- Canada

- /

- Transportation

- /

- TSX:CNR

Does the Recent Freight Recovery Signal New Value for Canadian National Railway in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Canadian National Railway shares? You are not alone. With the stock recently closing at $135.25 and posting a tidy 3.1% gain in the past week, investors are weighing their next moves. After a tough year, with the stock still down 10.5% over the past 12 months and showing a modest 2.6% increase across five years, questions about true growth potential and valuation are as relevant as ever.

Some of the latest market chatter points to shifts in risk perception across the North American rail sector, driven by hopes of improving freight volumes and a more stable economic outlook. Although these developments might not make headlines every day, they have quietly helped support the recent uptick in Canadian National Railway’s share price.

What matters most now is whether the current price still offers value, or if recent optimism is already priced in. Based on our concentrated scoring system, Canadian National Railway earns a value score of 3 out of a possible 6, meaning it appears undervalued in half of the valuation checks we use.

So, how do we break down these different approaches to valuing the company, and is a simple score enough? Let’s dig into some of the most common valuation methods. Stick around, because we will wrap up with an even more insightful way to gauge whether this stock deserves a spot in your portfolio.

Why Canadian National Railway is lagging behind its peers

Approach 1: Canadian National Railway Discounted Cash Flow (DCF) Analysis

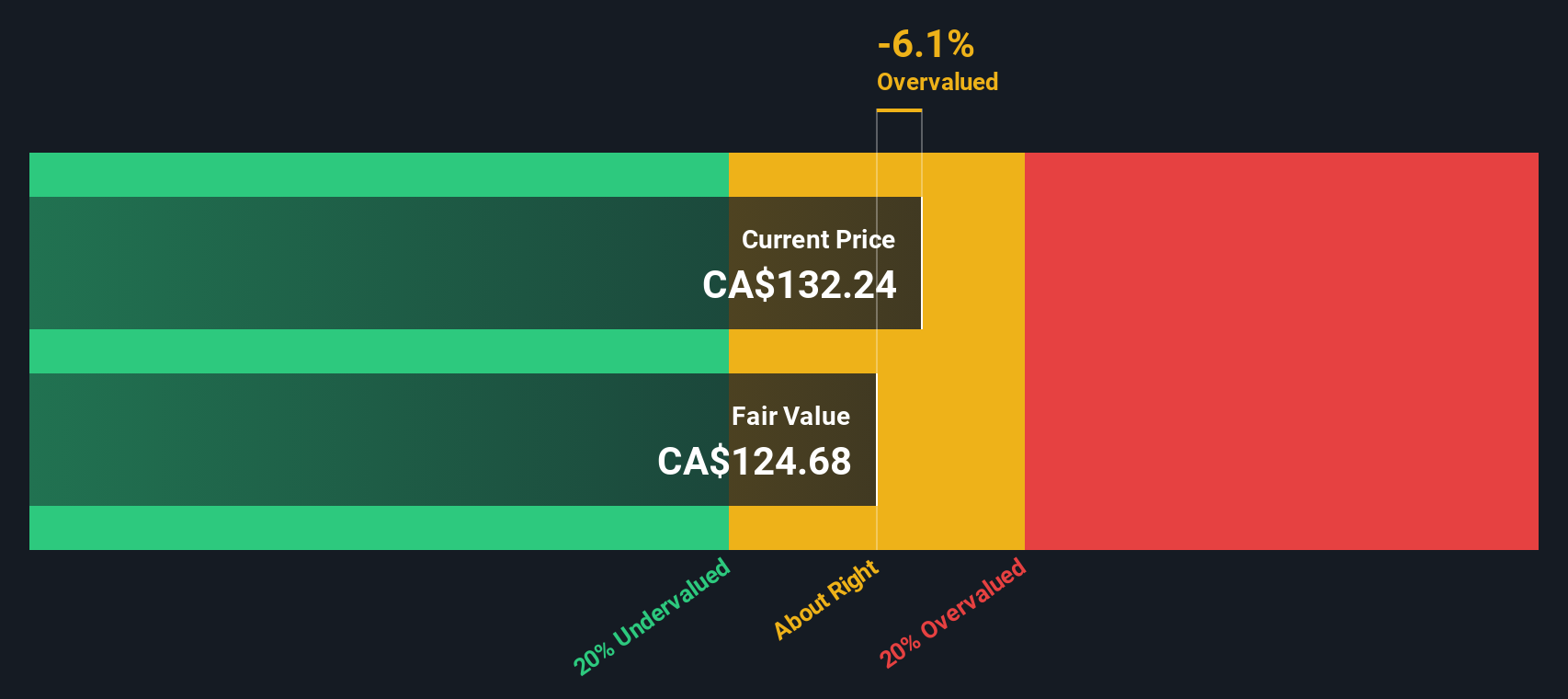

The Discounted Cash Flow (DCF) valuation is a widely used approach to estimate a company's intrinsic worth by forecasting its future cash flows and then discounting those projections back to present value. For Canadian National Railway, this model uses a 2 Stage Free Cash Flow to Equity approach, capturing both analyst forecasts and long-term extrapolations.

