- Canada

- /

- Renewable Energy

- /

- TSXV:WEB

TSX Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As we approach the end of 2025, the Canadian market is navigating a landscape marked by economic uncertainties such as trade tensions and emerging credit concerns. Despite these challenges, favorable factors like anticipated interest rate cuts and positive corporate earnings growth suggest a resilient outlook for investors. In this context, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for those seeking growth at lower price points. By focusing on stocks with strong balance sheets and solid fundamentals, investors may uncover hidden gems that could deliver impressive returns without many of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.83 | CA$66.49M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.45 | CA$224.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.18 | CA$788.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$20.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.67 | CA$429.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$171.55M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.05 | CA$193.19M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. offers equipment and technologies to support tubular running operations for the energy industry across various regions, with a market cap of CA$92.16 million.

Operations: The company generates CA$84.46 million in revenue from its Energy Products & Services segment.

Market Cap: CA$92.16M

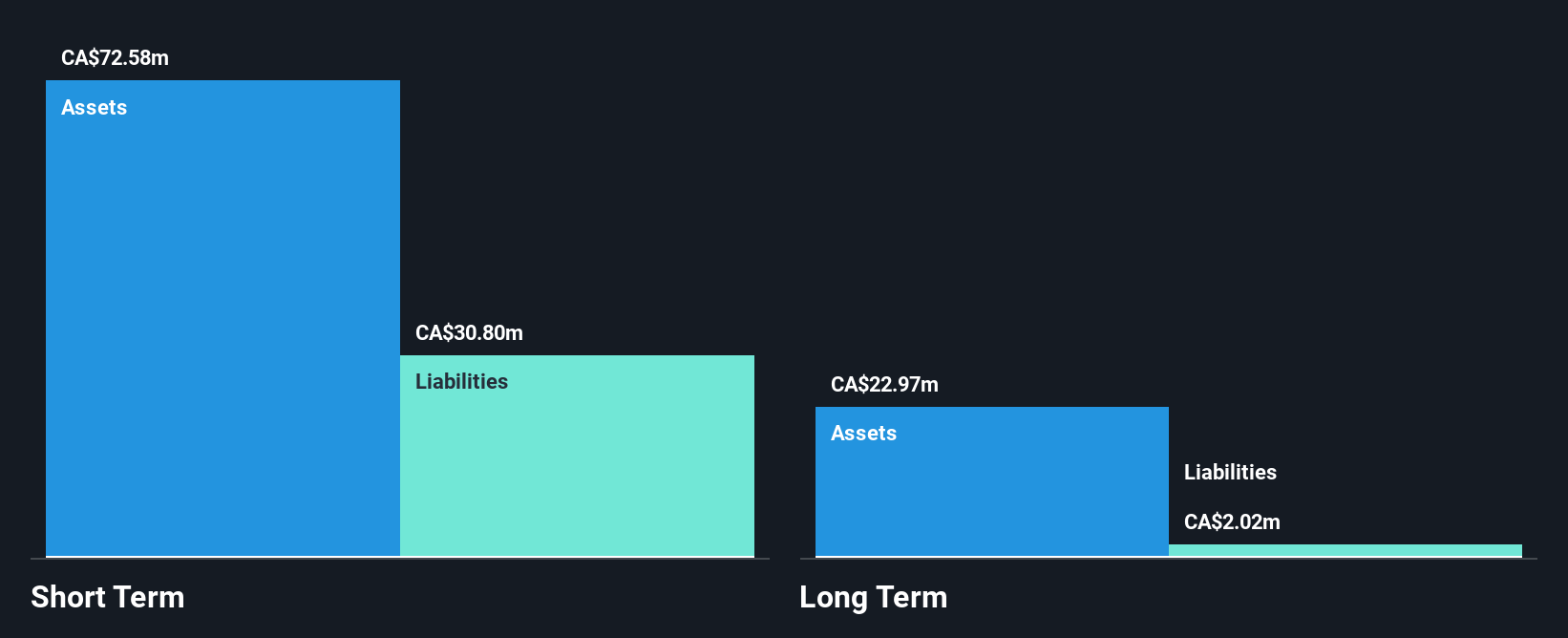

McCoy Global Inc., with a market cap of CA$92.16 million, offers equipment and technologies for the energy sector. Despite a decline in net profit margins from 11.9% to 8.4% over the past year, McCoy remains debt-free, with short-term assets exceeding liabilities significantly. The company's revenue is projected to grow by 8.8% annually, though recent earnings have declined by 18.3%. A share repurchase program aims to buy back up to 9.48% of its shares by August 2026, reflecting confidence in its valuation despite trading below estimated fair value and offering a dividend yield of 2.79%.

- Get an in-depth perspective on McCoy Global's performance by reading our balance sheet health report here.

- Understand McCoy Global's earnings outlook by examining our growth report.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications, with a market cap of CA$80.69 million.

Operations: The company generates its revenue from the Electric Equipment segment, amounting to CA$1.80 million.

Market Cap: CA$80.69M

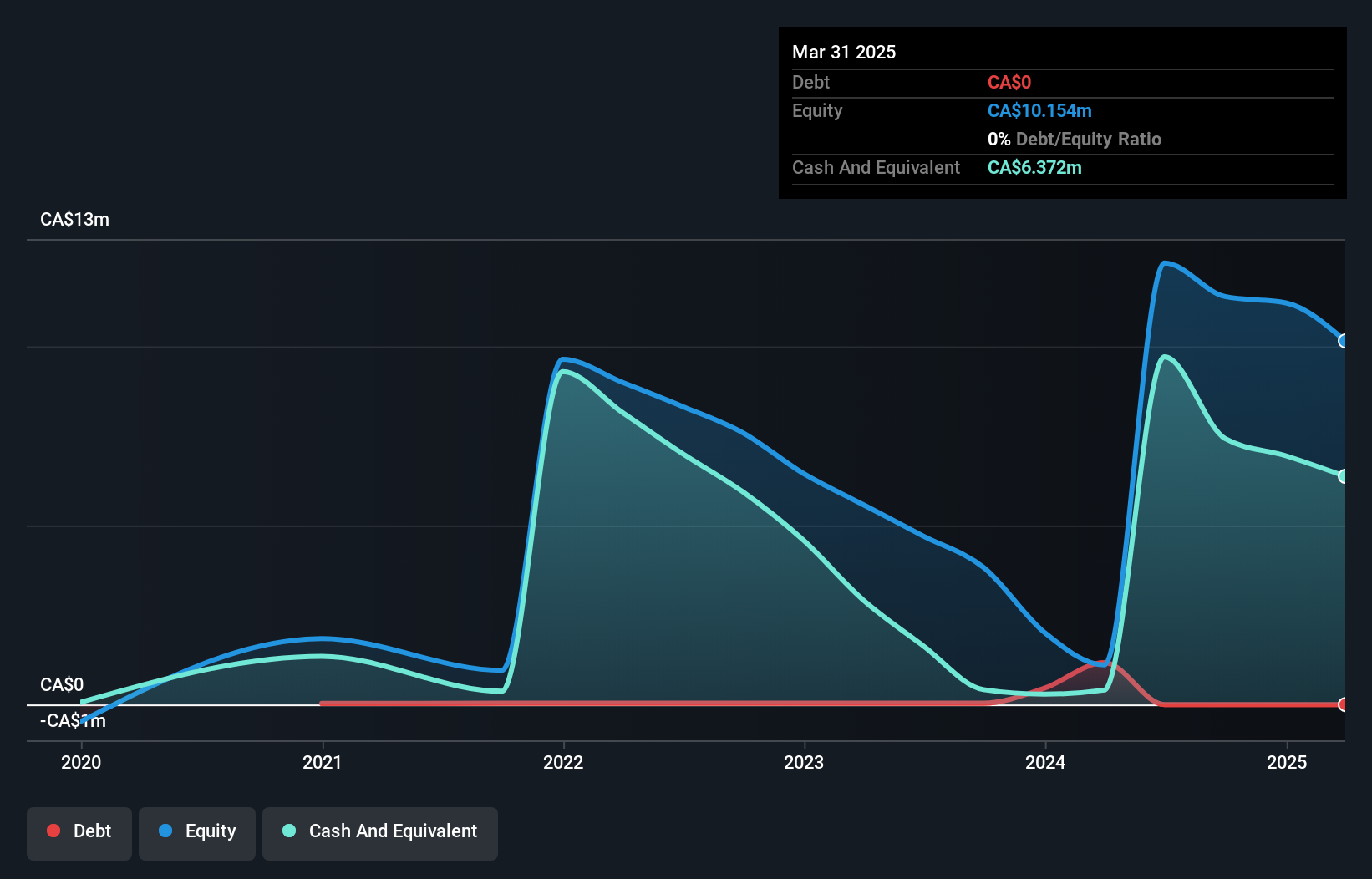

SPARQ Systems Inc. has a market cap of CA$80.69 million and focuses on microinverters for solar applications, yet it remains unprofitable with a negative return on equity of -52.67%. The company is debt-free, and its short-term assets significantly exceed both short- and long-term liabilities, indicating strong liquidity. Despite being unprofitable over the past five years with increasing losses, SPARQ's revenue is forecast to grow by 51.45% annually. Recent earnings reports show reduced net losses year-over-year, suggesting some operational improvements as sales increased from CA$0.0167 million to CA$0.1627 million in the second quarter of 2025.

- Dive into the specifics of SPARQ Systems here with our thorough balance sheet health report.

- Assess SPARQ Systems' future earnings estimates with our detailed growth reports.

Westbridge Renewable Energy (TSXV:WEB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westbridge Renewable Energy Corp. focuses on acquiring and developing solar photovoltaic projects across Canada, the United States, the United Kingdom, and Italy with a market cap of CA$66.49 million.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CA$66.49M

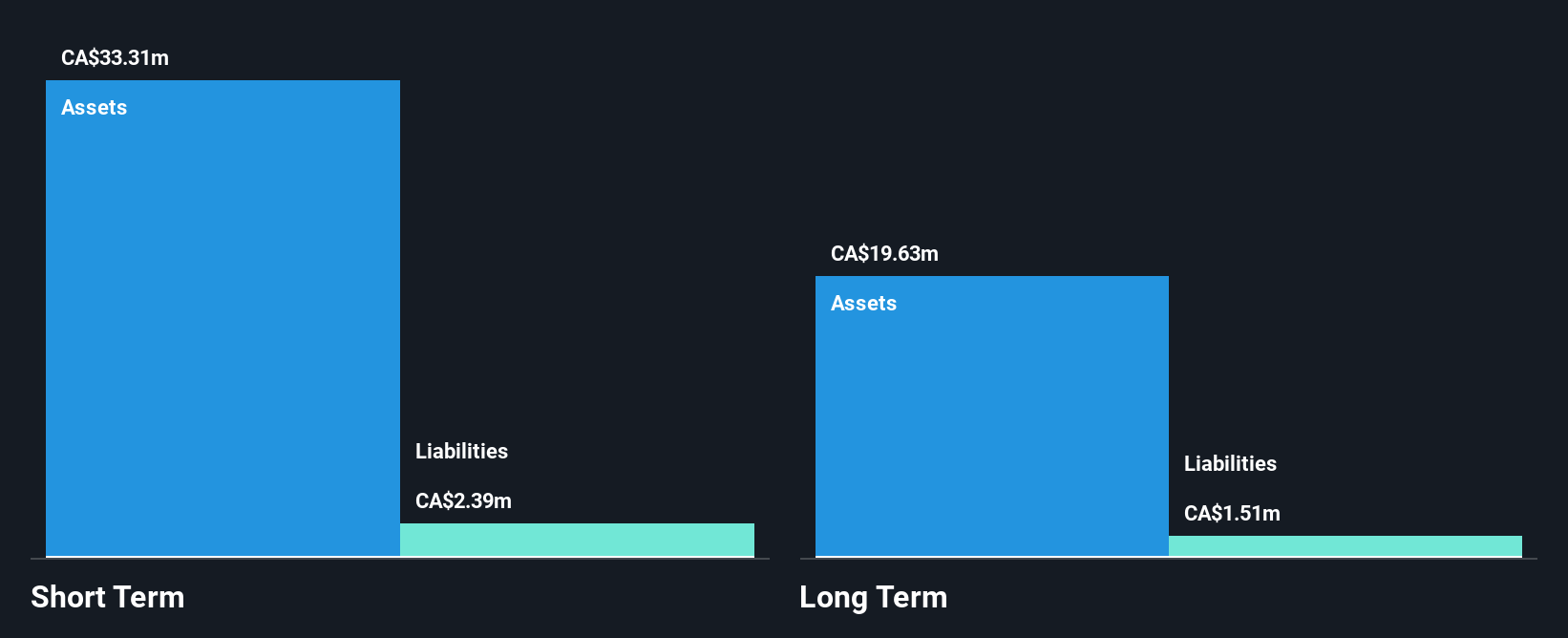

Westbridge Renewable Energy Corp., with a market cap of CA$66.49 million, remains pre-revenue, focusing on solar photovoltaic projects across multiple regions. Despite negative earnings growth of -45.4% over the past year, the company benefits from a strong balance sheet with short-term assets of CA$33.3 million exceeding both its long-term liabilities (CA$1.5M) and short-term liabilities (CA$2.4M). The management and board are experienced, averaging over four years in tenure each. Trading at 91.3% below estimated fair value and debt-free status offers potential appeal despite recent insider selling activities and high non-cash earnings levels.

- Jump into the full analysis health report here for a deeper understanding of Westbridge Renewable Energy.

- Learn about Westbridge Renewable Energy's future growth trajectory here.

Where To Now?

- Access the full spectrum of 408 TSX Penny Stocks by clicking on this link.

- Interested In Other Possibilities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westbridge Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WEB

Westbridge Renewable Energy

Engages in the acquisition and development of solar photovoltaic (PV) projects in Canada, the United States, the United Kingdom, and Italy.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>