Exploring Canada's Undervalued Small Caps With Insider Action For October 2024

Reviewed by Simply Wall St

As we enter the fourth quarter of 2024, the Canadian market has experienced a volatile start despite strong performances earlier in the year, with key indices like the TSX showing significant gains. This volatility is influenced by global uncertainties and economic indicators such as labor market dynamics and interest rate expectations, which are crucial for small-cap companies navigating these conditions. In this environment, identifying promising small-cap stocks often involves looking at those with solid fundamentals and notable insider activity, suggesting confidence in their potential amidst broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.2x | 0.9x | 17.86% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 23.33% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 49.57% | ★★★★★☆ |

| Rogers Sugar | 15.5x | 0.6x | 47.90% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.2x | 3.3x | 48.90% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.98% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -8.19% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -60.13% | ★★★☆☆☆ |

| Spartan Delta | 4.4x | 2.2x | -40.54% | ★★★☆☆☆ |

| Obsidian Energy | 5.8x | 0.9x | -218.16% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

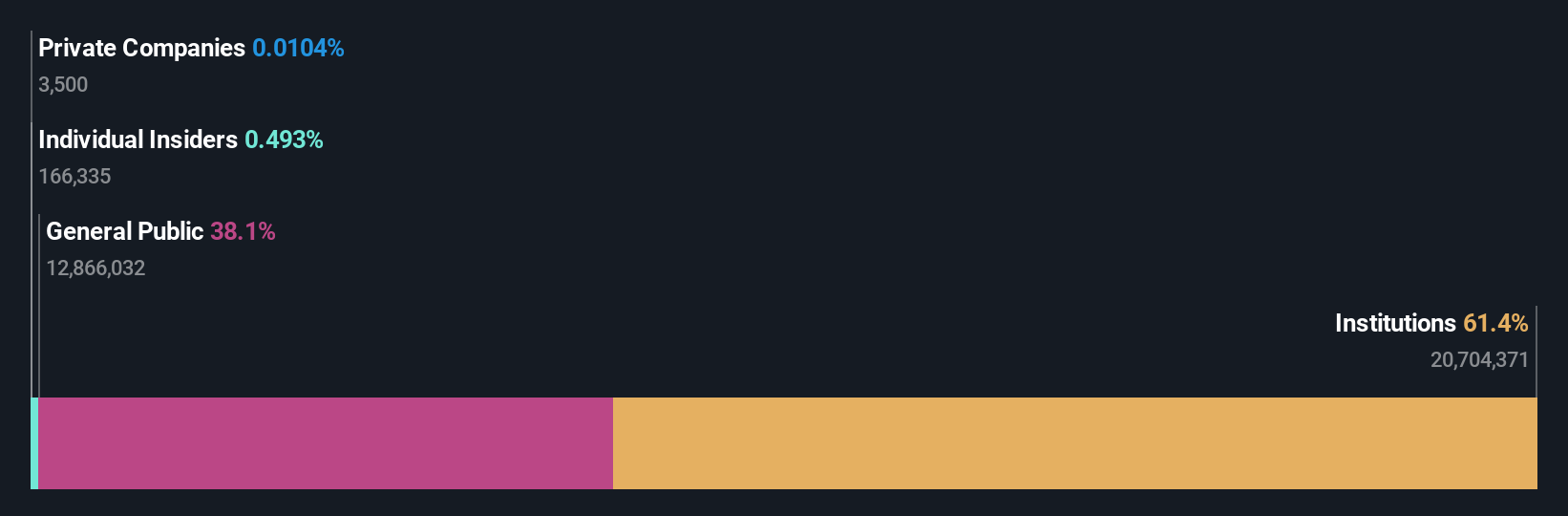

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavating services and has a market capitalization of CAD $1.21 billion.

Operations: The company generates revenue primarily from Non-Destructive Excavating Services, with recent figures showing a gross profit margin of 28.29%. Operating expenses include significant allocations to general and administrative costs and depreciation & amortization, which have been notable components of the cost structure.

PE: 24.0x

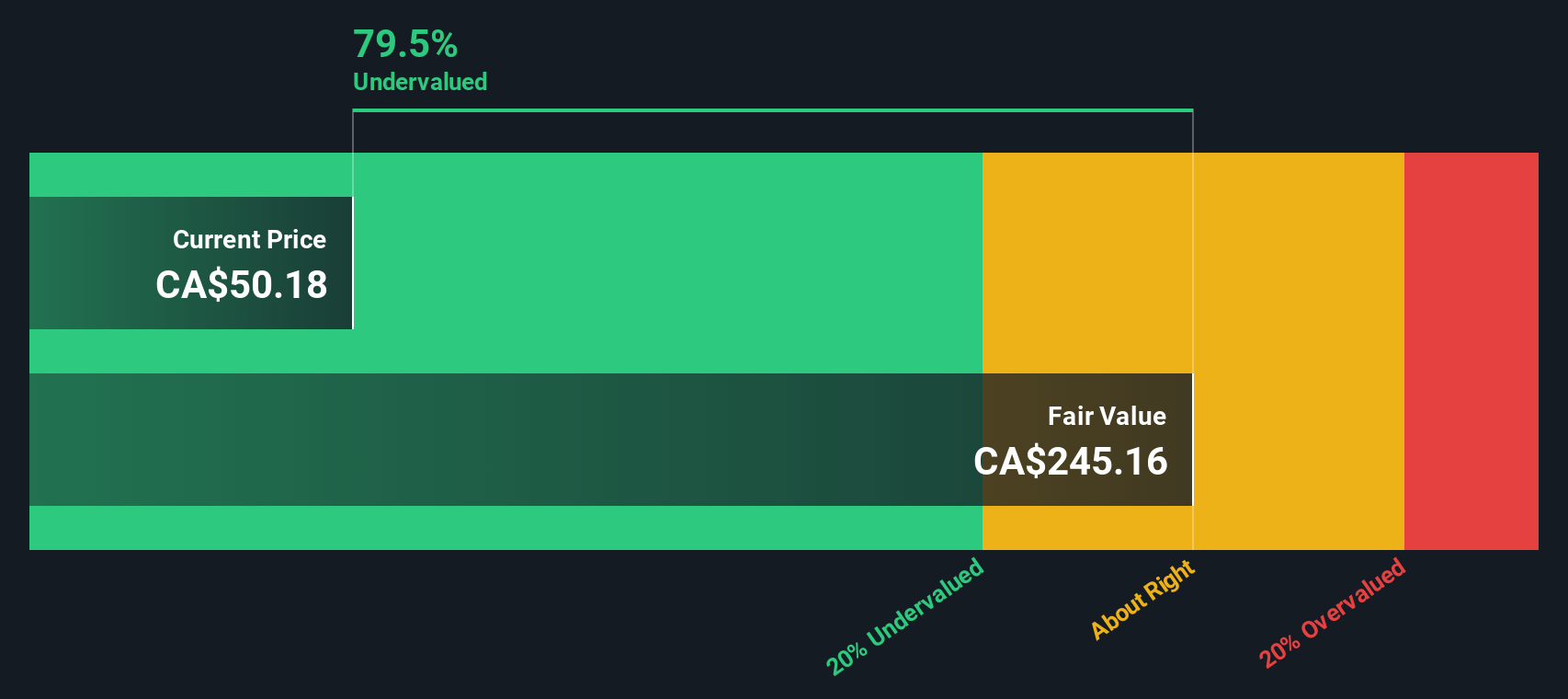

Badger Infrastructure Solutions, a smaller player in Canada, shows potential as an undervalued investment. For Q2 2024, they reported sales of US$186.84 million and net income of US$11.91 million, both up from last year. Despite high debt levels and reliance on external funding, insider confidence is evident with recent share purchases this year. The company is considering a share repurchase program while maintaining dividends at C$0.18 per share for Q3 2024, signaling stability amidst growth prospects projected at 36% annually for earnings.

Calian Group (TSX:CGY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Calian Group operates in diverse sectors including IT and Cyber Solutions, Health, Learning, and Advanced Technologies with a market cap of CA$1.12 billion.

Operations: Calian Group's revenue is derived from four primary segments: ITCS, Health, Learning, and Advanced Technologies. The company's gross profit margin has shown an upward trend, reaching 33.17% as of June 2024. Operating expenses include significant allocations to general and administrative costs as well as sales and marketing efforts.

PE: 34.0x

Calian Group, a smaller Canadian company, is capturing attention with strategic alliances and innovative projects. Recent collaborations with Walmart Canada and Microsoft highlight its expansion in digital health and cybersecurity. The partnership with Walmart leverages Calian's Nexi platform to enhance pharmacy services, while the Microsoft alliance strengthens its security offerings. Despite a dip in net income to C$1.3 million this quarter, revenue rose to C$185 million from last year. Insider confidence is evident as they purchase shares amidst ongoing share repurchase plans targeting 8.41% of issued capital by August 2025. Looking ahead, Calian anticipates revenue between C$750 million and C$810 million for the fiscal year ending September 2024, signaling potential growth opportunities within diverse sectors like healthcare and defense.

- Delve into the full analysis valuation report here for a deeper understanding of Calian Group.

Gain insights into Calian Group's past trends and performance with our Past report.

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified company operating primarily in the aerospace, aviation, and manufacturing sectors with a market cap of CA$2.25 billion.

Operations: The company generates revenue from its Manufacturing and Aerospace & Aviation segments, with the latter contributing a larger portion. Recent data shows a gross profit margin of 34.72% as of June 30, 2024. Operating expenses and non-operating expenses are significant cost components affecting overall profitability.

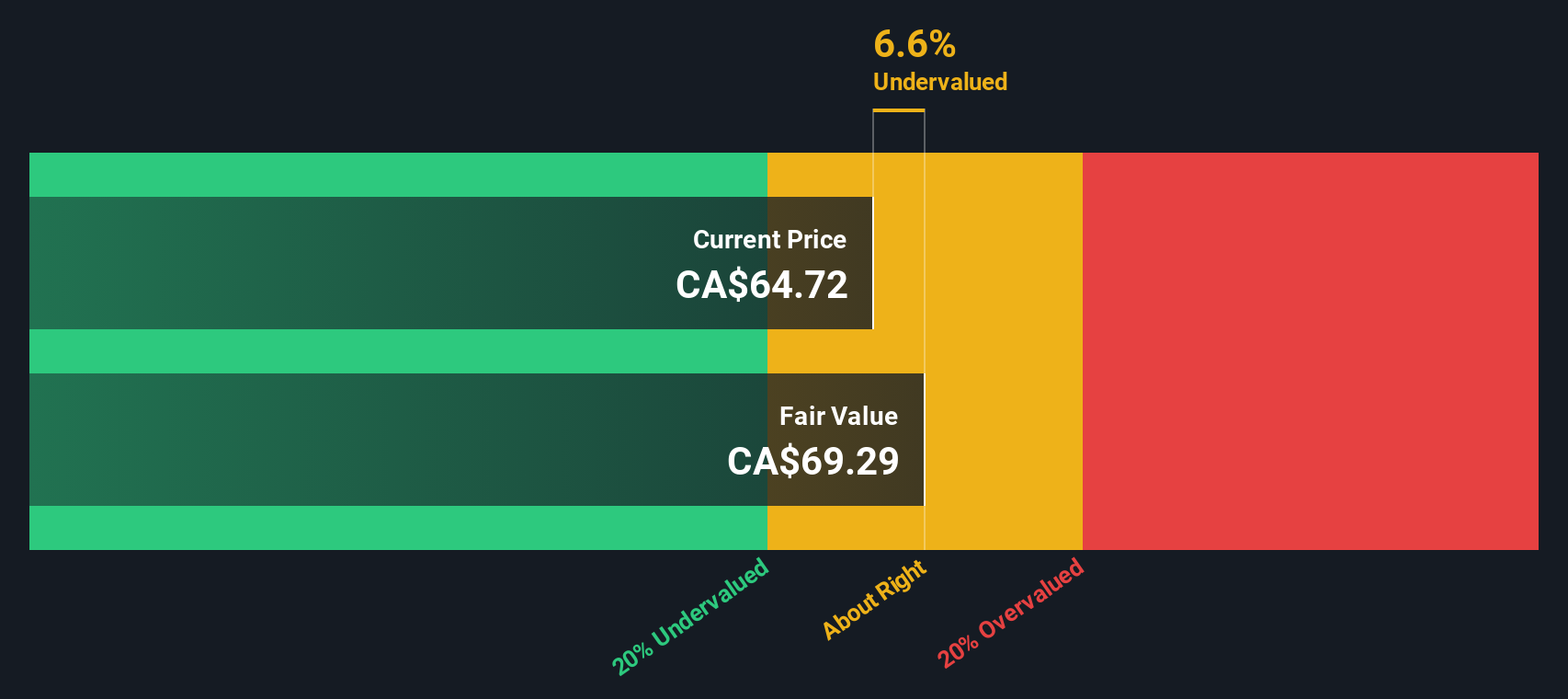

PE: 21.9x

Exchange Income, a Canadian company with a focus on aviation and manufacturing, has seen insider confidence through recent share purchases. Despite challenges in covering interest payments from earnings, the company is forecasted to grow earnings by 25.94% annually. Recent financials show increased sales to C$426.92 million for Q2 2024 but a decline in net income to C$32.65 million compared to last year. Their Atik Mason Pilot Pathway program highlights community engagement and growth potential, offering training for Indigenous students in Canada's north and east coast regions.

- Click to explore a detailed breakdown of our findings in Exchange Income's valuation report.

Review our historical performance report to gain insights into Exchange Income's's past performance.

Key Takeaways

- Delve into our full catalog of 19 Undervalued TSX Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with acceptable track record.