Exchange Income (TSE:EIF) Has Re-Affirmed Its Dividend Of CA$0.19

The board of Exchange Income Corporation (TSE:EIF) has announced that it will pay a dividend of CA$0.19 per share on the 15th of June. Based on this payment, the dividend yield on the company's stock will be 5.8%, which is an attractive boost to shareholder returns.

See our latest analysis for Exchange Income

Exchange Income Doesn't Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, Exchange Income's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Over the next year, EPS is forecast to expand by 90.0%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 110%, which probably can't continue putting some pressure on the balance sheet.

Exchange Income Has A Solid Track Record

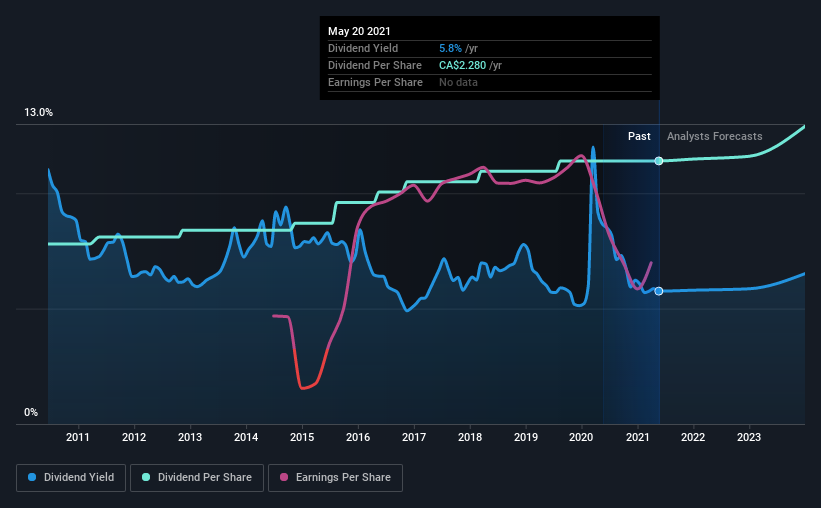

The company has a sustained record of paying dividends with very little fluctuation. Since 2011, the dividend has gone from CA$1.56 to CA$2.28. This implies that the company grew its distributions at a yearly rate of about 3.9% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Exchange Income's EPS has declined at around 9.6% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 5 warning signs for Exchange Income you should be aware of, and 1 of them is a bit unpleasant. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential and fair value.

Market Insights

Community Narratives