- Canada

- /

- Renewable Energy

- /

- TSX:INE

Investors in Innergex Renewable Energy (TSE:INE) from three years ago are still down 35%, even after 4.3% gain this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Innergex Renewable Energy Inc. (TSE:INE) shareholders, since the share price is down 42% in the last three years, falling well short of the market return of around 40%. And the ride hasn't got any smoother in recent times over the last year, with the price 34% lower in that time.

On a more encouraging note the company has added CA$108m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Innergex Renewable Energy

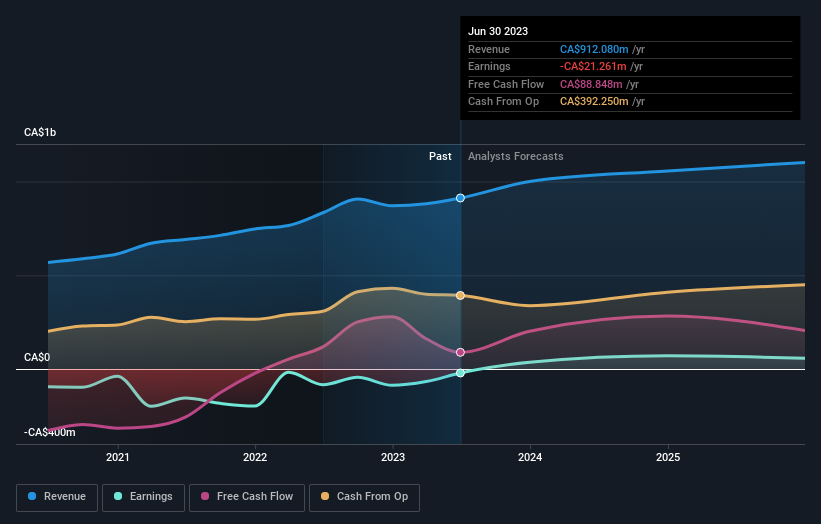

Because Innergex Renewable Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Innergex Renewable Energy saw its revenue grow by 16% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 12% per year, for three years. This implies the market had higher expectations of Innergex Renewable Energy. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Innergex Renewable Energy's TSR for the last 3 years was -35%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Innergex Renewable Energy had a tough year, with a total loss of 31% (including dividends), against a market gain of about 2.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Innergex Renewable Energy is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:INE

Innergex Renewable Energy

Operates as an independent renewable power producer in Canada, the United States, France, and Chile.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives