In recent weeks, global markets have experienced a wave of optimism, with U.S. small- and mid-cap indexes advancing for the fourth consecutive week amid easing trade tensions and positive earnings reports. Despite mixed economic signals such as declining job openings and a slight contraction in GDP, investor sentiment remains buoyant, particularly within the small-cap sector which often benefits from domestic economic resilience. In this context, identifying stocks that are potentially undervalued with notable insider activity can offer intriguing opportunities for investors looking to capitalize on these market dynamics.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.2x | 0.5x | 38.89% | ★★★★★☆ |

| Nexus Industrial REIT | 5.4x | 2.8x | 20.86% | ★★★★★☆ |

| Savills | 24.6x | 0.5x | 41.04% | ★★★★☆☆ |

| Westshore Terminals Investment | 12.4x | 3.4x | 42.27% | ★★★★☆☆ |

| Sing Investments & Finance | 6.9x | 3.5x | 44.62% | ★★★★☆☆ |

| Eastnine | 17.9x | 8.7x | 39.90% | ★★★★☆☆ |

| Tristel | 30.3x | 4.3x | 19.10% | ★★★☆☆☆ |

| AKVA group | 19.4x | 0.7x | 48.87% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 49.34% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 1.6x | -143.23% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

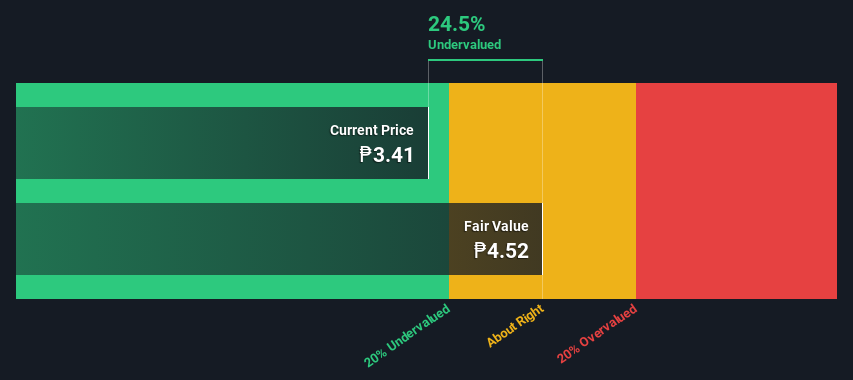

Bloomberry Resorts (PSE:BLOOM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bloomberry Resorts operates integrated resort facilities and has a market capitalization of approximately ₱114.07 billion.

Operations: The company's primary revenue stream is derived from its integrated resort facility, with recent figures indicating revenue of ₱52.76 billion. The cost of goods sold (COGS) for the latest period was ₱14.39 billion, resulting in a gross profit margin of 72.72%. Operating expenses have been significant, impacting net income margins which stood at 4.97% for the most recent period analyzed.

PE: 18.0x

Bloomberry Resorts, a smaller company in the gaming and hospitality sector, has experienced insider confidence with Cyrus Sherafat purchasing 9 million shares for approximately PHP 69.93 million recently. Despite reporting a net loss of PHP 920 million in Q4 2024, their revenue increased to PHP 14.55 billion from PHP 11.91 billion the previous year. The company declared a cash dividend of PHP 0.0847 per share in March and completed a significant refinancing deal to manage debt more effectively over time, potentially easing future financial strain.

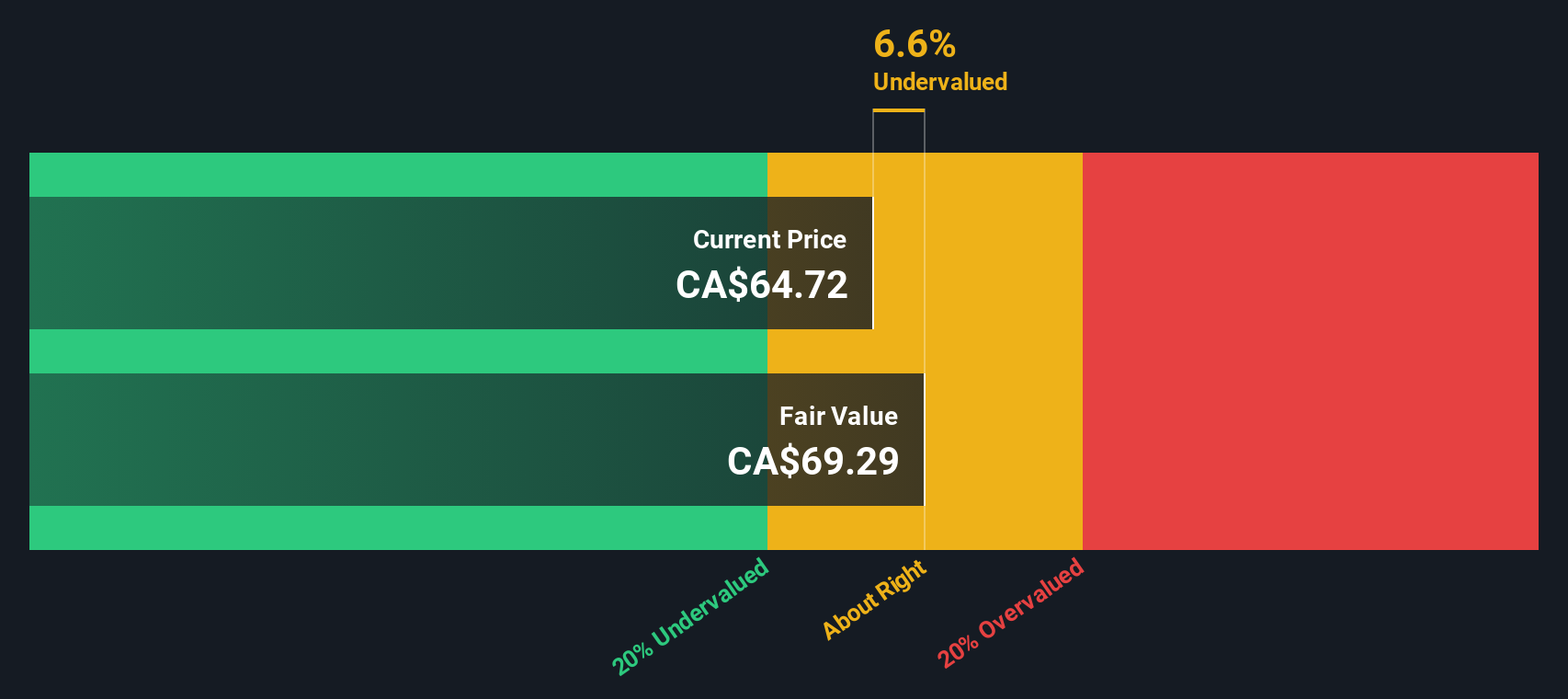

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified company operating primarily in the aerospace, aviation, and manufacturing sectors with a market cap of CA$2.15 billion.

Operations: The company generates revenue primarily from its Manufacturing and Aerospace & Aviation segments, with recent figures showing CA$1.02 billion and CA$1.64 billion respectively. Over the analyzed period, gross profit margin has shown fluctuations, reaching 36.40% by the end of 2024. Operating expenses have consistently increased alongside revenue growth, impacting overall profitability metrics such as net income margin which was at 4.56% in December 2024.

PE: 23.2x

Exchange Income, a smaller company in its sector, recently expanded its credit facility to C$3 billion, signaling financial flexibility despite relying solely on external borrowing. The company's earnings are projected to grow by 25.41% annually. While dividends remain steady at C$0.22 per share monthly, insider confidence is reflected through recent share purchases by insiders between January and March 2025. These actions suggest potential growth opportunities amid current market conditions without any recent buybacks executed yet under the new program expiring in 2026.

- Click here and access our complete valuation analysis report to understand the dynamics of Exchange Income.

Evaluate Exchange Income's historical performance by accessing our past performance report.

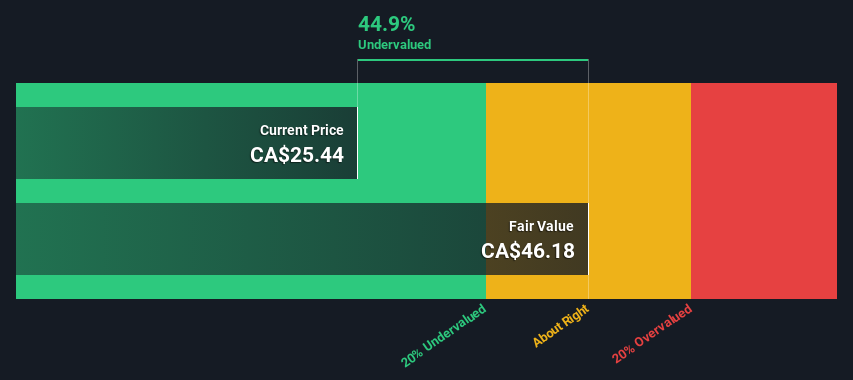

Propel Holdings (TSX:PRL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Propel Holdings is a financial technology company that provides innovative online credit solutions to underserved consumers, with a market capitalization of approximately CAD $0.2 billion.

Operations: Propel Holdings generates revenue primarily through its operations, with a notable gross profit margin of 100% from 2020 onwards. Operating expenses have consistently increased, reaching $381.84 million by early 2025, while net income margins have shown improvement over time, rising to approximately 11.53% in the same period.

PE: 16.7x

Propel Holdings, a dynamic player in its sector, recently reported strong financial performance with Q1 2025 revenue at US$138.94 million and net income rising to US$23.5 million. The company increased its annual dividend to CAD 0.72 per share, marking the eighth hike since early 2023, reflecting confidence in future cash flows. Recent insider confidence is evident as they have been acquiring more shares over the past months, suggesting belief in Propel's growth potential amidst expanding U.S. partnerships and reduced borrowing costs following credit facility adjustments.

- Dive into the specifics of Propel Holdings here with our thorough valuation report.

Gain insights into Propel Holdings' past trends and performance with our Past report.

Next Steps

- Click through to start exploring the rest of the 151 Undervalued Global Small Caps With Insider Buying now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives