- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

How Rogers’ 19% Rally and Recent Shaw Merger Shape Its 2025 Valuation Outlook

Reviewed by Bailey Pemberton

If you have been watching Rogers Communications and wondering whether now is the time to buy, hold, or move on, you are not alone. The stock has been quietly making moves, and it is worth digging deeper to see if there is hidden value waiting to be unlocked. Over the past month, Rogers shares have gained 6.1% with a steady climb supported by a modest 1.4% uptick in the last week and an impressive 19.3% jump year to date. Long-term investors might note that the returns over three and five years are respectable at 10.8% and 8.0% respectively, though the one-year gain of 1.3% does hint at some rollercoaster moments along the way.

So, what is driving these shifts in sentiment? Industry watchers have pointed to broader market optimism in the communications sector and evolving competitive dynamics among Canadian telecom companies. These factors seem to be fueling both growth expectations and shifting perceptions around risk, nudging Rogers into the spotlight for those looking for reliable, long-term bets.

Of course, consistent price growth makes it tempting to hit the buy button right now, but valuation is key. On our six-point value score, Rogers comes in at 3, showing it is undervalued in half of the key checks. Before making any decisions, let us run through the different ways analysts assess valuation. Stick around, because there is an even better way to judge whether Rogers truly deserves a place in your portfolio, which we will explore at the end.

Why Rogers Communications is lagging behind its peers

Approach 1: Rogers Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company’s fair value by forecasting its future free cash flows and then discounting those projections back to their present-day value. This approach helps investors determine what a business is worth today, based on the cash it is expected to generate in the years ahead.

For Rogers Communications, the latest twelve months of Free Cash Flow came in at CA$1.68 billion. Analysts expect this figure to steadily climb, with projections reaching CA$3.38 billion by the end of 2027. Over the next decade, estimates indicate Free Cash Flow could approach CA$4.75 billion by 2035, thanks to ongoing growth from analyst-driven forecasts in the next five years and further extrapolations beyond that.