Currently, Canadian National Railway generates Free Cash Flow of approximately CA$3.45 Billion annually. Analyst estimates provide projections over the next five years, showing a moderate growth trajectory, with expected Free Cash Flow rising to CA$4.26 Billion by 2029. After this period, projections are continued based on estimated growth rates to reflect a decelerating but positive long-term outlook.

Based on these cash flow projections, the DCF analysis estimates Canadian National Railway’s fair value at CA$124.44 per share. When compared to the recent market price of CA$135.25, the stock appears about 8.7% overvalued relative to the model.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Canadian National Railway's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Canadian National Railway Price vs Earnings

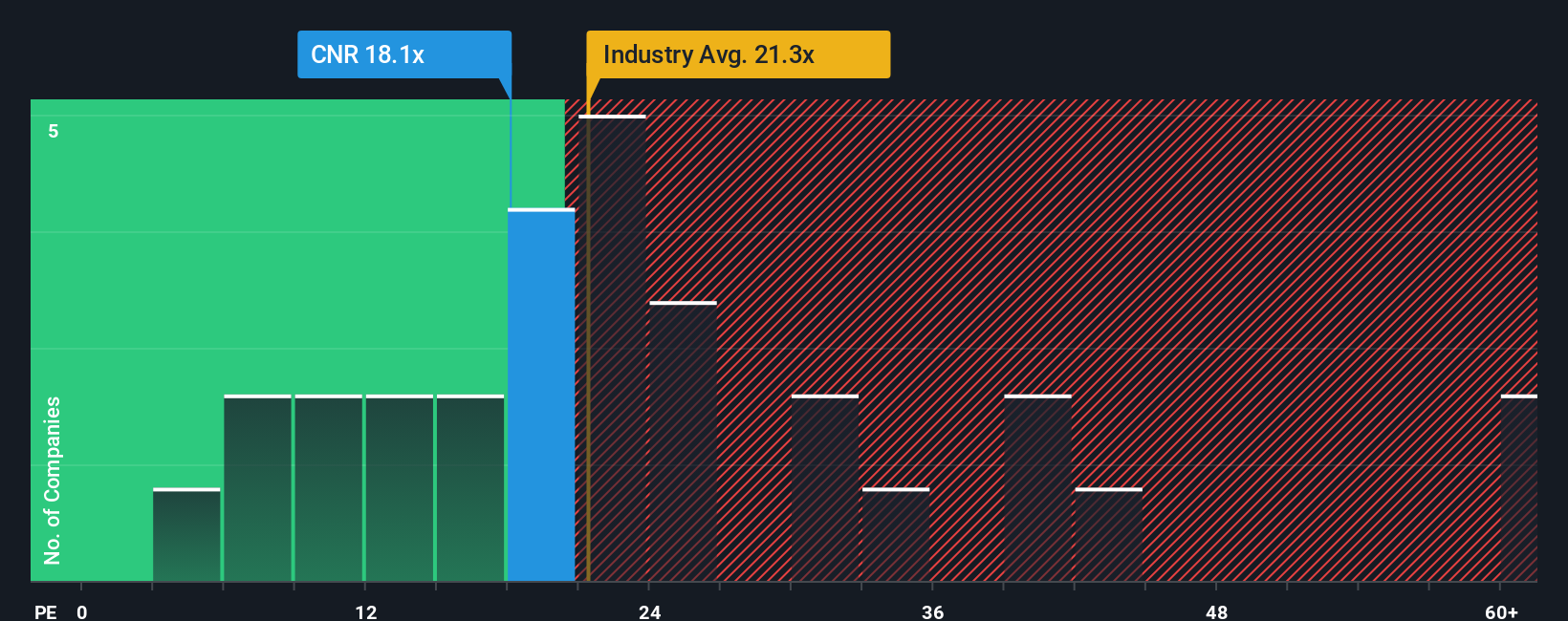

For companies like Canadian National Railway that generate steady profits year after year, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. The PE ratio compares a company’s current share price to its earnings per share, offering a quick snapshot of how much investors are willing to pay for each dollar of profit. It is especially useful for profitable and established companies, as it reflects both expectations of future growth and the perceived level of risk in those earnings.

Generally, a higher PE ratio can indicate that the market expects stronger growth in the future or that the company is seen as lower risk relative to peers. On the flip side, a lower PE ratio may signal more modest growth expectations or potential challenges ahead. Canadian National Railway currently trades at a PE ratio of 18.5x. This sits above the Transportation industry average of 15.7x, but below the peer group average of 21.4x. This highlights a middle ground in how investors are valuing the stock compared to alternatives.

To add another layer of context, Simply Wall St’s “Fair Ratio” framework goes beyond industry or peer averages by incorporating Canadian National Railway’s earnings growth prospects, profit margins, market capitalization, and broader industry risks. With a Fair Ratio of 19.4x, this approach offers a more tailored benchmark for where the stock should reasonably trade, based on its own unique qualities. Comparing the current PE ratio of 18.5x with the Fair Ratio of 19.4x, the valuation appears to be about right. There is less than a 0.10 difference between the two, suggesting the stock’s price fairly reflects its fundamentals at present.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian National Railway Narrative

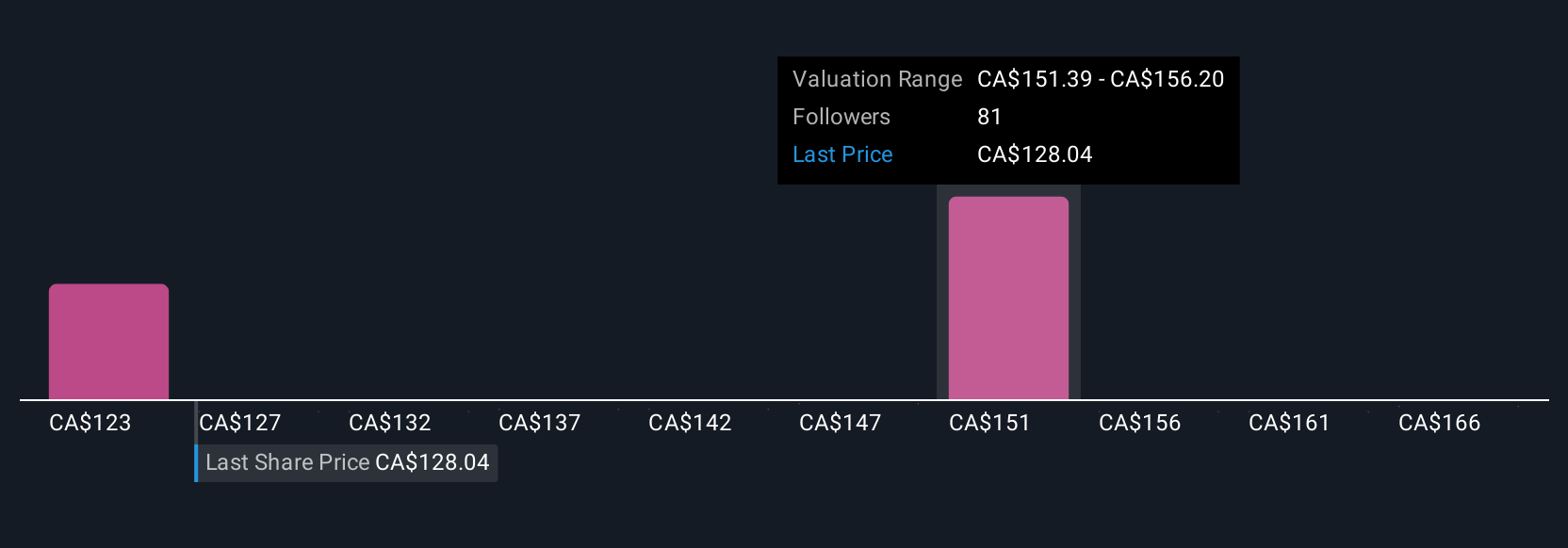

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, a way to match your view of Canadian National Railway’s future (revenue, earnings, profit margins) to a forecast and a fair value. This creates a clear link between what you believe and what the numbers suggest.

On Simply Wall St’s Community page, Narratives help millions of investors express their own take on a company’s prospects. They make it easy to outline why you think the stock is undervalued or overvalued. Narratives show how your expectations could translate into a fair value, allowing you to compare your view with the current market price and decide when it might be time to buy, hold, or sell.

You do not need to build elaborate spreadsheets. Just plug in your assumptions and instantly see the story unfold, updated in real time if new company news or earnings arrive. For example, one investor's Narrative about Canadian National Railway could be optimistic, focusing on operational discipline and unique network advantages to justify a higher price target of CA$185.00. Another investor might highlight threats like weak demand or competitive pressures, leading to a more conservative estimate of CA$133.00.

With Narratives, the numbers become part of your own investing story, making complex analysis accessible, dynamic, and truly personal.

Do you think there's more to the story for Canadian National Railway? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives