- Canada

- /

- Capital Markets

- /

- TSXV:PALI

3 TSX Penny Stocks With Market Caps Under CA$80M

Reviewed by Simply Wall St

While recent shifts in bond yields have impacted prices, they also suggest potential for stronger fixed-income returns as the Bank of Canada continues to adjust rates. In this context, understanding what makes a good stock is crucial—particularly when considering penny stocks, which can still offer valuable opportunities despite being considered somewhat outdated. These smaller or newer companies may provide investors with hidden value and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.97 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.56 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cabral Gold (TSXV:CBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cabral Gold Inc. is a mineral exploration and development company primarily focused on gold properties in Brazil, with a market cap of CA$46.69 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and development company.

Market Cap: CA$46.69M

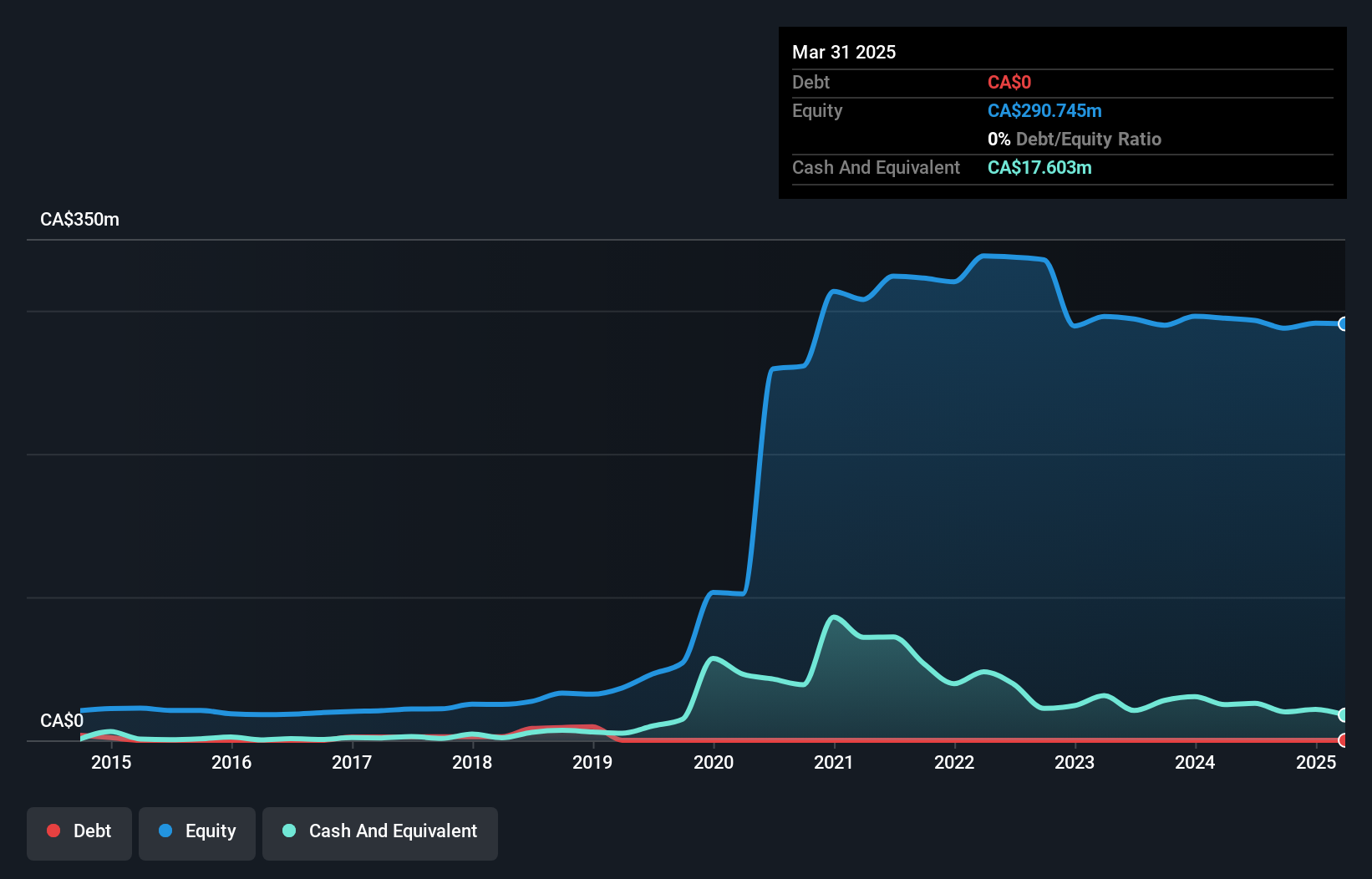

Cabral Gold Inc., a pre-revenue mineral exploration company, recently closed a private placement raising CA$2.1 million, indicating ongoing efforts to secure capital amidst its unprofitable status. The company's recent exploration results at the Jerimum Cima target within the Cuiú Cuiú Gold District highlight promising gold-in-oxide mineralization, potentially expanding resource estimates. However, challenges persist with shareholder dilution and limited cash runway despite recent fundraising efforts. The board and management are relatively inexperienced with short tenures, suggesting potential for strategic shifts as Cabral continues its exploration activities in Brazil without significant revenue streams.

- Get an in-depth perspective on Cabral Gold's performance by reading our balance sheet health report here.

- Explore historical data to track Cabral Gold's performance over time in our past results report.

Palisades Goldcorp (TSXV:PALI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Palisades Goldcorp Ltd. is a resource investment company and merchant bank that invests in junior companies within the resource and mining sector, with a market cap of CA$69.46 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to CA$1.44 million.

Market Cap: CA$69.46M

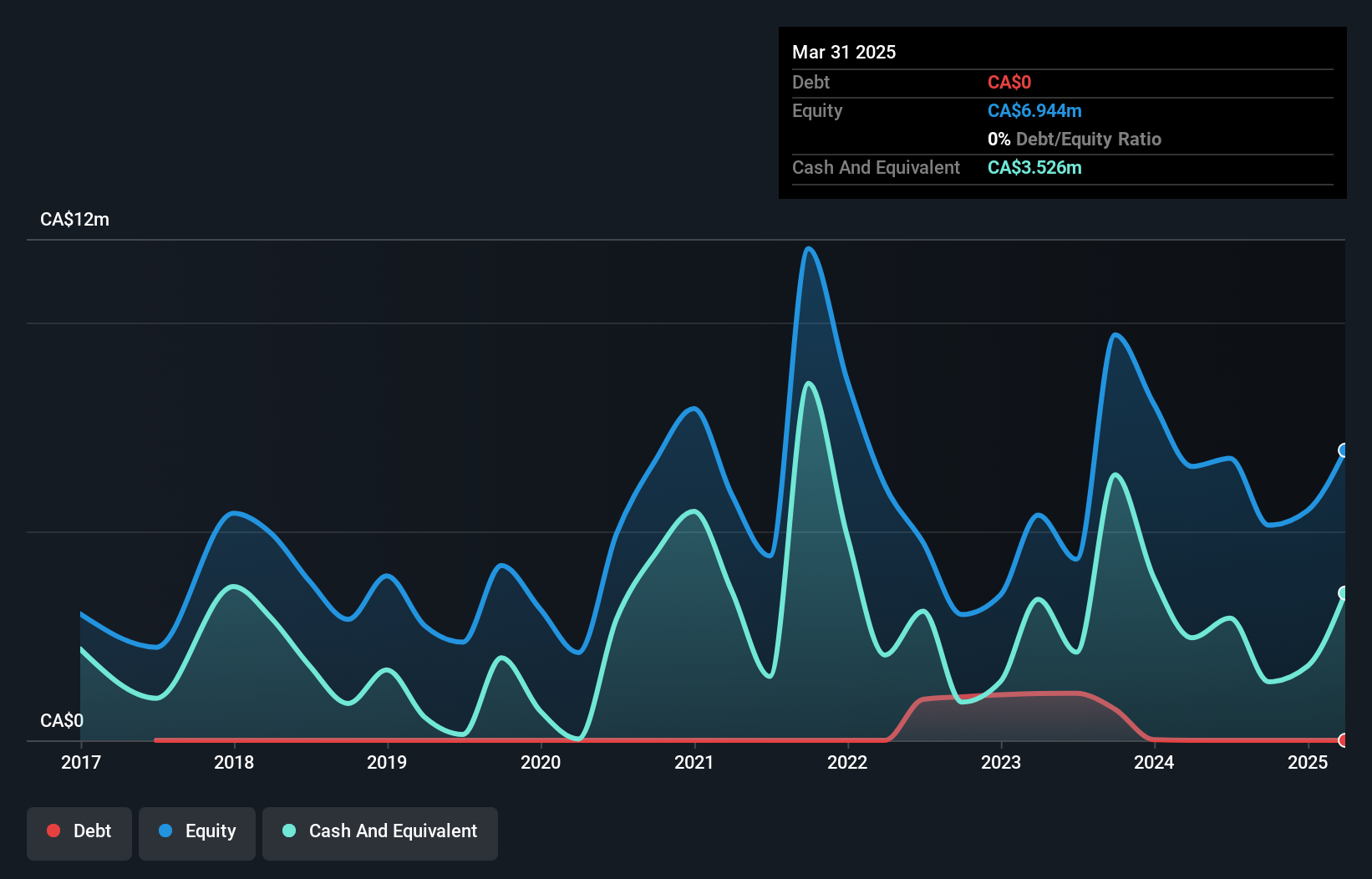

Palisades Goldcorp Ltd., a resource investment company, reported CA$1.26 million in revenue for Q3 2024, marking an improvement from negative figures the previous year. Despite this, the company remains pre-revenue with substantial losses and a negative return on equity of -46.95%. The recent resignation of board member Bill Hayden and its removal from the S&P/TSX Venture Composite Index could signal strategic shifts. While debt-free with a stable cash runway exceeding three years, Palisades faces challenges covering long-term liabilities with short-term assets and has not experienced shareholder dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Palisades Goldcorp.

- Learn about Palisades Goldcorp's historical performance here.

Wallbridge Mining (TSX:WM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wallbridge Mining Company Limited focuses on the acquisition, exploration, discovery, development, and production of gold properties with a market cap of CA$71.28 million.

Operations: Wallbridge Mining Company Limited does not report any specific revenue segments.

Market Cap: CA$71.28M

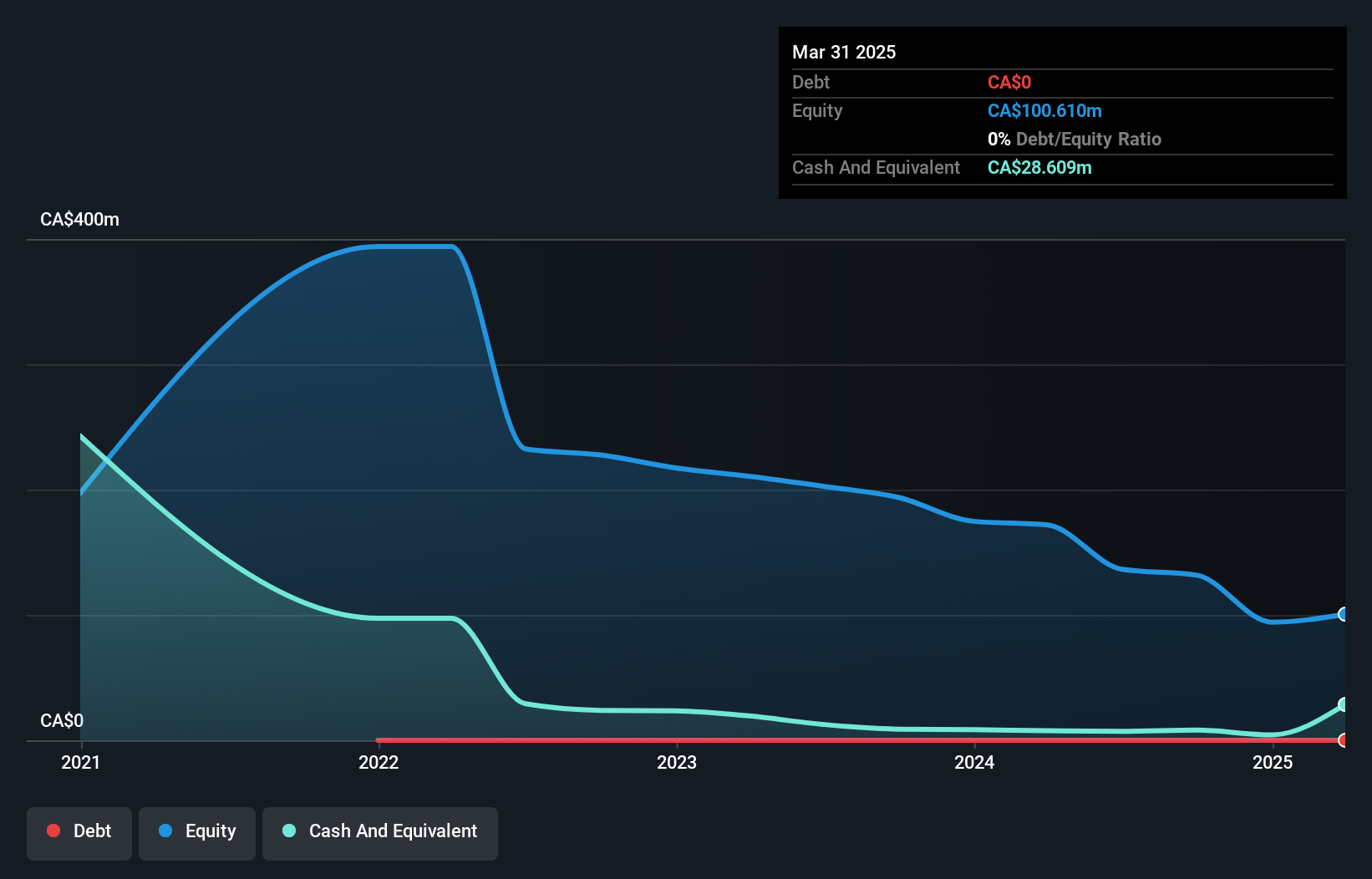

Wallbridge Mining Company Limited, with a market cap of CA$71.28 million, is pre-revenue and currently unprofitable. The company has experienced shareholder dilution over the past year and faces challenges covering long-term liabilities with its short-term assets. Despite these financial hurdles, Wallbridge recently reported promising metallurgical test results from its Martiniere Gold Project, achieving gold recoveries up to 84.8%. Additionally, recent drilling at the Fenelon Gold Project returned significant high-grade gold intercepts, indicating potential resource expansion. Wallbridge remains debt-free but has a limited cash runway of nine months based on current estimates.

- Click to explore a detailed breakdown of our findings in Wallbridge Mining's financial health report.

- Examine Wallbridge Mining's past performance report to understand how it has performed in prior years.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 956 more companies for you to explore.Click here to unveil our expertly curated list of 959 TSX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PALI

Palisades Goldcorp

A resource investment company and merchant bank, focuses on investing in junior companies in the resource and mining sector.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)