For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Capital Power (TSE:CPX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Capital Power with the means to add long-term value to shareholders.

View our latest analysis for Capital Power

Capital Power's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Capital Power has achieved impressive annual EPS growth of 41%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

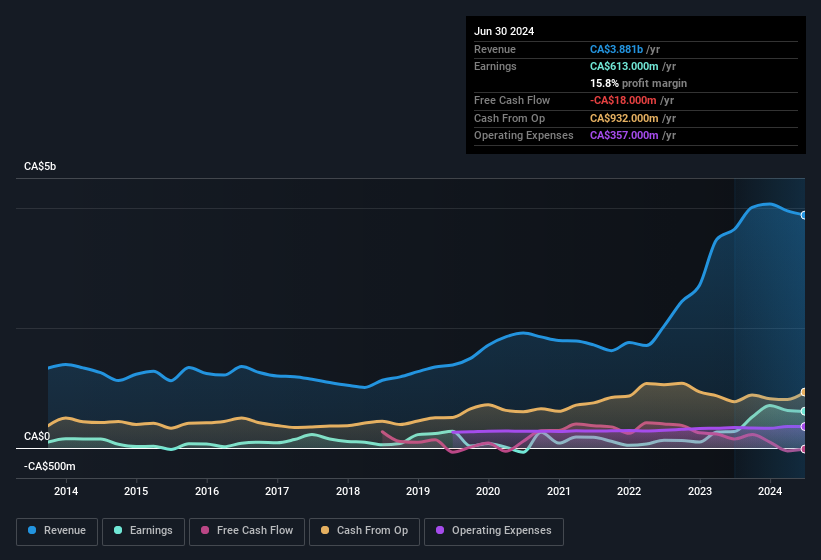

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Capital Power is growing revenues, and EBIT margins improved by 12.6 percentage points to 26%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Capital Power.

Are Capital Power Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between CA$5.4b and CA$16b, like Capital Power, the median CEO pay is around CA$5.9m.

Capital Power offered total compensation worth CA$4.5m to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Capital Power Worth Keeping An Eye On?

Capital Power's earnings per share have been soaring, with growth rates sky high. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. However, before you get too excited we've discovered 5 warning signs for Capital Power (2 shouldn't be ignored!) that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CA with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Moderate, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives