss Exchange Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Engages in the development, manufacture, distribution, and sale of specialty chemicals worldwide.

Adequate balance sheet and fair value.