- Switzerland

- /

- Banks

- /

- SWX:SGKN

3 Dividend Stocks On SIX Swiss Exchange Yielding Up To 5.3%

Reviewed by Simply Wall St

The Switzerland market ended on a strong note on Wednesday, buoyed by encouraging global economic data and optimism about a potential interest rate cut by the Federal Reserve. The benchmark SMI gained 1.2%, reflecting investor confidence across various sectors. In such a positive market environment, dividend stocks can be particularly attractive for investors seeking both income and stability. Here are three dividend stocks on the SIX Swiss Exchange that offer yields of up to 5.3%.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.24% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.61% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.28% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.83% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.64% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.38% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.67% | ★★★★★☆ |

| Berner Kantonalbank (SWX:BEKN) | 4.26% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.14 billion.

Operations: Compagnie Financière Tradition SA generates revenue from various regions, including CHF350.89 million from the Americas, CHF271.44 million from Asia-Pacific, and CHF431.78 million from Europe, Middle East and Africa.

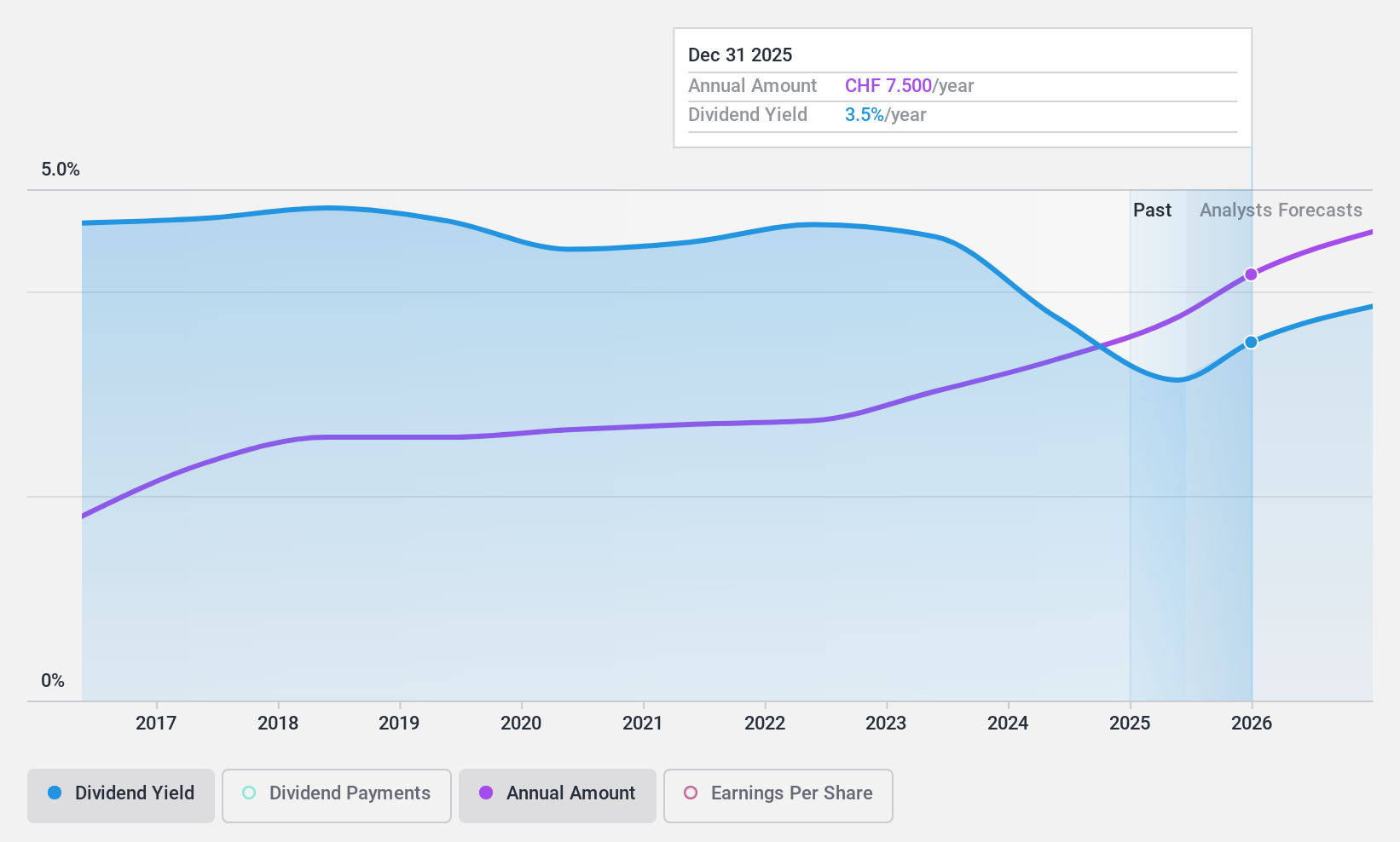

Dividend Yield: 4.1%

Compagnie Financière Tradition offers a reliable dividend yield of 4.08%, slightly below the top 25% of Swiss dividend payers. The company’s dividends have been stable and growing over the past decade, with a payout ratio of 47.2% and cash payout ratio of 40.8%, indicating strong coverage by both earnings and cash flows. However, shareholders experienced dilution in the past year, which may impact future returns.

- Unlock comprehensive insights into our analysis of Compagnie Financière Tradition stock in this dividend report.

- Our valuation report unveils the possibility Compagnie Financière Tradition's shares may be trading at a discount.

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to the local population and small to medium-sized enterprises in the Cantons of St. Gallen, with a market cap of CHF2.54 billion.

Operations: St. Galler Kantonalbank AG generates revenue primarily from providing banking products and services to residents and SMEs in the Cantons of St. Gallen, with a market cap of CHF2.54 billion.

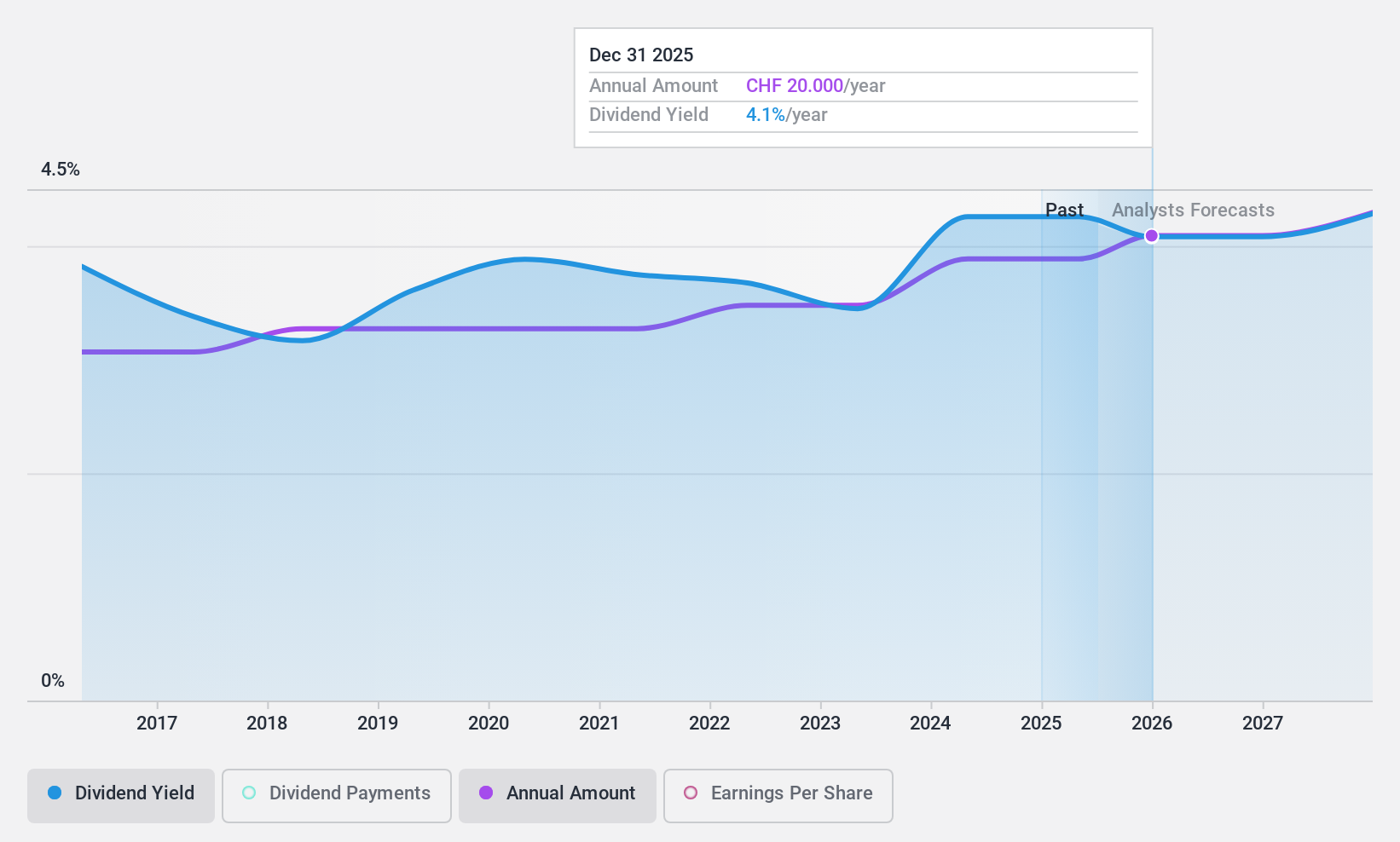

Dividend Yield: 4.5%

St. Galler Kantonalbank's dividend yield of 4.48% places it in the top 25% of Swiss dividend payers, with stable and increasing dividends over the past decade. The current payout ratio is 54.9%, indicating dividends are well-covered by earnings, and this coverage is expected to remain sustainable with a forecasted payout ratio of 50.2%. Additionally, the stock trades at a significant discount to its estimated fair value, enhancing its attractiveness for dividend investors.

- Dive into the specifics of St. Galler Kantonalbank here with our thorough dividend report.

- Upon reviewing our latest valuation report, St. Galler Kantonalbank's share price might be too pessimistic.

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG develops, manufactures, and distributes precision machine tools for various materials, with a market cap of CHF253.32 million.

Operations: StarragTornos Group AG generates revenue from developing, manufacturing, and distributing precision machine tools for milling, turning, boring, grinding, and machining of metal, composite materials, and ceramics.

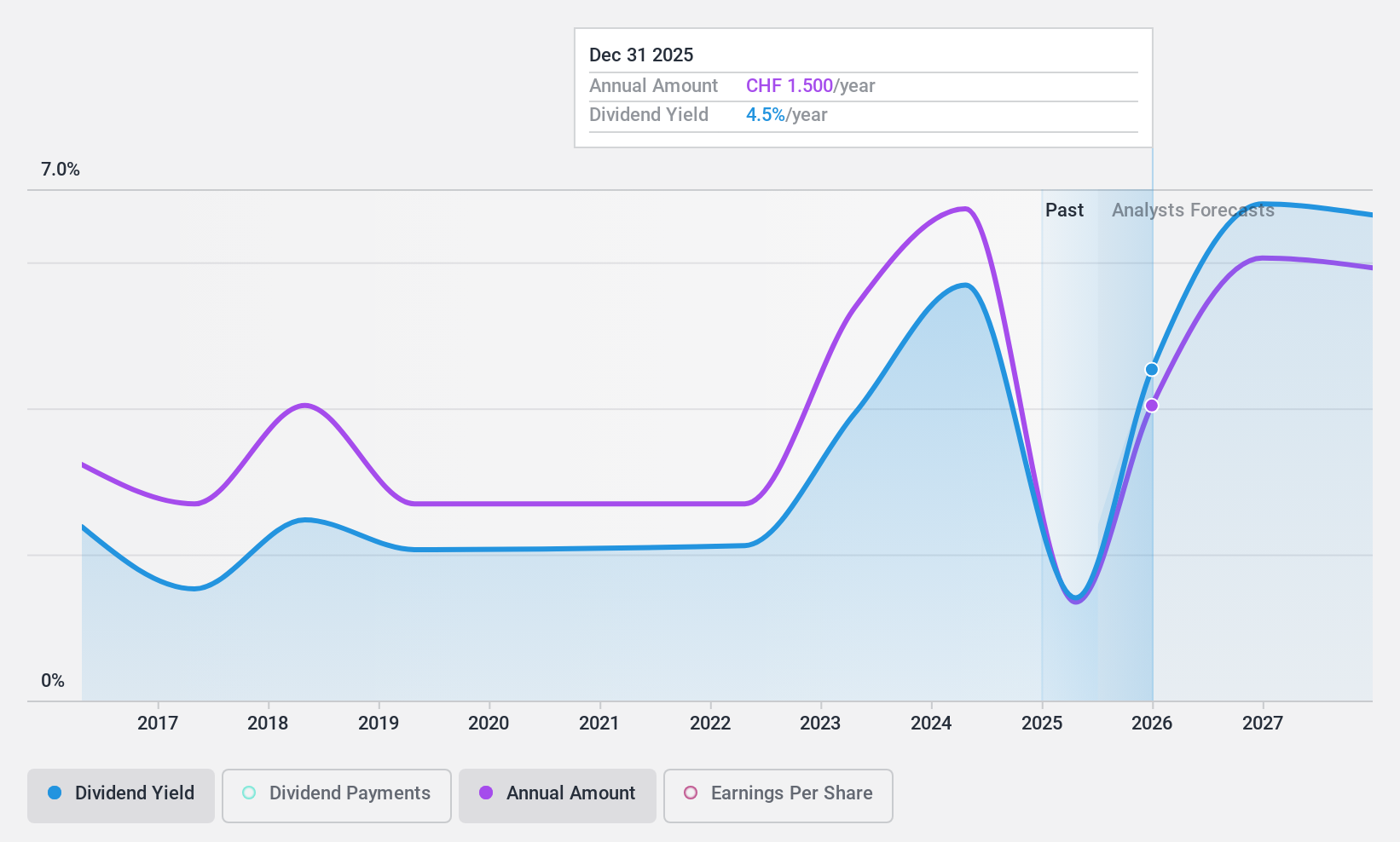

Dividend Yield: 5.4%

StarragTornos Group's dividend yield of 5.36% ranks among the top 25% in Switzerland, but its sustainability is questionable due to a lack of free cash flows and unreliable payments over the past decade. Recent earnings show a decline in net income from CHF 13.62 million to CHF 6.57 million, despite increased sales. The company has also diluted shareholders significantly in the past year, further impacting dividend reliability and value stability for investors.

- Navigate through the intricacies of StarragTornos Group with our comprehensive dividend report here.

- Our expertly prepared valuation report StarragTornos Group implies its share price may be lower than expected.

Seize The Opportunity

- Discover the full array of 25 Top SIX Swiss Exchange Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGKN

St. Galler Kantonalbank

A cantonal bank, provides banking products and services to the local population, and small and middle-sized companies in the Cantons of St.

Excellent balance sheet established dividend payer.