Should Air Canada’s (TSX:AC) Plan to Restore U.S. Capacity Signal a Shift in Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Air Canada presented at the Bloomberg Canadian Finance Conference on October 7, 2025, with Executive VP & CFO John Di Bert addressing recent developments including a 27% drop in Canadians returning from the U.S. and subsequent flight cancellations to secondary U.S. cities.

- Despite the significant decline in U.S. travel demand, Air Canada is planning to restore U.S. flight capacity to summer 2024 levels by next year, while industry partnerships like American Airlines' codeshare with Porter Airlines point to possible improvements in future cross-border travel trends.

- We'll explore how Air Canada's intent to rebuild U.S. flight capacity could impact its future international growth narrative and earnings outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Canada Investment Narrative Recap

Owning Air Canada stock means believing in its ability to recover and grow international travel demand, particularly as it aims to restore U.S. flight capacity despite a steep decline in Canadian-U.S. traffic. The recent conference update highlighting soft transborder demand does not materially impact the most important short-term catalyst, international travel expansion, but does reinforce that ongoing transborder weakness is the biggest risk to sustained revenue growth.

Of the recent announcements, Air Canada’s plan to add new transborder flights for Summer 2026, despite current demand challenges, stands out. This move aligns with the company’s focus on expanding its U.S. network as a growth driver, but it also tests whether capacity increases will match a rebound in cross-border travel and offset recent regional revenue declines.

In contrast, investors need to be aware of how persistent softness in key markets like U.S. transborder routes could...

Read the full narrative on Air Canada (it's free!)

Air Canada's narrative projects CA$26.3 billion in revenue and CA$869.3 million in earnings by 2028. This requires 5.6% yearly revenue growth and a CA$630.7 million earnings decrease from current earnings of CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$24.36 fair value, a 33% upside to its current price.

Exploring Other Perspectives

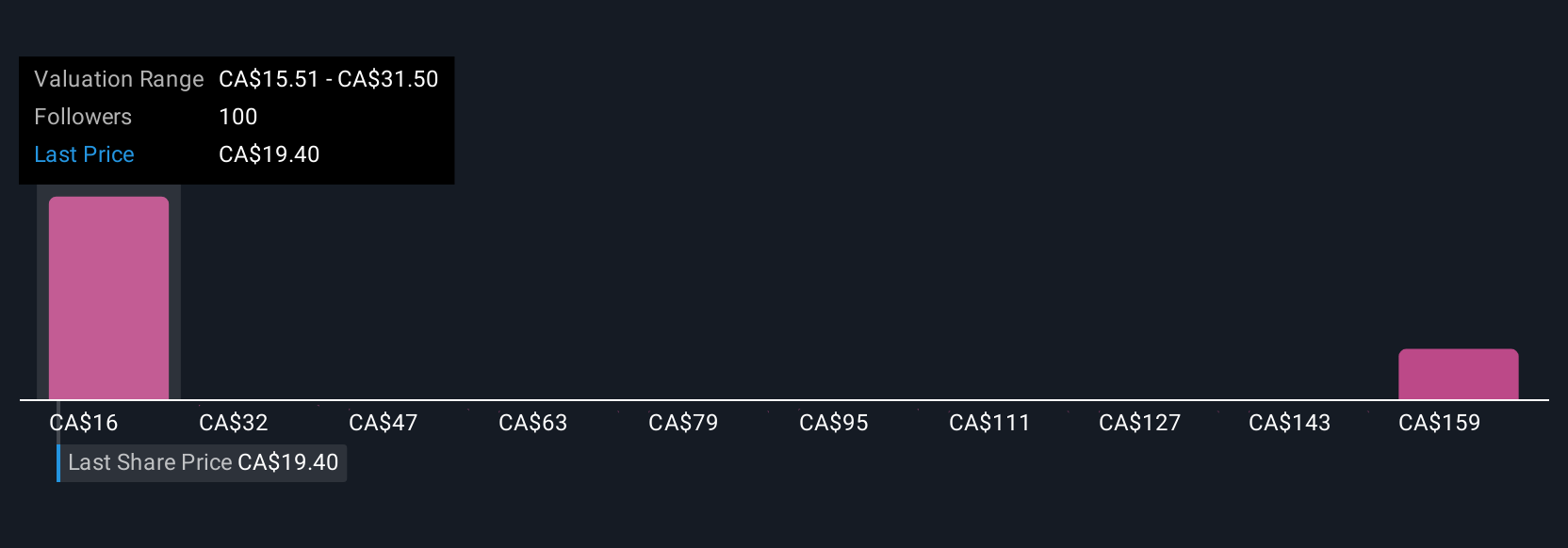

Fair value estimates from the Simply Wall St Community range from CA$15.51 to CA$52.57, with nine investor perspectives. Ongoing weakness in US-Canada travel demand could challenge many of these assumptions, review a range of outlooks before making up your mind.

Explore 9 other fair value estimates on Air Canada - why the stock might be worth over 2x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with low risk.

Similar Companies

Market Insights

Community Narratives