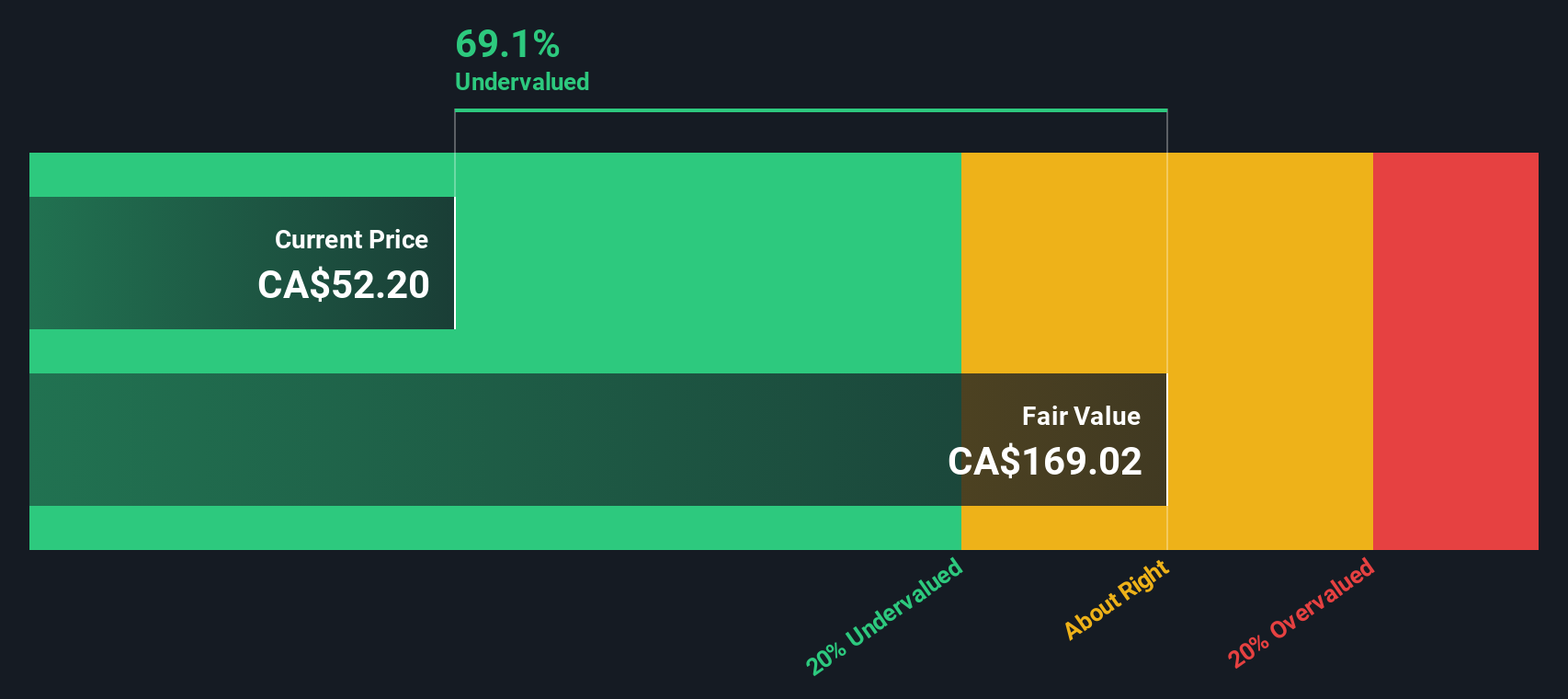

After tallying up all future cash flows and discounting them accordingly, the DCF analysis assigns an intrinsic value of CA$169.02 per share to Rogers. At current prices, this implies a potential 69.1% discount, suggesting the stock is dramatically undervalued on a DCF basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rogers Communications is undervalued by 69.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rogers Communications Price vs Earnings (P/E)

For profitable companies like Rogers Communications, the price-to-earnings (P/E) ratio is one of the most popular ways to judge valuation. The P/E ratio shows how much investors are willing to pay today for each dollar of the company’s earnings, making it especially useful when earnings are stable and growing, as is the case with Rogers.

The "right" P/E ratio is not set in stone. Growth expectations can boost what is considered normal, while higher risks tend to compress the P/E multiple investors are comfortable paying. Industry averages and peer multiples offer context, but they do not tell the full story for any individual business.

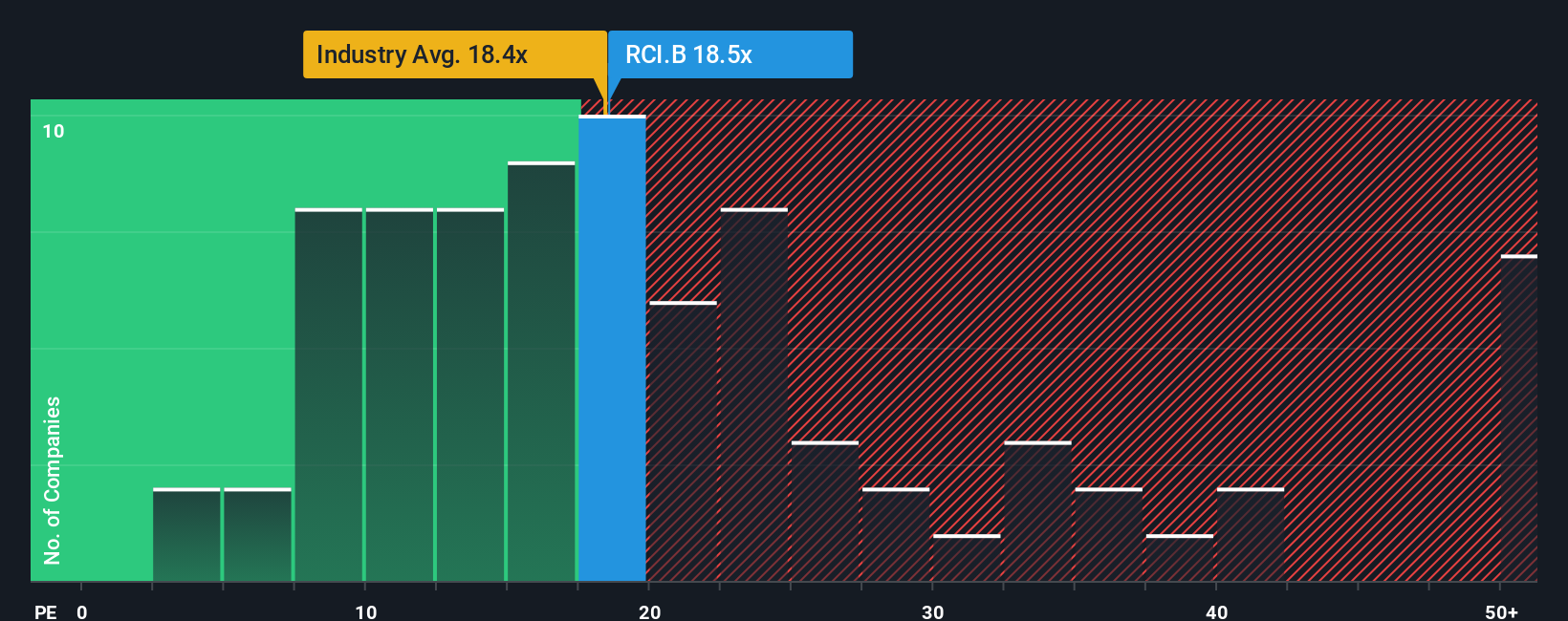

Currently, Rogers trades at an 18.5x P/E ratio. This is almost exactly in line with the Wireless Telecom industry average of 18.4x and well below the average of its peers at 34.0x. However, Simply Wall St's proprietary "Fair Ratio" goes a step further. It factors in Rogers’ expected earnings growth, profit margin, business risks, market cap, and the unique features of its industry. That yields a Fair Ratio of 18.5x, pinpointing the level at which Rogers would be fairly valued given these specifics.

This more tailored approach provides a sharper read than simply comparing with the broad industry or other companies. In this case, Rogers’ P/E exactly matches its Fair Ratio, suggesting the stock is trading at a price that truly fits with its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rogers Communications Narrative

Earlier, we mentioned that there is an even better way to judge whether Rogers truly deserves a place in your portfolio, and that is through Narratives. A Narrative is a simple but powerful tool where investors connect the company's story, such as new products, industry shifts, or challenges, to their own expectations for future revenue, earnings, and margins. This process ultimately shapes their view of what the shares are really worth.

Unlike just crunching numbers, Narratives blend your personal perspective on Rogers with a forward-looking financial forecast, drawing a direct line from your outlook to a clear Fair Value. This approach is available to everyone on Simply Wall St's Community page and is already being used by millions of investors looking for a smarter, more tailored way to make buy or sell decisions.

Narratives make it easy to compare your Fair Value against today's market price, so you can decide if now is the time to act or wait. They update automatically as new news or company results come in, keeping your investment thesis current without extra effort.

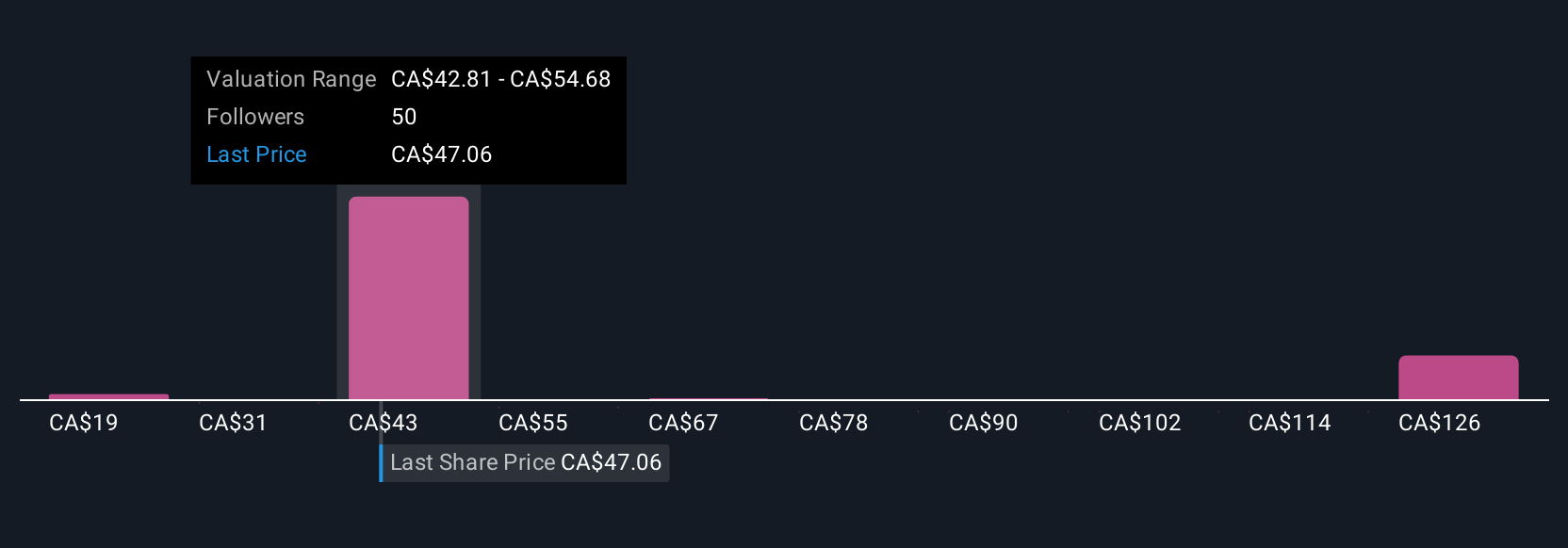

For Rogers Communications, one investor might believe its rural 5G expansion and satellite connectivity will drive major growth, supporting a bullish Fair Value as high as CA$71.00 per share. Another could focus on risks from high debt or regulatory pressure, landing at a much lower valuation like CA$40.00. Your Narrative lets you decide which story best fits your convictions and your portfolio.

Do you think there's more to the story for Rogers Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)