- Canada

- /

- Renewable Energy

- /

- TSX:BEP.UN

Did the Google Deal and Isagen Stake Boost Just Shift Brookfield Renewable Partners’ (TSX:BEP.UN) Narrative?

Reviewed by Simply Wall St

- Earlier this month, Brookfield Renewable Partners announced an agreement with Google to supply up to 3,000 MW of carbon-free hydroelectric power in the U.S., alongside a US$1 billion investment to increase its stake in Colombia's Isagen to about 38%.

- These moves highlight Brookfield's commitment to expanding flexible, dispatchable clean energy solutions for major technology players while strengthening its hydroelectric assets and long-term cash flow outlook.

- We'll explore how the Google partnership accelerates Brookfield's role as a leading provider of carbon-free energy for the tech sector.

Brookfield Renewable Partners Investment Narrative Recap

Owning Brookfield Renewable Partners means believing in the ongoing shift toward clean energy and the importance of long-term supply agreements with major technology firms for future growth. The recent Google hydro agreement signals progress toward locking in large, stable revenues, yet does not materially change the biggest short-term risk: potential regulatory shifts or changes to U.S. renewable tax credits, which could alter project economics and earnings outlook. In the near term, the fundamental catalyst remains Brookfield’s ability to expand its advanced development pipeline to capture surging electricity demand, particularly from AI and data center growth.

Among recent announcements, Brookfield’s 10.5 GW renewable capacity agreement with Microsoft stands out. Together with the Google deal, these agreements support the thesis that securing long-term deals with leading tech companies remains central, both for driving future revenue and for addressing potential concentration risks tied to large offtaker commitments.

However, while these corporate partnerships are appealing, investors should also be mindful that if regulatory support for renewables unexpectedly shifts…

Read the full narrative on Brookfield Renewable Partners (it's free!)

Brookfield Renewable Partners' outlook anticipates $8.1 billion in revenue and $927.4 million in earnings by 2028. This would require 10.6% annual revenue growth and a $1,394.4 million earnings increase from current earnings of -$467.0 million.

Exploring Other Perspectives

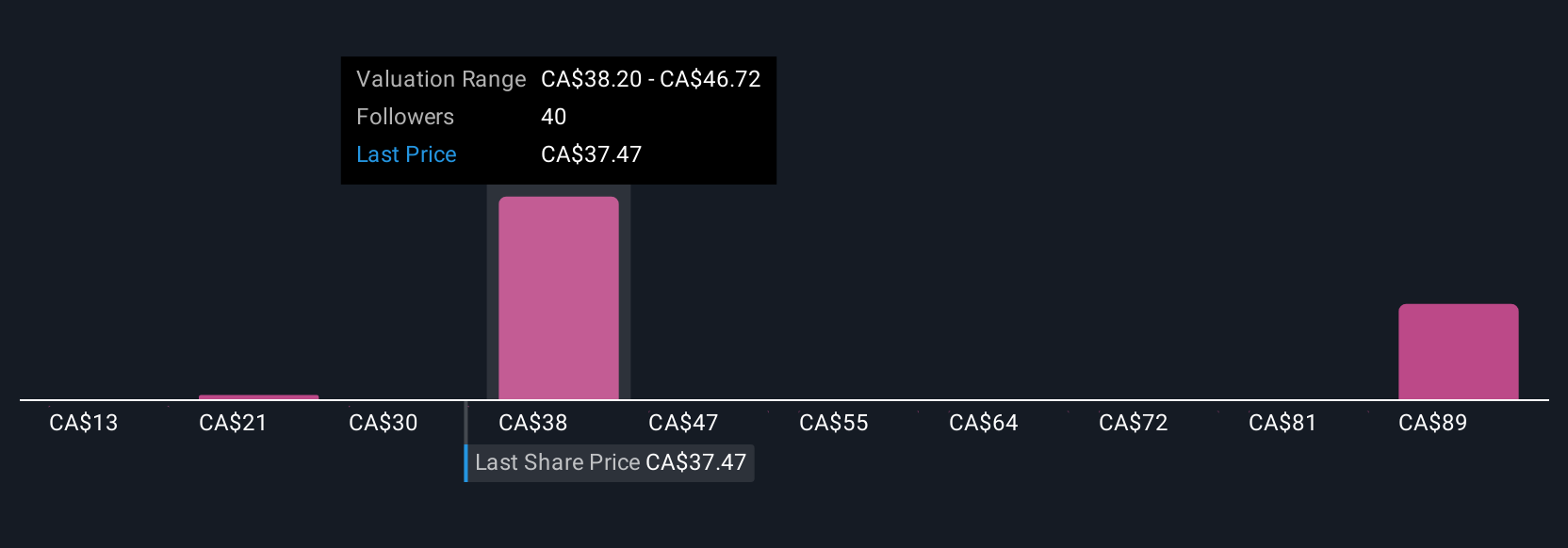

The Simply Wall St Community has shared eight fair value estimates for Brookfield Renewable Partners, ranging widely from US$12.64 to US$98.20 per share. While some position the shares as extremely undervalued, the ongoing risk of regulatory changes to tax credits could play a significant role in shaping future cash flows and earnings potential.

Build Your Own Brookfield Renewable Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Renewable Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Brookfield Renewable Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Renewable Partners' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEP.UN

Brookfield Renewable Partners

Owns a portfolio of renewable power generating facilities in North America, Colombia, and Brazil.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives