- Canada

- /

- Electric Utilities

- /

- TSX:H

Will Grid Investments Reinvent Hydro One’s Reliability Story or Raise New Investor Questions? (TSX:H)

Reviewed by Sasha Jovanovic

- Hydro One recently faced heightened scrutiny after a significant power outage in Ontario impacted over 200,000 customers and disrupted business operations, with the company committing to grid resilience upgrades in response.

- This event has brought increased focus to Hydro One's infrastructure improvement plans and management’s upcoming commentary on reliability and future investments.

- We'll now explore how investor concerns about grid reliability and planned resilience upgrades may influence Hydro One's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hydro One Investment Narrative Recap

Investors in Hydro One need to be confident in the long-term story of stable, regulated earnings driven by Ontario’s growing electricity demand and the company’s ongoing infrastructure investments. The recent power outage has not shifted the immediate catalyst, which is management’s commentary in the upcoming Q3 results around reliability, resilience upgrades, and the costs of capital investments. The main short-term risk remains further increases in capital spending that could put pressure on future earnings growth or dilute shareholder returns, but the impact of the outage has not been material to date.

The most relevant recent announcement is Hydro One's upcoming Q3 earnings release on November 13, 2025, where management is expected to address grid reliability and planned infrastructure upgrades. With heightened investor focus on resilience spending following the outage, this event will likely provide key updates on expected capital requirements and how they may affect Hydro One’s near-term financial profile.

By contrast, investors should pay close attention to the rising capital expenditure requirements for grid modernization and how these could influence debt levels and future shareholder returns…

Read the full narrative on Hydro One (it's free!)

Hydro One's outlook anticipates CA$9.5 billion in revenue and CA$1.5 billion in earnings by 2028. This projection assumes a 2.8% annual revenue growth and a CA$0.2 billion earnings increase from the current CA$1.3 billion level.

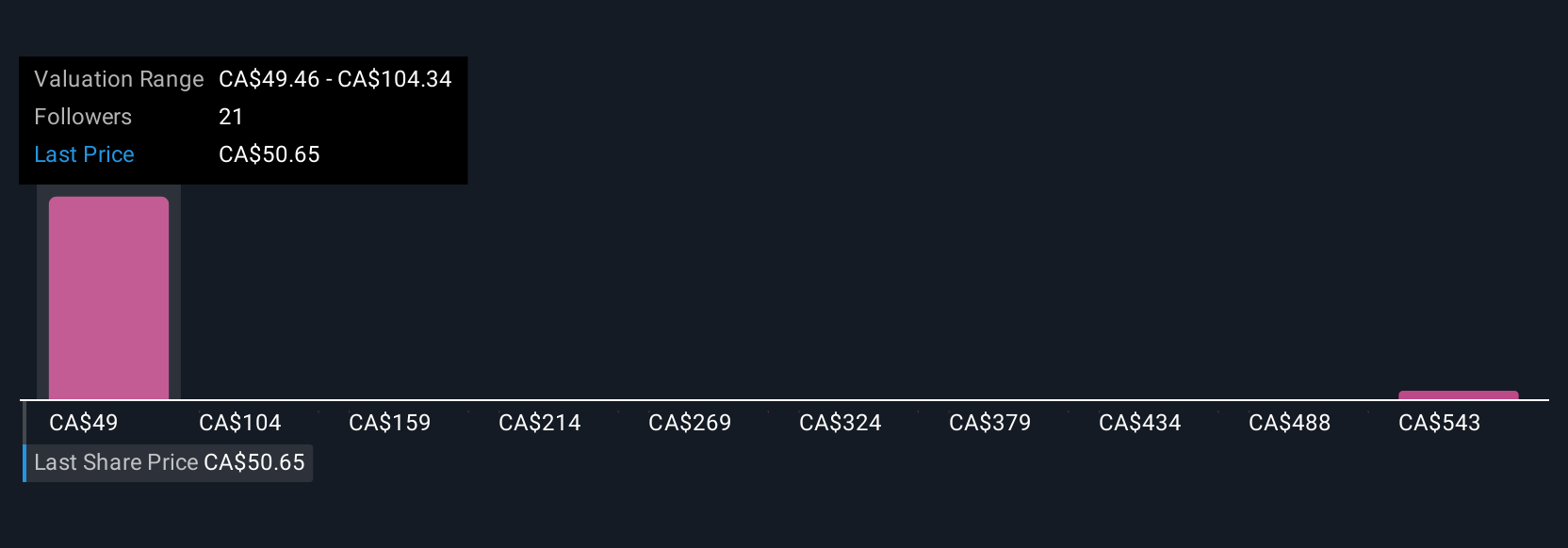

Uncover how Hydro One's forecasts yield a CA$49.68 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from CA$49.68 to CA$598.19 (2 contributors). Many participants are watching upcoming capital spending, which may shape future returns and shareholder outcomes. Compare these different perspectives to weigh your own view.

Explore 2 other fair value estimates on Hydro One - why the stock might be a potential multi-bagger!

Build Your Own Hydro One Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hydro One research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hydro One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hydro One's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydro One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:H

Hydro One

Through its subsidiaries, operates as an electricity transmission and distribution company in Ontario.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives