- Canada

- /

- Transportation

- /

- TSX:TFII

Is TFI International’s (TSX:TFII) Tight LTL Capacity Advantage Masking Deeper Freight-Demand Risks?

Reviewed by Sasha Jovanovic

- Recent commentary highlighted TFI International’s ability to manage weak freight demand, inflation, and softer consumer spending through careful fleet management and strong liquidity, while also benefiting from tightening less-than-truckload (LTL) capacity as bankruptcies thin out competitors.

- This combination of operational resilience and improving LTL industry undercapacity is drawing attention to how TFI might maintain pricing power despite a challenging freight backdrop.

- Next, we’ll examine how TFI’s resilience amid weak freight demand and tightening LTL capacity could influence its broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TFI International Investment Narrative Recap

To own TFI International, you need to believe it can grind through a freight downturn while protecting margins and cash flows, then benefit when volumes eventually recover. The latest commentary on disciplined fleet management and liquidity supports that resilience, but Q3 numbers still reflect soft demand, so the near term catalyst remains any sign of a sustained volume or pricing uptick. The biggest risk, prolonged weak freight and industrial demand, is essentially unchanged by this news.

The recent decision to lift the quarterly dividend to US$0.47 per share, despite year to date revenue and net income coming in below last year, ties directly into this resilience story. It signals management’s confidence in TFI’s cash generation even with weaker freight volumes, which may appeal to investors who see the LTL capacity tightening as a potential support for pricing once demand improves. How that balance between shareholder returns and elevated debt evolves will matter if the downturn lasts longer than expected.

But while the setup can look appealing, investors should be aware that prolonged weak freight demand could still...

Read the full narrative on TFI International (it's free!)

TFI International's narrative projects $9.2 billion revenue and $562.8 million earnings by 2028. This requires 3.6% yearly revenue growth and about a $194.6 million earnings increase from $368.2 million today.

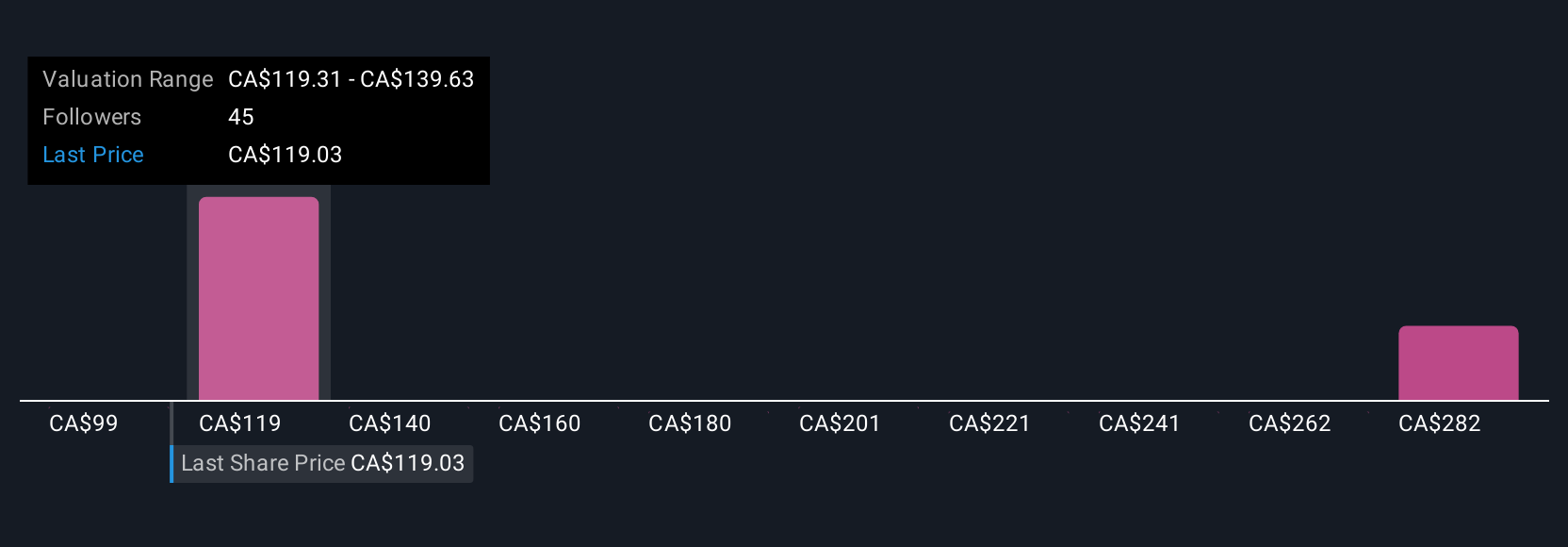

Uncover how TFI International's forecasts yield a CA$144.16 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for TFI International span roughly US$97 to US$294, reflecting very different assumptions about future cash generation. When you set that wide range against current freight softness and underused assets, it highlights why it can pay to review several viewpoints before deciding how TFI’s resilience story fits into your own expectations for the business.

Explore 9 other fair value estimates on TFI International - why the stock might be worth 28% less than the current price!

Build Your Own TFI International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFI International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TFI International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFI International's overall financial health at a glance.

No Opportunity In TFI International?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFI International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion