- Canada

- /

- Electric Utilities

- /

- TSX:H

Should Hydro One's (TSX:H) Strong Earnings and Executive Shift Prompt Investor Reassessment?

Reviewed by Simply Wall St

- Hydro One Limited recently reported robust second quarter 2025 earnings and announced a temporary executive transition, with CEO David Lebeter taking compassionate care leave and Harry Taylor serving as interim President and CEO.

- These leadership updates were accompanied by the appointment of Michael W. Rencheck to the Board, bringing extensive expertise from the nuclear energy sector to the company.

- We’ll explore how the combination of strong earnings and executive changes may influence Hydro One’s long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hydro One Investment Narrative Recap

To be a shareholder of Hydro One, an investor needs to believe in Ontario’s long-term electrification and infrastructure upgrade story, backed by ongoing regulatory and government support for grid expansion. The recent executive transition and board appointment do not appear to materially impact the company’s principal near-term catalyst: reliably executing major transmission and distribution expansion projects. The biggest short-term risk continues to be rising capital requirements for grid modernization, which could impact future funding and potential dilution.

Among recent developments, Hydro One’s reaffirmed earnings guidance for 2027 remains the most relevant. The company continues to target annual earnings per share growth of 6% to 8% by leveraging a growing regulated asset base, despite management changes. This steady outlook remains tied to delivery of large-scale capital projects and effective regulatory outcomes.

But investors should also be mindful that, despite these positives, the real risk for Hydro One now may stem from higher-than-expected funding needs or...

Read the full narrative on Hydro One (it's free!)

Hydro One's outlook foresees revenues reaching CA$9.5 billion and earnings reaching CA$1.5 billion by 2028. This implies a 2.8% annual revenue growth rate and a CA$0.2 billion earnings increase from current earnings of CA$1.3 billion.

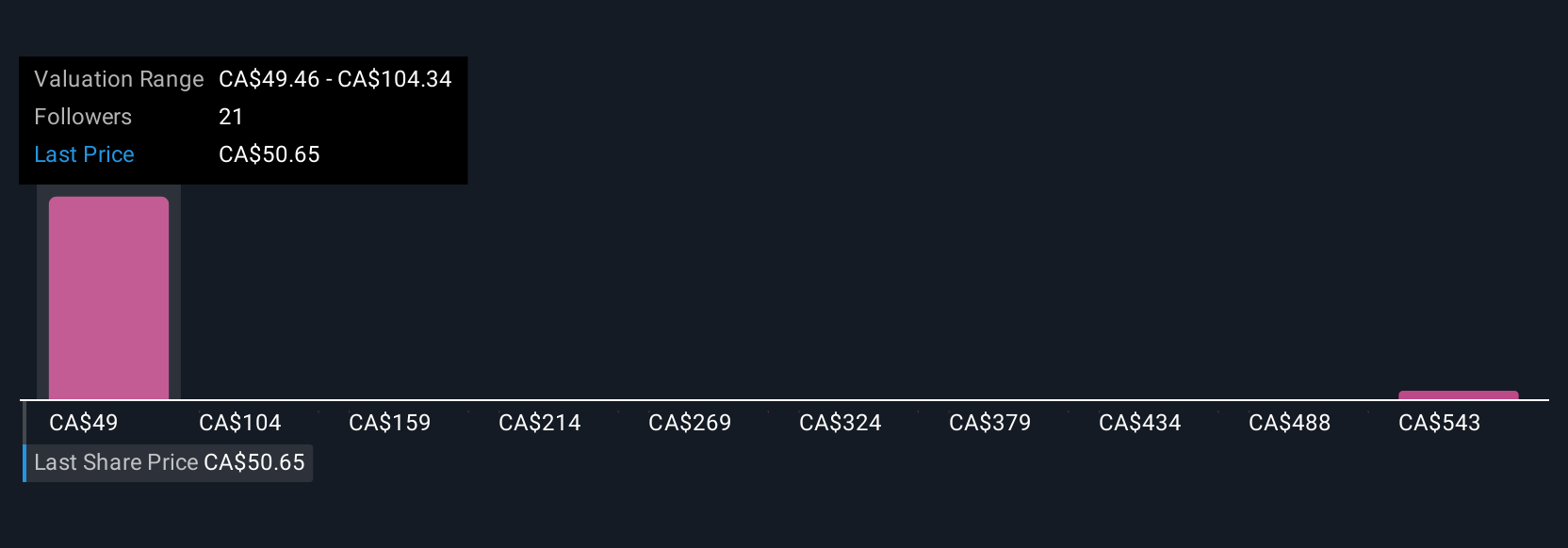

Uncover how Hydro One's forecasts yield a CA$49.46 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Hydro One’s fair value anywhere from CA$49 to CA$598 per share, with only two perspectives included. While such varied expectations exist, ongoing capital expenditure demands could affect both funding requirements and future shareholder returns. See how these diverse viewpoints shape the full discussion.

Explore 2 other fair value estimates on Hydro One - why the stock might be worth just CA$49.46!

Build Your Own Hydro One Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hydro One research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hydro One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hydro One's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydro One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:H

Hydro One

Through its subsidiaries, operates as an electricity transmission and distribution company in Ontario.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives