- Canada

- /

- Other Utilities

- /

- TSX:AQN

Algonquin Power & Utilities Corp.'s (TSE:AQN) Price Is Right But Growth Is Lacking

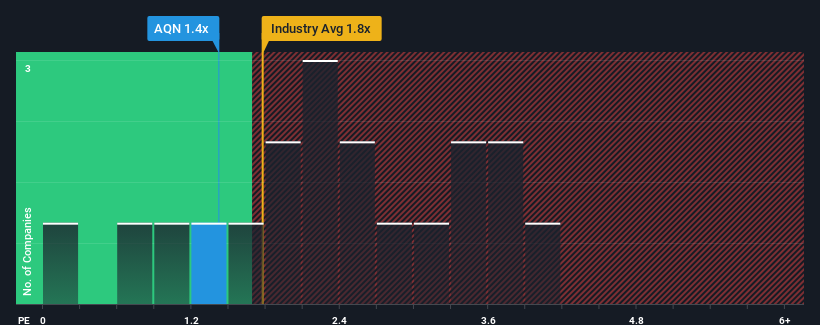

When you see that almost half of the companies in the Integrated Utilities industry in Canada have price-to-sales ratios (or "P/S") above 2.4x, Algonquin Power & Utilities Corp. (TSE:AQN) looks to be giving off some buy signals with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Algonquin Power & Utilities

How Has Algonquin Power & Utilities Performed Recently?

Algonquin Power & Utilities certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Algonquin Power & Utilities.How Is Algonquin Power & Utilities' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Algonquin Power & Utilities' is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 20% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 0.4% per year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 7.1% each year growth forecast for the broader industry.

With this information, we can see why Algonquin Power & Utilities is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Algonquin Power & Utilities' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Algonquin Power & Utilities' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 3 warning signs for Algonquin Power & Utilities (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Algonquin Power & Utilities, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AQN

Algonquin Power & Utilities

Operates in the power and utility industries.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)