- Switzerland

- /

- Paper and Forestry Products

- /

- SWX:CPHN

3 Dividend Stocks On SIX Swiss Exchange With Up To 5.3% Yield

Reviewed by Simply Wall St

The Swiss market recently experienced a modest recovery after a weak start, with the SMI index managing to close slightly higher despite mixed performances among major stocks. In this fluctuating environment, dividend stocks on the SIX Swiss Exchange offer an attractive option for investors seeking stability and income through consistent yields.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.12% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.74% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.56% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.73% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.47% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.99% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.89% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.45% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private and corporate customers in Switzerland, with a market cap of CHF1.84 billion.

Operations: Basellandschaftliche Kantonalbank generates revenue of CHF466.77 million from its banking segment, catering to both private and corporate clients in Switzerland.

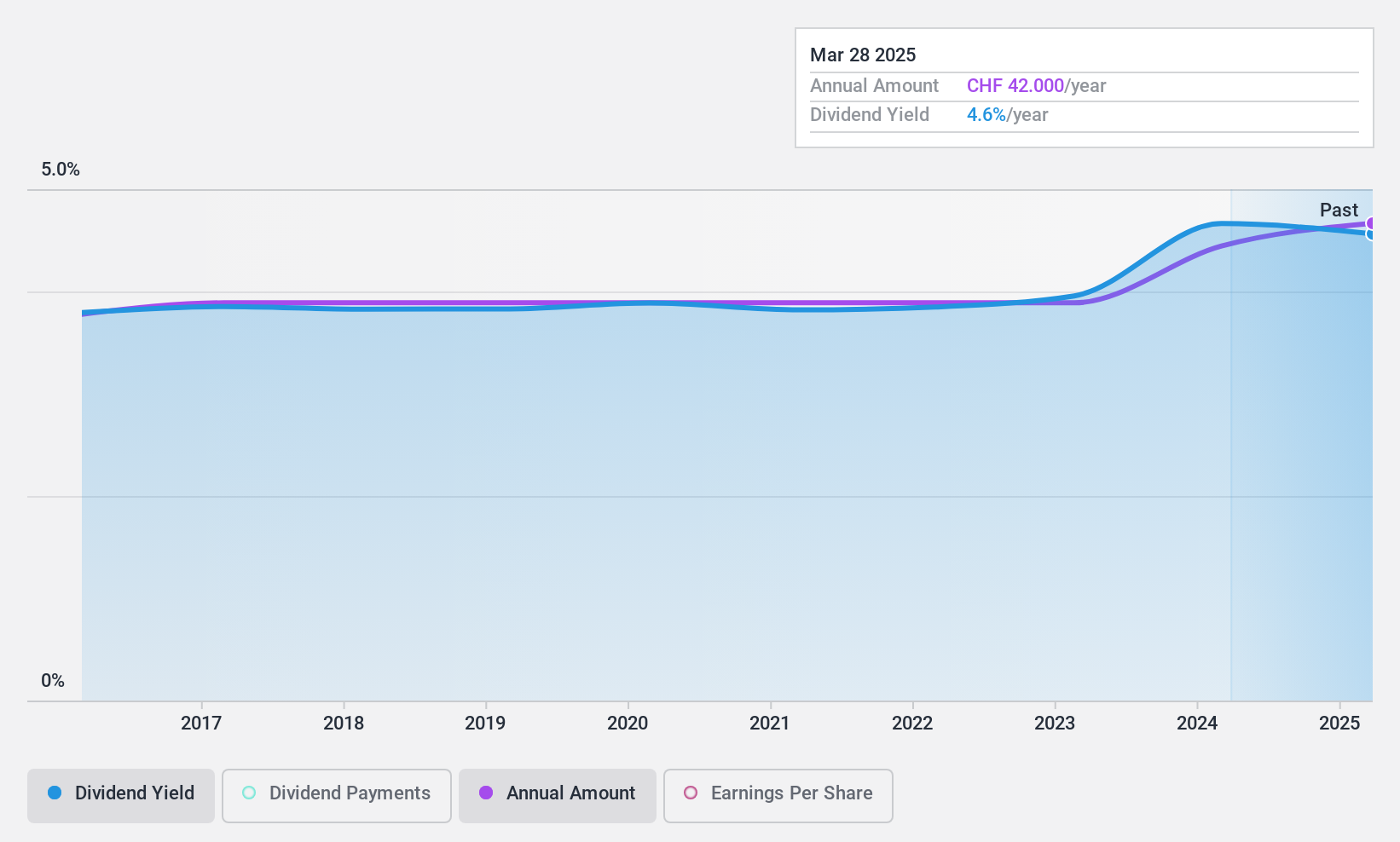

Dividend Yield: 4.7%

Basellandschaftliche Kantonalbank offers a compelling option for dividend investors, with a dividend yield of 4.71%, placing it in the top 25% of Swiss market payers. The bank's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 56.7%. However, there is insufficient data to confirm future coverage or sustainability beyond three years. Recent earnings growth further strengthens its position, reporting CHF 67.06 million net income for H1 2024.

- Get an in-depth perspective on Basellandschaftliche Kantonalbank's performance by reading our dividend report here.

- Our valuation report here indicates Basellandschaftliche Kantonalbank may be overvalued.

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG, with a market cap of CHF446.04 million, operates in the manufacture and sale of chemicals and packaging films across Switzerland, Europe, the Americas, Asia, and internationally.

Operations: CPH Group AG generates revenue from its Chemistry segment (CHF128.62 million), Packaging segment (CHF219.70 million), and Spun-off divisions (Paper) segment (CHF245.37 million).

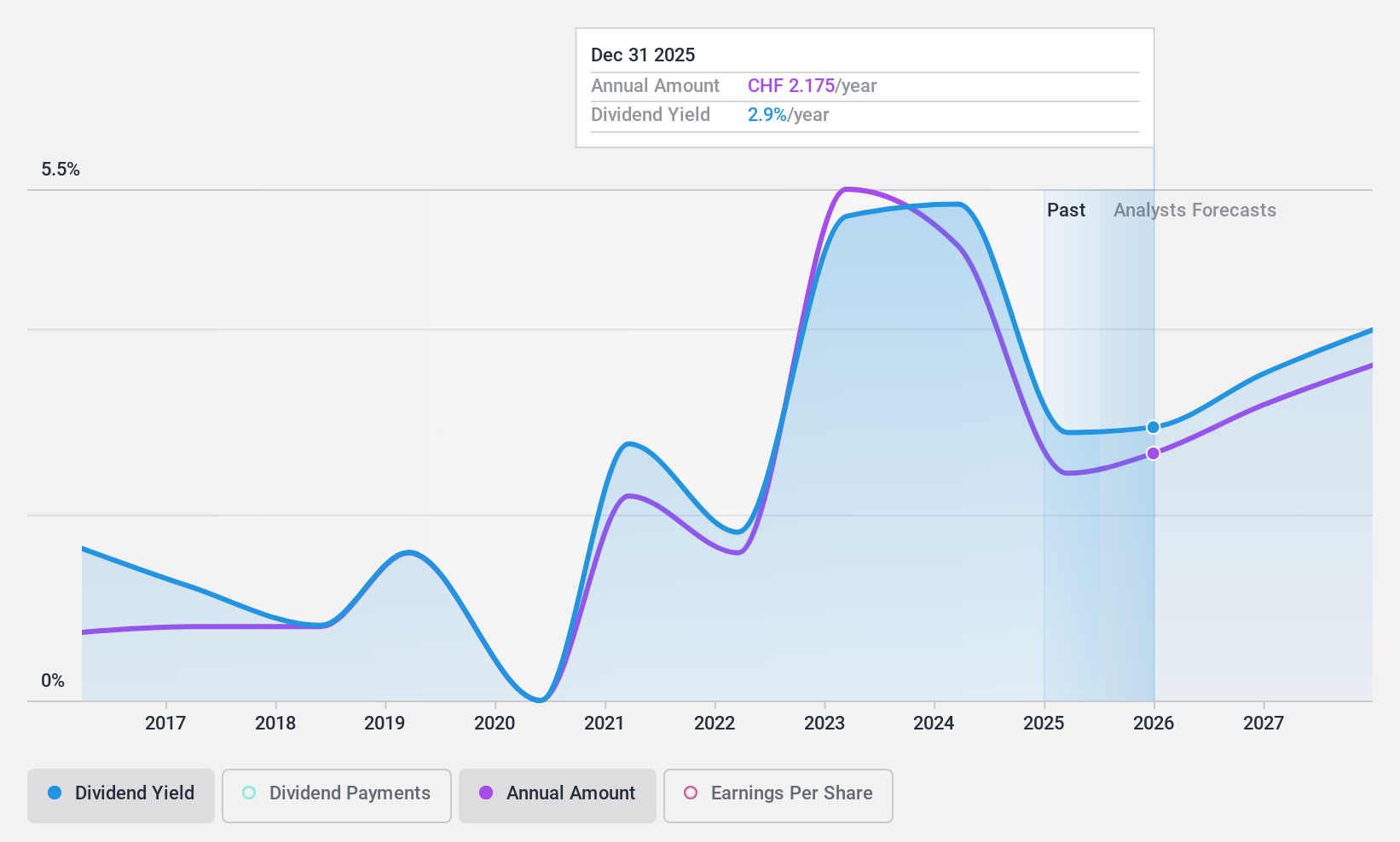

Dividend Yield: 5.4%

CPH Group's dividend yield of 5.38% ranks in the top 25% of Swiss payers, yet its sustainability is questionable due to a high payout ratio of 249.1%, indicating dividends are not covered by earnings. Despite a low cash payout ratio of 47%, past dividend volatility and recent financial setbacks, including a CHF 8.66 million net loss for H1 2024, suggest caution for investors prioritizing stable and reliable income streams.

- Navigate through the intricacies of CPH Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of CPH Group shares in the market.

Luzerner Kantonalbank (SWX:LUKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzerner Kantonalbank AG offers a range of banking products and services in Switzerland, with a market cap of CHF3.17 billion.

Operations: Luzerner Kantonalbank AG generates revenue through diverse banking products and services in Switzerland.

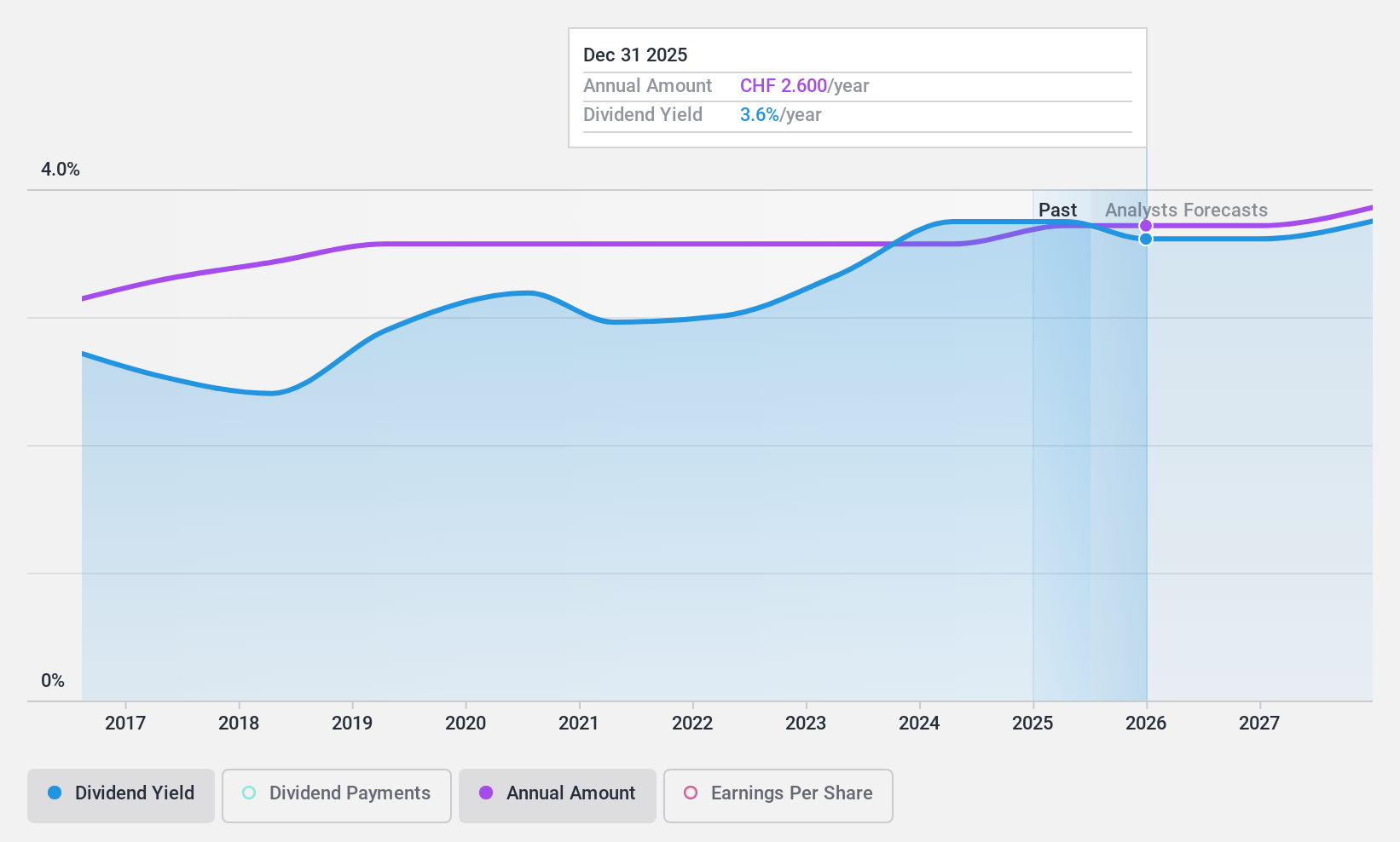

Dividend Yield: 3.9%

Luzerner Kantonalbank offers a stable dividend with a yield of 3.89%, though it falls short of the Swiss top-tier payers. The bank's dividend has grown steadily over the past decade, supported by a manageable payout ratio of 46.5%, ensuring coverage by earnings now and in future forecasts (42%). Recent financials show robust growth, with net income rising to CHF 144.73 million for H1 2024, reinforcing its capability to sustain dividends.

- Dive into the specifics of Luzerner Kantonalbank here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Luzerner Kantonalbank shares in the market.

Next Steps

- Unlock our comprehensive list of 26 Top SIX Swiss Exchange Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CPHN

CPH Group

Develops, manufactures, and distributes chemical products and packaging solutions for pharmaceutical customers in Europe, Asia, and North and South America.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives