- Canada

- /

- Renewable Energy

- /

- TSX:NPI

Northland Power (TSX:NPI): How Fair Is the Valuation as Investor Day Approaches?

Reviewed by Kshitija Bhandaru

Northland Power (TSX:NPI) is drawing extra attention as it prepares for its 2025 Investor Day in Toronto. Executives are set to discuss the company’s performance, strategic plans, and updates on ongoing construction projects.

See our latest analysis for Northland Power.

Northland Power’s share price has climbed nearly 8% in the past month and surged more than 36% year-to-date, reflecting renewed optimism as momentum returns in anticipation of its high-profile Investor Day and recent conference appearances. That said, the one-year total shareholder return of 24% marks a solid rebound. However, long-term holders remain in the red over a three- and five-year horizon.

If the setup around upcoming events has you wondering what else could be gaining steam, it’s a good moment to discover fast growing stocks with high insider ownership

With shares rebounding sharply and Investor Day approaching, investors are left to wonder if Northland Power is genuinely undervalued or if the market has already factored in its growth prospects, leaving little room for upside.

Most Popular Narrative: 9.5% Undervalued

With Northland Power's fair value seen at CA$27.46 by the most widely followed narrative, shares are still trading below that level. This sets up a compelling scenario as expectations for growth are running high ahead of Investor Day.

The imminent commissioning of Hai Long (Taiwan) and Baltic Power (Poland), which will together add over 2 GW of gross capacity and diversify Northland's offshore wind exposure geographically, aligns with robust long-term government decarbonization mandates and strong policy support across Europe and Asia. As these large projects reach commercial operation, they are expected to drive significant step-changes in EBITDA and revenue growth.

Curious about the thinking that drives this valuation? Prepare to be surprised by the ambitious earnings and profit margin projections underlying this forecast. The analysts' logic behind Northland's future value might just upend your assumptions. Find out what daring assumptions fuel this target.

Result: Fair Value of $27.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low wind conditions or higher than expected negative power prices in offshore operations could quickly challenge the current growth narrative.

Find out about the key risks to this Northland Power narrative.

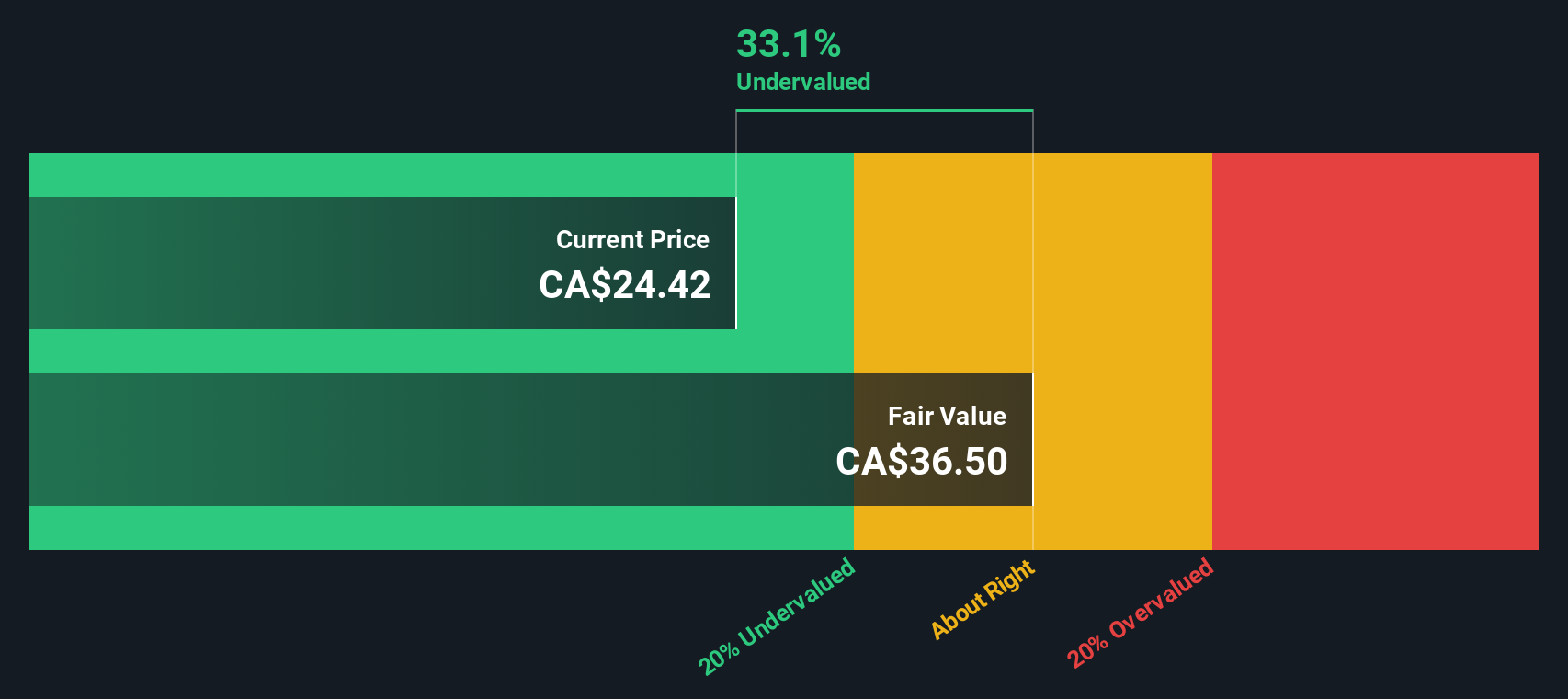

Another View: Sizing Up With the SWS DCF Model

Looking at Northland Power through our SWS DCF model gives a decidedly different perspective. This approach estimates shares to be trading 31% below their fair value, which signals a potentially deeper undervaluation than what traditional analyst targets suggest. Could this indicate more upside than most expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northland Power Narrative

If you think your perspective tells a different story, or want to dig into the numbers first-hand, there’s nothing stopping you from building your own viewpoint in just a few minutes. Do it your way

A great starting point for your Northland Power research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the opportunity to get ahead by uncovering stocks making big moves and tailoring your portfolio to tomorrow’s winners. Start right now with these standouts:

- Multiply your potential by seeking out companies delivering strong cash flows with these 901 undervalued stocks based on cash flows that stand out for value.

- Unlock future healthcare breakthroughs by scouting innovative picks among these 32 healthcare AI stocks pushing the boundaries of AI in medicine.

- Secure steady returns by tapping into these 19 dividend stocks with yields > 3% that offer yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northland Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NPI

Northland Power

Operates as a power producer in Canada, the Netherlands, Germany, Colombia, Spain, the United States, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives