- Canada

- /

- Transportation

- /

- TSX:CNR

Should Strong Q2 Results and Leadership Changes Require Action From Canadian National Railway (TSX:CNR) Investors?

Reviewed by Simply Wall St

- Canadian National Railway recently announced its second-quarter earnings with revenue of C$4.27 billion and net income of C$1.17 billion, alongside a confirmed quarterly dividend and completion of a C$300 million share buyback for 2.2 million shares.

- An interim executive appointment saw Janet Drysdale step into the Chief Commercial Officer role, highlighting ongoing leadership changes during a period marked by operational and financial updates.

- To understand how these developments, particularly the strong earnings and continued capital returns, influence Canadian National Railway’s investment outlook, we will now reassess the narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Canadian National Railway Investment Narrative Recap

To own Canadian National Railway shares, you need to believe this is a business that can reliably convert its extensive North American rail network and operational investments into steady cash flow, even when top-line growth is muted. The latest earnings report, modestly higher net income and increased EPS despite slightly lower sales, doesn’t materially alter the near-term catalyst of a potential demand rebound or the biggest risk of structurally flat volumes if macroeconomic pressures persist.

The most relevant announcement is the completion of the C$300 million share buyback, which underscores ongoing capital return as a pillar of value for shareholders. This action may reassure those focused on return of capital, but it does not directly address the concern that long-term revenue growth could remain subdued if freight demand or trade volumes stagnate.

In contrast, investors should be alert to how persistent weak volumes could impact the outlook if...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's narrative projects CA$19.7 billion revenue and CA$5.6 billion earnings by 2028. This requires 4.5% yearly revenue growth and a CA$1.1 billion increase in earnings from CA$4.5 billion today.

Exploring Other Perspectives

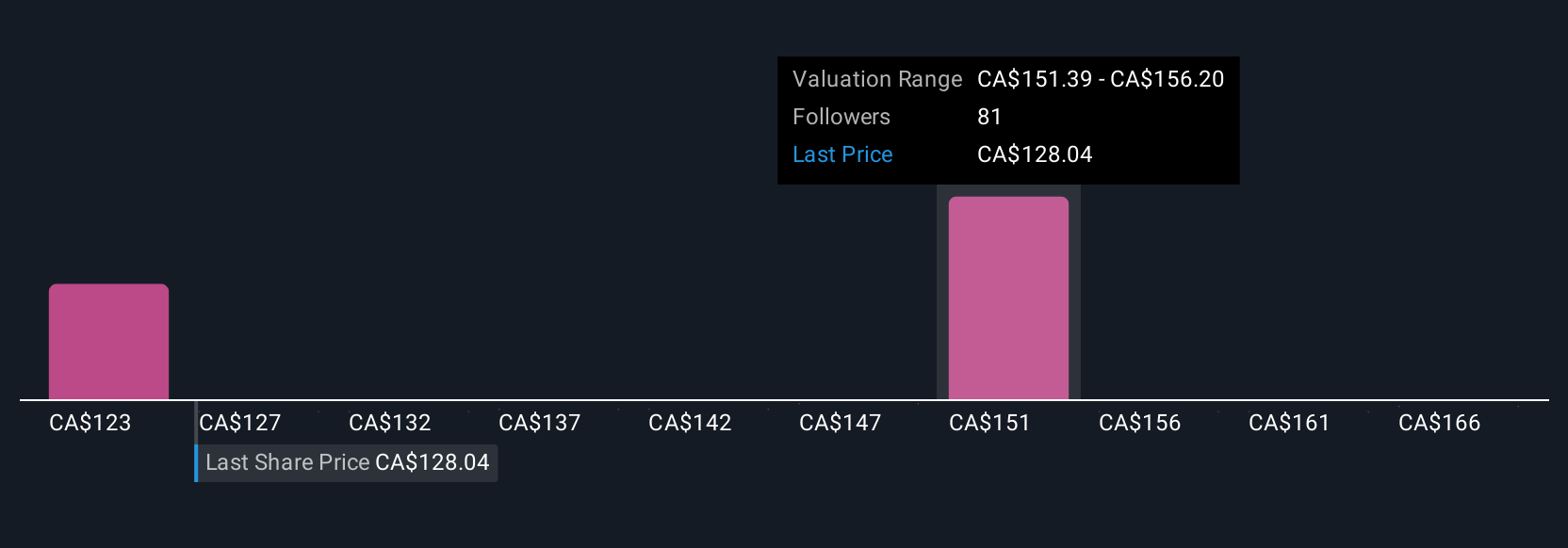

Nine members of the Simply Wall St Community estimate Canadian National Railway's fair value anywhere from C$122.08 up to C$170.48 per share. While these opinions reflect a wide spectrum, ongoing concerns about flat volumes and uncertain demand continue to weigh on many participants’ outlooks, explore what other investors are seeing and why opinions differ.

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success