- Canada

- /

- Electric Utilities

- /

- TSX:EMA

The Bull Case For Emera (TSX:EMA) Could Change Following Surging Profitability in Q2 2025 Results

Reviewed by Simply Wall St

- Emera Incorporated recently reported its second quarter and first half 2025 results, showing revenue rose to CA$1.99 billion for the quarter and net income increased to CA$154 million, while basic earnings per share from continuing operations remained at CA$0.45.

- For the first six months of 2025, net income more than doubled year-over-year, reaching CA$755 million, underscoring a significant improvement in profitability compared to the prior year.

- With this marked increase in net income, we'll explore how Emera's latest earnings update could influence the company's long-term growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Emera Investment Narrative Recap

To be a shareholder in Emera, you need confidence that electrification, urban growth, and regulated returns will translate to reliable earnings and dividend streams, even in the face of heavy capital spending and regulatory oversight. The company’s recent surge in six-month net income more than doubled year-over-year, a positive sign, yet this improvement did not materially alter the impact of short-term refinancing risks looming with upcoming debt maturities or the need for effective interest cost management.

The latest quarterly dividend declaration stands out as particularly relevant, reaffirming Emera's commitment to consistent shareholder returns. This action aligns with the company’s emphasis on stable payouts, despite potential earnings volatility triggered by external factors like interest rate changes or unforeseen operational losses. These reliable distributions will likely remain an important consideration for many investors as they evaluate short-term catalysts versus ongoing risks.

On the other hand, investors should not overlook how persistent high interest rates and looming debt maturities in 2026 could dramatically affect...

Read the full narrative on Emera (it's free!)

Emera's narrative projects CA$8.7 billion revenue and CA$1.1 billion earnings by 2028. This requires 1.8% yearly revenue growth and a CA$224 million earnings increase from CA$875.6 million.

Uncover how Emera's forecasts yield a CA$64.96 fair value, a 3% downside to its current price.

Exploring Other Perspectives

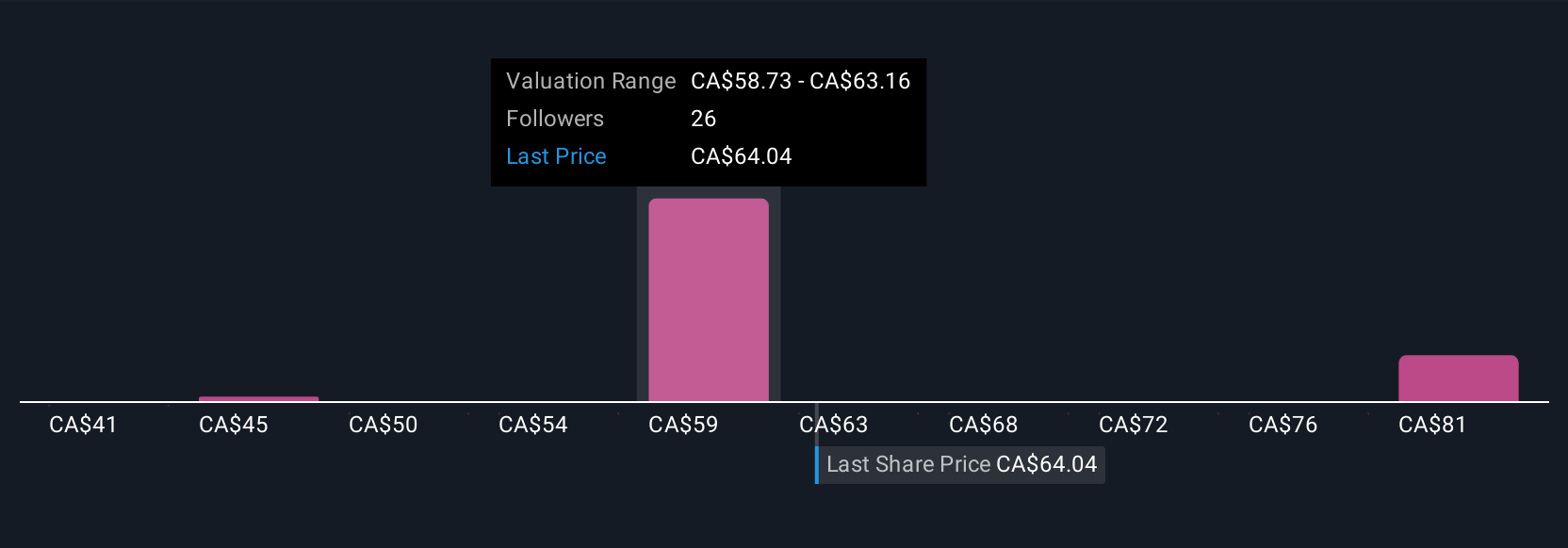

Six individual fair value estimates from the Simply Wall St Community span from CA$41 to CA$86.65 per share. With refinancing risk flagged as a pressing concern, market participants show just how differently future earnings strength could be viewed.

Explore 6 other fair value estimates on Emera - why the stock might be worth 39% less than the current price!

Build Your Own Emera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emera research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Emera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emera's overall financial health at a glance.

No Opportunity In Emera?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EMA

Emera

An energy and services company, invests in generation, transmission, and distribution of electricity in the United States, Canada, Barbados, and the Bahamas.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives