- Canada

- /

- Transportation

- /

- TSX:CP

Canadian Pacific Kansas City (TSX:CP) Appoints Arturo Gutiérrez Hernández to Board, Reports Mixed Q2 Earnings

Reviewed by Simply Wall St

The Canadian Pacific Kansas City (TSX:CP) is currently experiencing significant developments that impact its performance and outlook. Recent news highlights include an 8% revenue growth in Q2 and the opening of a new auto compound in Texas, contrasted by rising fuel expenses and a decline in profit margins. In the discussion that follows, we will explore CPKC's core advantages, critical issues, growth opportunities, and key risks to provide a comprehensive overview of the company's current business situation.

Strengths: Core Advantages Driving Sustained Success For Canadian Pacific Kansas City

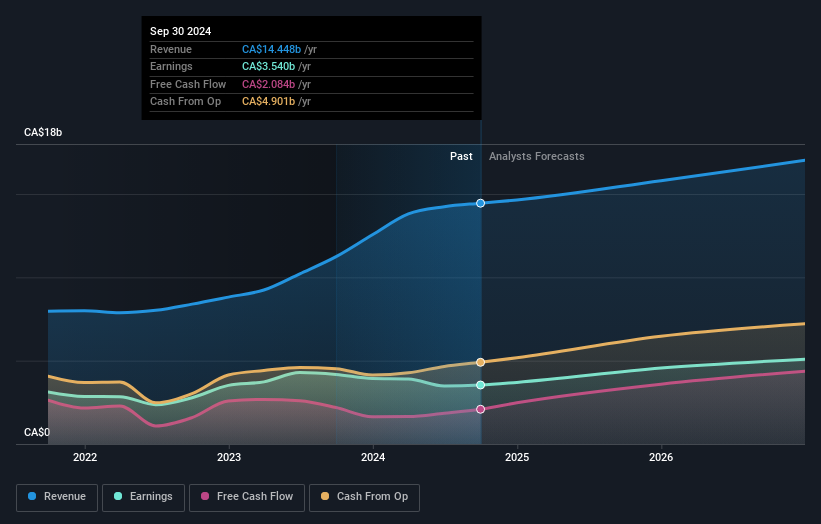

Canadian Pacific Kansas City (CPKC) has demonstrated revenue growth, with second-quarter revenues reaching CA$3.8 billion, an 8% increase from the previous year. This growth is attributed to volume growth of 6% and improved operating efficiency, evidenced by a 280 basis point improvement in the operating ratio to 61.8%. The company's earnings per share (EPS) also saw a significant rise of 27%, reaching CA$1.05. Additionally, CPKC has shown strong cash flow generation, with CA$526 million in adjusted combined free cash flow, which has been used to repay debt. The company is trading at 17.3% below its estimated fair value of CA$139.67, indicating potential undervaluation despite its high Price-To-Earnings Ratio (30.9x) compared to the peer average (23.2x).

To dive deeper into how Canadian Pacific Kansas City's valuation metrics are shaping its market position, check out our detailed analysis of Canadian Pacific Kansas City's Valuation.Weaknesses: Critical Issues Affecting Canadian Pacific Kansas City's Performance and Areas For Growth

CPKC faces several challenges, including labor issues and performance problems in specific areas such as forest products, which are impacted by a soft macro environment. The company's fuel expenses have risen by 9%, reaching CA$466 million, contributing to increased operating expenses. Additionally, the Metals, Minerals, and Consumer Products segment experienced a 3% revenue decrease on a 9% volume decline. The company's Price-To-Earnings Ratio (30.9x) is higher than both the peer average (23.2x) and the North American Transportation industry average (29x), making it appear expensive. Furthermore, the company's Return on Equity (ROE) is forecasted to be low at 12.7% in three years, and its current net profit margins have decreased to 24.5% from 42% last year.

To gain deeper insights into Canadian Pacific Kansas City's historical performance, explore our detailed analysis of past performance.Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CPKC has several growth opportunities, including market expansion and new facilities. The company is on track to set a record for all-time tonnage with Canpotex this year, and it recently opened a new auto compound at its Wylie, Texas Intermodal terminal. These initiatives are expected to drive future revenue growth, which is forecasted at 7.6% per year, outpacing the Canadian market's 6.9% growth rate. Additionally, the company is well-positioned to deliver double-digit core adjusted combined earnings growth, leveraging synergies from its operations. Positive market trends, such as the expected ramp-up in production in the back half of the year, further enhance its growth prospects.

Threats: Key Risks and Challenges That Could Impact Canadian Pacific Kansas City's Success

CPKC faces several external threats, including economic factors and regulatory risks. The freight environment remains challenging, and regulatory uncertainties, such as the CRIB's involvement in labor issues, pose potential risks. The company also faces competitive pressures, with the need to continuously improve and adapt to market conditions. Market volatility, highlighted by the potential for strikes, adds another layer of uncertainty. Additionally, CPKC's high level of debt and the significant decrease in profit margins from 42% to 24.5% year-over-year could impact its financial stability and long-term growth.

Conclusion

Canadian Pacific Kansas City has shown strong revenue and EPS growth, driven by increased volumes and improved operating efficiency, which are positive indicators for its future performance. However, the company faces significant challenges, including rising fuel expenses, labor issues, and declining profit margins, which could impact its financial stability. CPKC's strategic initiatives, such as market expansion and new facilities, position it well for future growth, with revenue forecasted to outpace the Canadian market. While the company is considered expensive based on its Price-To-Earnings Ratio (30.9x) compared to its peers and industry averages, it is trading below its estimated fair value of CA$139.67, suggesting potential for future appreciation. Investors should weigh these factors carefully when considering the company's long-term prospects.

Key Takeaways

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Fair value with mediocre balance sheet.