Volatus Aerospace (TSXV:FLT): Valuation in Focus After Tactical ISR Drone Contract Expansion

Reviewed by Kshitija Bhandaru

Volatus Aerospace (TSXV:FLT) just expanded its tactical ISR drone contract by CAD 700,000, taking the total to about CAD 1.7 million. With deliveries currently underway, the move signals strengthened partnerships and continued momentum in the sector.

See our latest analysis for Volatus Aerospace.

The latest CAD 700,000 contract expansion adds to a string of positive signals for Volatus Aerospace, including its recent presentation at the Canada Growth Conference. As total shareholder return edged up 2.5% over the past year, this modest increase points to slow but steady momentum and suggests that recent operational wins could be starting to shift sentiment.

If the defense sector’s pace has you interested in similar stories, consider exploring See the full list for free..

With shares up just over 2% in the past year and a price still under most analyst targets, investors now face the question: Is Volatus Aerospace undervalued, or are markets already pricing in the company’s next growth phase?

Price-to-Sales of 14.8x: Is it justified?

Volatus Aerospace trades on a steep price-to-sales ratio of 14.8 times, a stark premium to peers and its own fair value estimate. At the last close of CA$0.72, the market appears to be expecting remarkable revenue expansion or other transformative events for this valuation to make sense.

The price-to-sales ratio is used to compare a company’s stock price to its revenues. It is especially relevant for high-growth, unprofitable businesses like Volatus Aerospace because traditional profit metrics do not capture the current story.

The current multiple signals market confidence in future sales growth. However, compared to the North American Airlines industry average of just 0.6x, Volatus stands out as an outlier. For further context, its own fair price-to-sales ratio is estimated at only 1.6x. This makes the current valuation look especially rich versus what fundamentals might suggest the market eventually demands.

Explore the SWS fair ratio for Volatus Aerospace

Result: Price-to-Sales of 14.8x (OVERVALUED)

However, continued net losses and reliance on high revenue growth present real risks that could quickly challenge the bullish valuation narrative.

Find out about the key risks to this Volatus Aerospace narrative.

Another View: Discounted Cash Flow Analysis

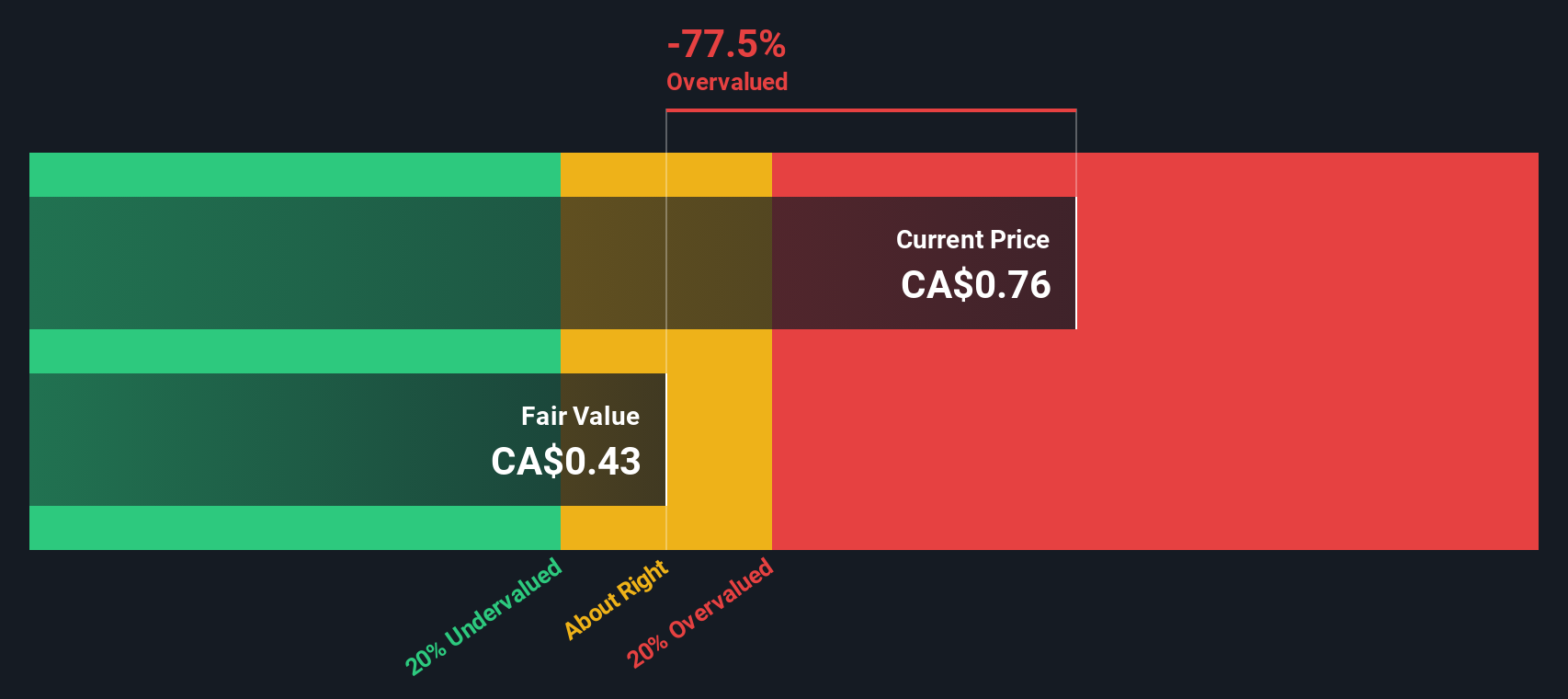

Looking at Volatus Aerospace through the lens of our DCF model offers a notably different perspective. The SWS DCF suggests shares are overvalued, trading around CA$0.72 while our fair value estimate sits lower at just CA$0.43. This puts a spotlight on future growth expectations baked into the current share price. Which view will the market trust: the optimism in revenue multiples, or the caution signaled by discounted cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Volatus Aerospace for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Volatus Aerospace Narrative

If you see things differently or want to follow your own line of research, building your own view is quick and easy. You can Do it your way in just a few minutes.

A great starting point for your Volatus Aerospace research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your stock search and stay ahead by tapping into unique ideas with proven upside. Don’t let great opportunities slip by. Your next win could be waiting!

- Boost your portfolio’s growth potential with these 25 AI penny stocks that are driving advances in machine learning and automation across key industries.

- Power up with consistent income by checking out these 19 dividend stocks with yields > 3% offering annual yields over 3% for reliable returns.

- Spot undervalued gems others might overlook by using these 886 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FLT

Volatus Aerospace

Provides integrated drone solutions in Canada, the United States, the United Kingdom, and Norway.

Low risk with limited growth.

Market Insights

Community Narratives