- Canada

- /

- Telecom Services and Carriers

- /

- TSX:QBR.A

Is There Still Value in Quebecor After Its 29.5% Share Price Climb?

Reviewed by Bailey Pemberton

If you’re scratching your head about what to do with Quebecor these days, you’re definitely not alone. There’s a lot to love here for both the cautious investor and the go-getter looking for growth potential. Over the past year, Quebecor’s share price has climbed 29.5%. If you zoom out to a three-year window, the stock is up a whopping 91.4%, and even in the last month, it managed a modest gain of 2.9%. Those kinds of numbers naturally catch your eye, but what’s really driving the interest now?

Some of it comes down to the company’s moves in the media and telecom space, where Quebecor has been anything but quiet. The company’s high-profile expansion efforts, especially in wireless, have stoked optimism about future growth. Investors seem to be rewarding what they see as strategic moves, not just quick wins. The result is that Quebecor has been reassessed by many, and that has altered both risk perceptions and the outlook for ongoing returns.

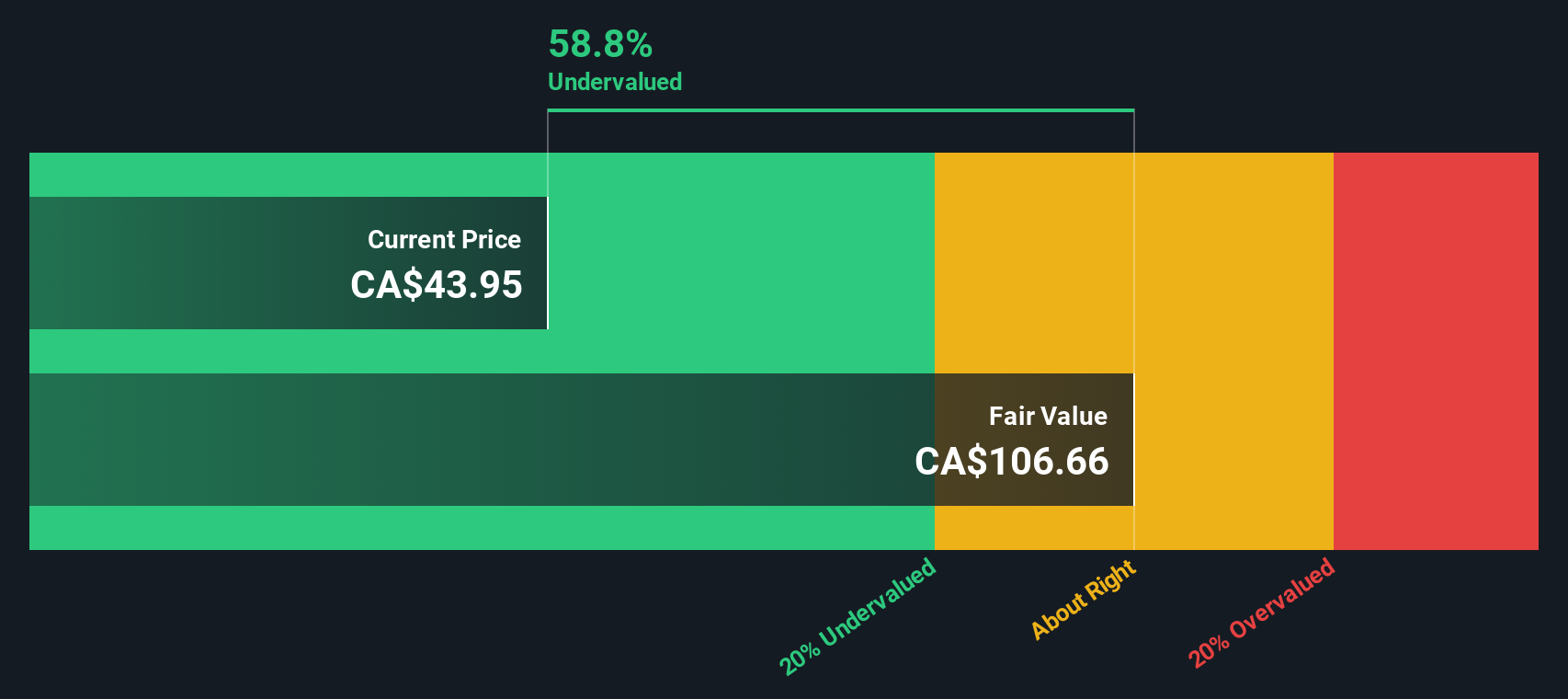

Of course, with the share price at $43.95 and the year-to-date return topping 33.2%, the big question is whether Quebecor is undervalued, fairly valued, or possibly a bit overbought. Here is where things get interesting: when you run the numbers using six well-known valuation checks, Quebecor scores a 5 out of 6 for being undervalued. That is not something you see every day and it is definitely worth a closer look.

Let’s dig into the main valuation methods investors and analysts use to size up Quebecor. But stick around, because at the end, there is an even better lens for understanding what this value score really means in practice.

Approach 1: Quebecor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for valuing a company by projecting its future cash flows and discounting them back to today's value. This approach estimates what the business is worth based on how much cash it can generate in the future, adjusted for the time value of money.

For Quebecor, the current Free Cash Flow over the last twelve months stands at CA$1.19 billion. Analysts have provided projections up to 2027, indicating that Free Cash Flow is expected to reach CA$1.09 billion. Beyond that, Simply Wall St extrapolates continued growth and shows a slow but steady increase in future years. In fact, ten-year forecasts see Free Cash Flow remaining above CA$1.02 billion annually, with most years well above that mark.

Using these projections, the DCF model estimates Quebecor’s intrinsic fair value at CA$107.19 per share. With the current share price at CA$43.95, this valuation implies the stock is trading at a 59.0% discount to its estimated fair value, signaling a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Quebecor is undervalued by 59.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Quebecor Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular benchmark for valuing profitable companies like Quebecor because it gives a quick sense of what investors are willing to pay for each dollar of earnings. It is especially useful when profits are stable or growing, as it balances out both market sentiment and the company's ability to generate profit.

When considering what counts as a “normal” or “fair” PE, it is important to remember that expectations for future growth, risk profile, and overall market conditions all play a role. Companies poised for strong or stable earnings growth often justify a higher PE, while higher perceived risks or slower growth can pull it lower.

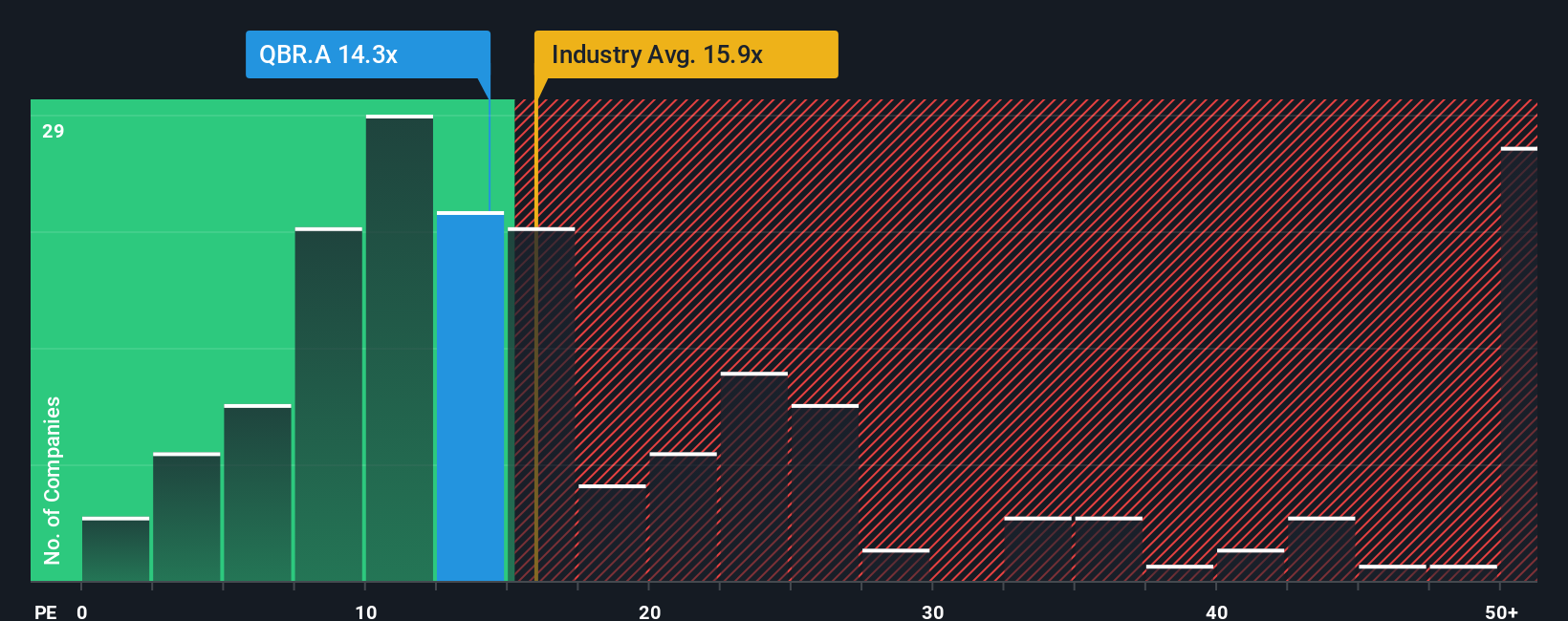

Quebecor is currently trading at a PE ratio of 13.0x, which is well below both the average for its Telecom industry peers at 16.7x and the broader peer group average of 30.2x. At first glance, this might imply the stock is undervalued in terms of simple comparisons.

However, Simply Wall St’s “Fair Ratio” offers deeper insight. Unlike raw comparisons, the Fair Ratio (here, 18.3x) is tailored specifically to Quebecor’s expected earnings growth, profit margins, risk, and overall industry and market cap. This proprietary benchmark provides a more accurate reference point by considering more than just industry averages.

Comparing Quebecor’s current PE of 13.0x with its Fair Ratio of 18.3x reveals the company trades at a noticeable discount to what is considered fair based on its underlying qualities.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Quebecor Narrative

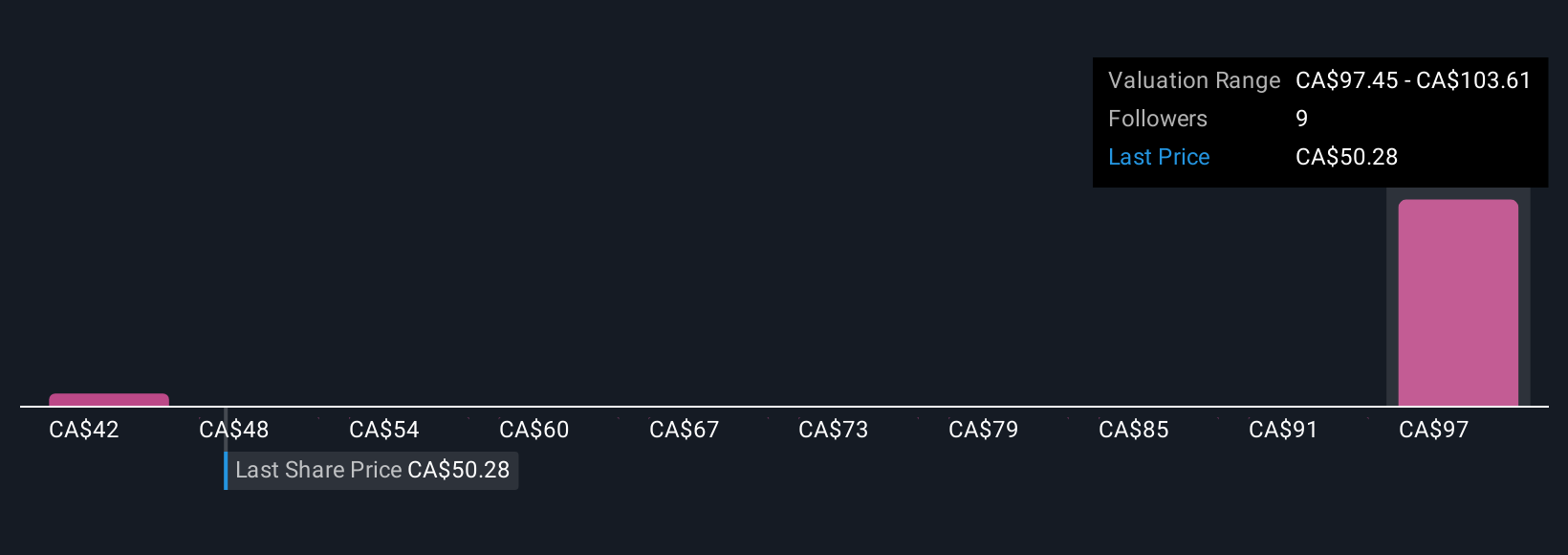

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is essentially your story about a company, uniting your assumptions about fair value, revenue growth, and future margins into one clear perspective. It connects what you believe will happen to Quebecor, translates that belief into forecasts and numbers, and then calculates a fair value grounded in your unique view.

Narratives are simple, accessible tools available within the Simply Wall St Community, already trusted by millions of investors. They help you decide when to buy or sell by comparing your Fair Value directly with today’s Price, and they stay relevant as they update automatically as new data or breaking news arrives.

This approach means you are not just following market moves; you are making informed decisions based on your own outlook. For example, while one investor’s Narrative for Quebecor sees a fair value at CA$118.95 based on bullish growth expectations, another may be much more cautious, estimating fair value as low as CA$63.12. Narratives let you explore, compare, and refine your view as the story evolves.

Do you think there's more to the story for Quebecor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quebecor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QBR.A

Quebecor

Operates in the telecommunications, media, and sports and entertainment businesses in Canada.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion