- Canada

- /

- Renewable Energy

- /

- TSX:BEP.UN

Brookfield Renewable (TSX:BEP.UN) Is Up 7.4% After Landmark Hydro Deal With Google Announced

Reviewed by Simply Wall St

- Earlier this week, Brookfield Renewable Partners, together with Brookfield Asset Management and Google, announced a new Hydro Framework Agreement to provide up to 3,000 MW of carbon-free hydroelectric capacity across the United States, beginning with US$3 billion in initial contracts for facilities in Pennsylvania.

- This arrangement marks the largest corporate clean power deal for hydroelectricity to date and reflects increasing demand from the technology sector for 24/7 carbon-free energy.

- We'll explore how this landmark agreement with Google could enhance Brookfield's long-term revenue visibility and deepen its role in clean tech energy supply.

Brookfield Renewable Partners Investment Narrative Recap

Investors in Brookfield Renewable Partners typically believe in a long-term rise in global demand for clean, dispatchable power and the company’s ability to secure large-scale agreements with technology leaders. The recent Google Hydro Framework Agreement is a significant example of such partnerships, potentially improving short-term revenue visibility, but it does not materially reduce the key risks of regulatory volatility or market concentration. The central short-term catalyst remains growing electricity demand, particularly from data center operators, while regulatory uncertainty stays front of mind for many.

Among recent company developments, Brookfield’s landmark 10.5 GW supply agreement with Microsoft closely aligns with the same theme as the Google deal: delivering scale and credibility with hyperscale clients in the renewable sector. This sustained focus on large, long-term PPAs continues to support management’s growth strategy but also raises questions about customer concentration and dependency as the company scales.

Yet, contrast remains as questions linger over potential regulatory changes in the U.S. renewable sector, an area investors should be aware of...

Read the full narrative on Brookfield Renewable Partners (it's free!)

Brookfield Renewable Partners' outlook anticipates $8.4 billion in revenue and $937.8 million in earnings by 2028. This scenario is based on a 12.7% annual revenue growth rate and a $1.33 billion increase in earnings from the current level of -$390.0 million.

Exploring Other Perspectives

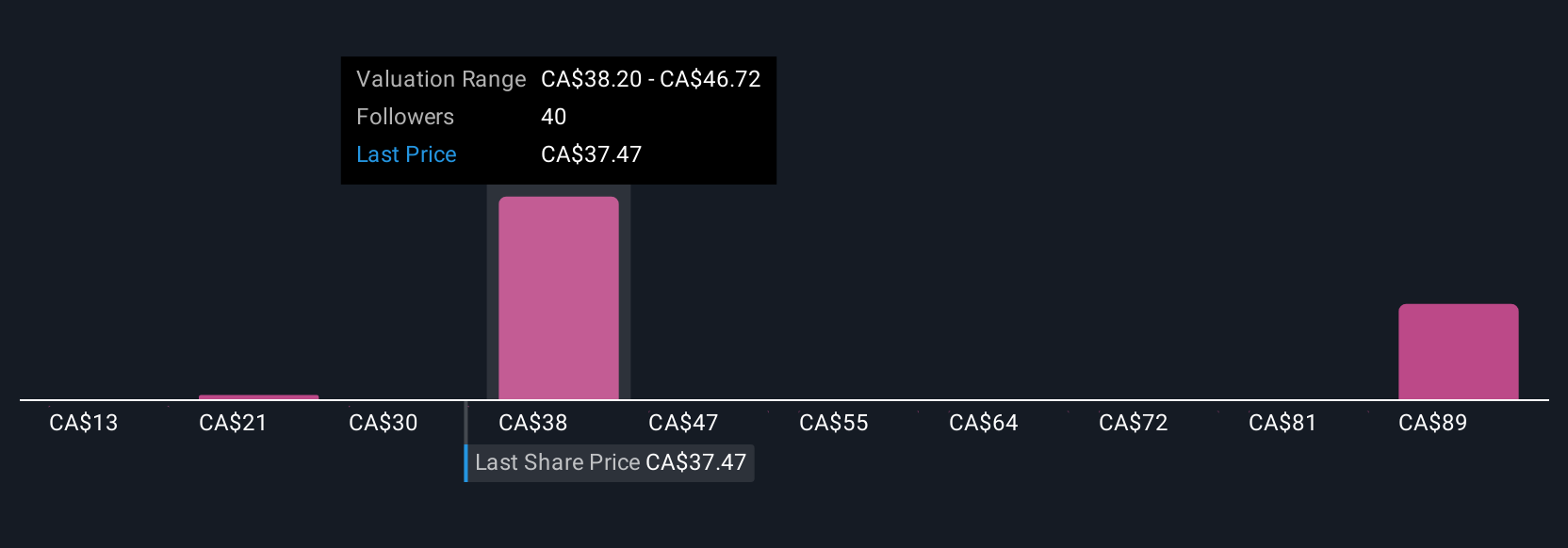

Simply Wall St Community fair value estimates for Brookfield Renewable Partners (range: US$12.64 to US$100.12, from 8 perspectives) show widely differing views on future performance. With concern about regulatory changes still top of mind, you may want to compare these opinions before making conclusions.

Build Your Own Brookfield Renewable Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Renewable Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Brookfield Renewable Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Renewable Partners' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEP.UN

Brookfield Renewable Partners

Owns a portfolio of renewable power generating facilities in North America, Colombia, and Brazil.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives