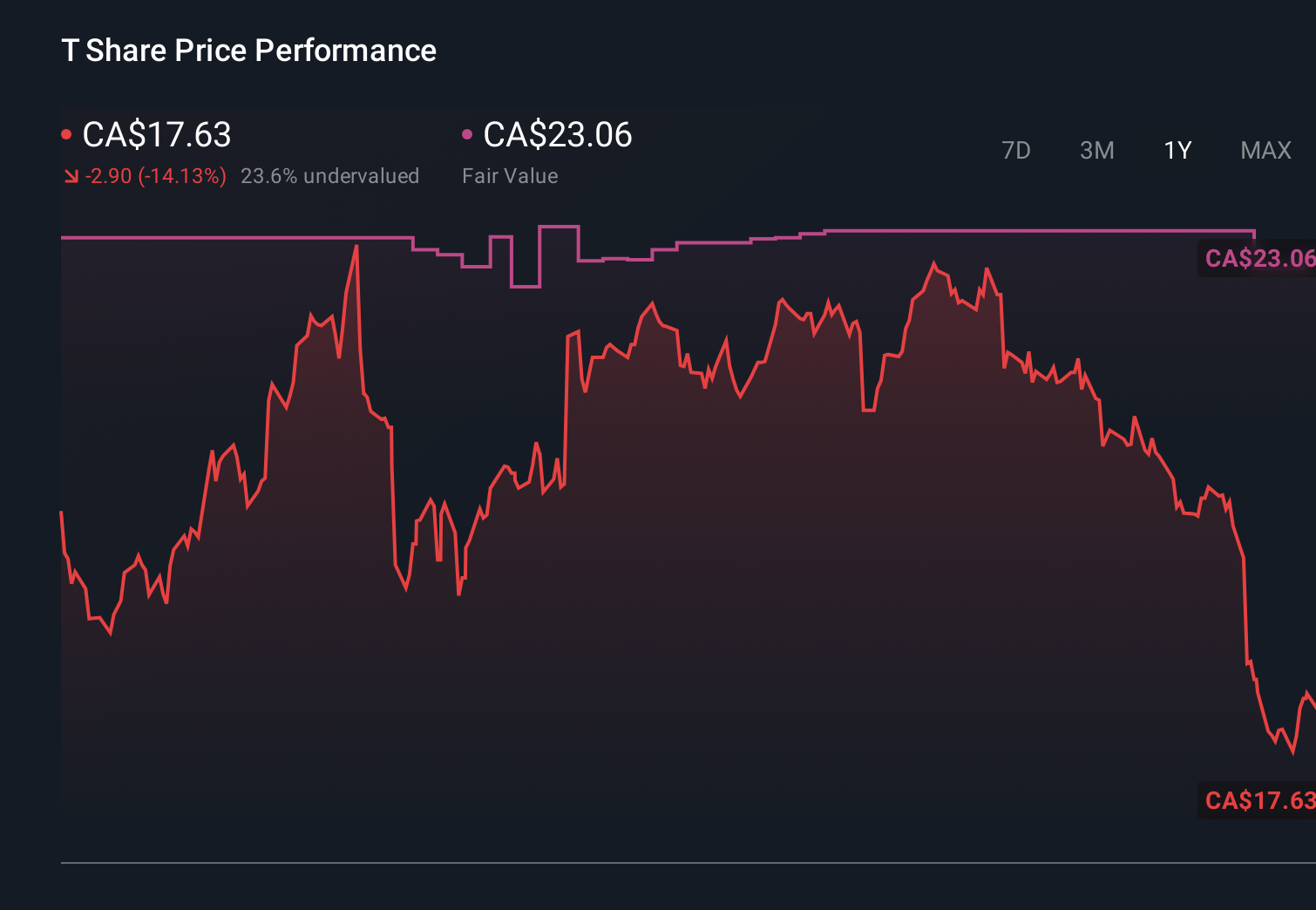

TELUS (TSX:T) Is Down 5.7% After Pausing Dividend Growth And Issuing Hybrid Debt For Deleveraging – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early December 2025, TELUS moved to reshape its balance sheet and capital allocation by issuing junior subordinated notes in both US$1.50 billion and C$800.00 million tranches, alongside tender offers for several long-dated bonds, while also pausing dividend growth and planning to phase out its discounted Dividend Reinvestment Plan.

- This shift toward debt refinancing, deleveraging, and fully cash-covered dividends marks a clear reset of TELUS’s long-running income-focused approach in favour of balance sheet resilience and funding flexibility.

- We’ll now examine how TELUS’s decision to pause dividend growth and emphasize deleveraging may alter the company’s long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TELUS Investment Narrative Recap

To own TELUS, you need to believe its core connectivity, health and AI businesses can support a high dividend while it gradually strengthens a stretched balance sheet. The December 2025 junior subordinated note issuance and bond tenders point squarely at the key near term catalyst and risk: improving free cash flow and leverage in a context where interest costs are not well covered by earnings. These moves aim to address that pressure, but do not fully remove it.

Among the latest announcements, the partnership with Qohash to harden data protection in TELUS’s Fuel iX AI platform stands out in the context of its AI and digital infrastructure catalyst. Embedding Qostodian into TELUS’s sovereign AI stack speaks directly to the company’s effort to build higher value, less commoditized revenue streams that can complement slower growing wireless and internet services and, over time, support the deleveraging and dividend reset story.

However, investors should also be aware that TELUS’s elevated debt load and interest coverage constraints could still...

Read the full narrative on TELUS (it's free!)

TELUS’ narrative projects CA$22.7 billion revenue and CA$1.5 billion earnings by 2028.

Uncover how TELUS' forecasts yield a CA$23.06 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently see TELUS’s fair value between C$20 and about C$47.40, highlighting very different expectations for the stock’s upside. Against that wide range, TELUS’s heavy capital needs in fiber, 5G and AI infrastructure keep financial risk front and center for the company’s future performance.

Explore 6 other fair value estimates on TELUS - why the stock might be worth just CA$20.00!

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)