- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

What Rogers Communications (TSX:RCI.B)'s Debt Buyback and Satellite Launch Means For Shareholders

Reviewed by Simply Wall St

- In the past week, Rogers Communications expanded and completed its debt tender offers, increasing its aggregate purchase cap to US$1.4 billion and CAD 400 million to buy back various series of long-dated senior notes, aiming to enhance financial flexibility and reduce leverage.

- Simultaneously, the company launched Rogers Satellite, a satellite-to-mobile text messaging service that dramatically extends wireless coverage across Canada, tapping into underserved rural and remote communities and reinforcing its role as a technology leader in Canadian telecommunications.

- We'll explore how Rogers' large-scale debt reduction and the rollout of Rogers Satellite influence its investment narrative and future growth opportunities.

Rogers Communications Investment Narrative Recap

To be a shareholder in Rogers Communications today, you need to believe in its ability to maintain strong wireless and cable performance while balancing financial discipline and innovation, a narrative reinforced by the recent US$1.4 billion and CA$400 million debt buybacks. While these moves strengthen the balance sheet and align with the company’s deleveraging catalyst, they do not materially shift the most pressing near-term risk: competitive pricing pressure in Canadian wireless, which could impact revenue and margins.

Perhaps most relevant is the launch of Rogers Satellite, which rapidly expanded network coverage across Canada’s rural and remote areas. This product could help Rogers differentiate its wireless offerings, potentially offsetting sector-wide pricing risks while supporting leadership in network reliability, a key growth catalyst.

On the flip side, investors should be aware that continuing competitive discounting in wireless market pricing could...

Read the full narrative on Rogers Communications (it's free!)

Rogers Communications is forecast to reach CA$21.9 billion in revenue and CA$2.5 billion in earnings by 2028. This outlook is based on analysts' assumption of 1.9% annual revenue growth and a CA$0.7 billion earnings increase from the current CA$1.8 billion.

Exploring Other Perspectives

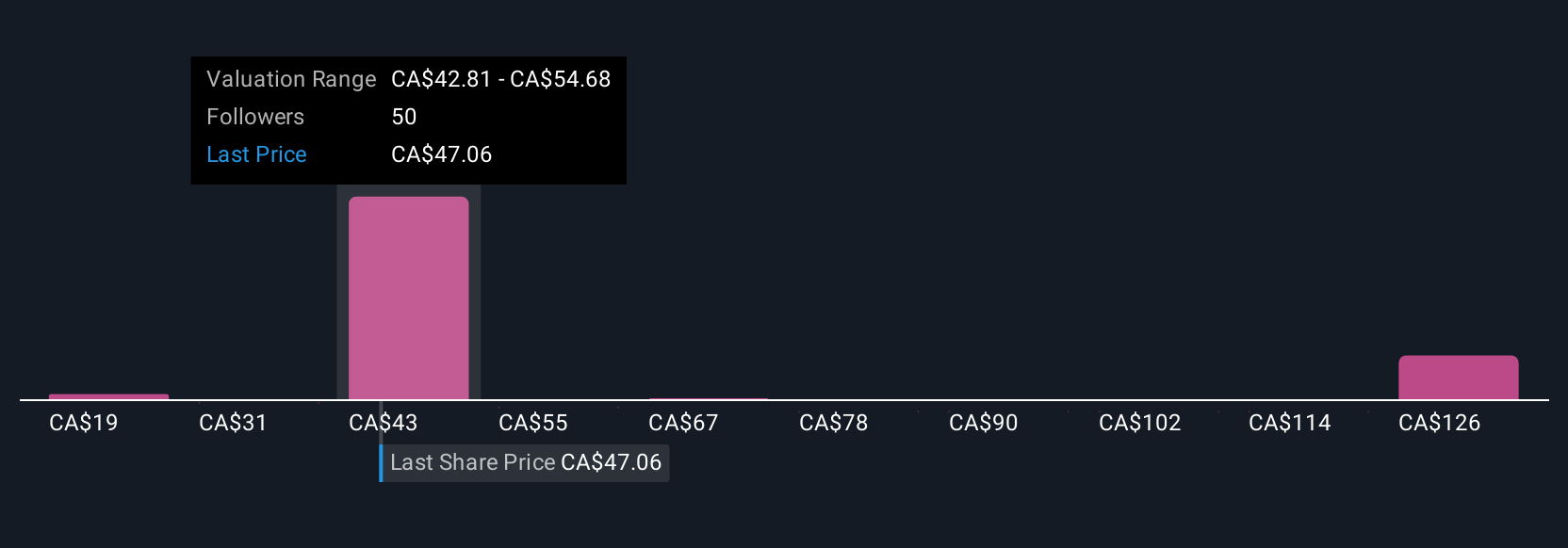

Simply Wall St Community members provided 11 distinct fair value estimates for Rogers, ranging from CA$19.07 to CA$142.75 per share. While some see significant upside, others may be watching how increased competition could weigh on Rogers’ earnings and market position. Consider comparing these perspectives for a wider view.

Build Your Own Rogers Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rogers Communications research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rogers Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers Communications' overall financial health at a glance.

No Opportunity In Rogers Communications?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives