- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

Two Days Left Until BCE Inc. (TSE:BCE) Trades Ex-Dividend

BCE Inc. (TSE:BCE) is about to trade ex-dividend in the next two days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves a full business day. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase BCE's shares before the 15th of December in order to receive the dividend, which the company will pay on the 15th of January.

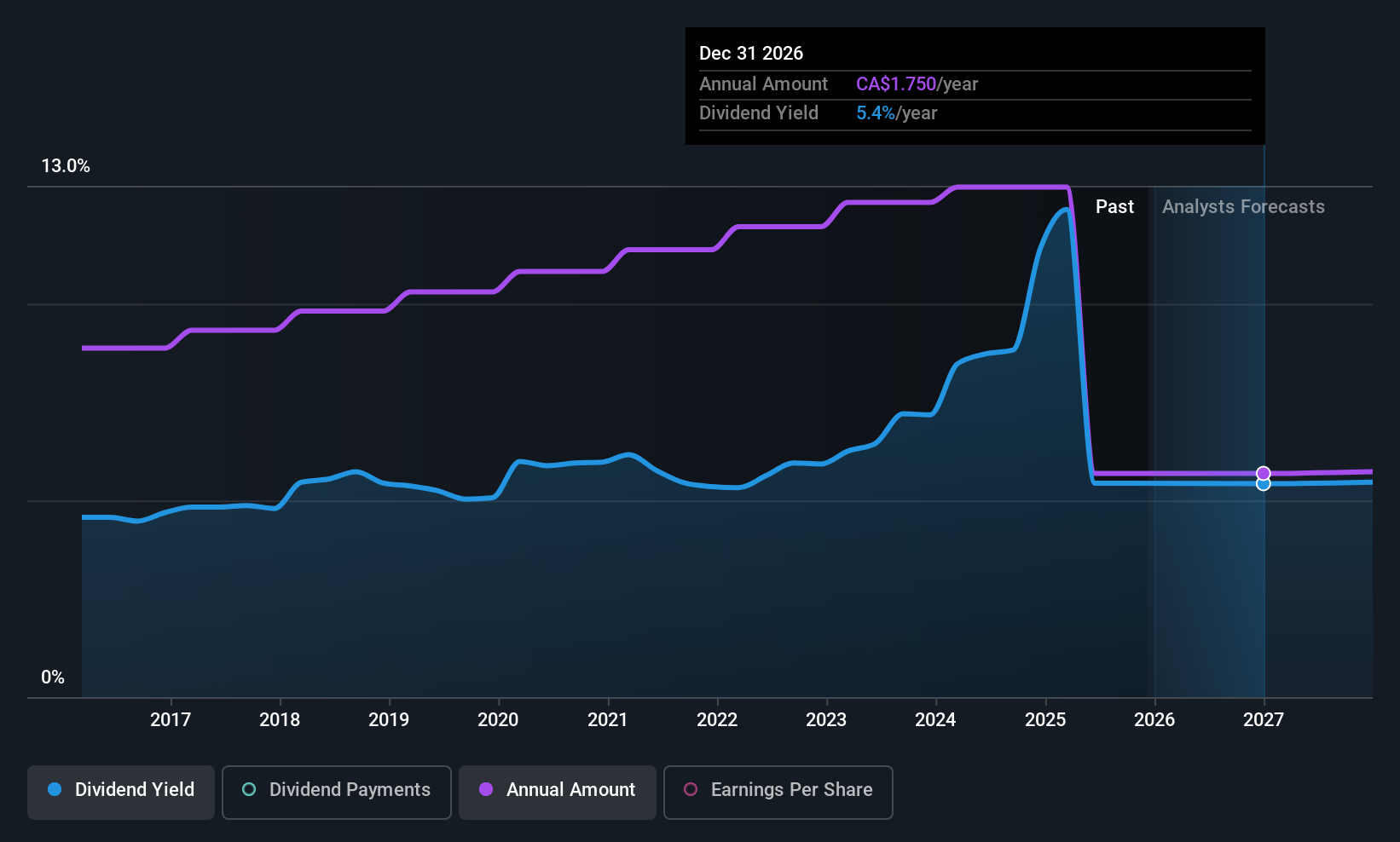

The company's next dividend payment will be CA$0.4375 per share, on the back of last year when the company paid a total of CA$1.75 to shareholders. Last year's total dividend payments show that BCE has a trailing yield of 5.4% on the current share price of CA$32.24. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately BCE's payout ratio is modest, at just 43% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out more than half (68%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that BCE's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for BCE

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see BCE's earnings per share have risen 15% per annum over the last five years. BCE is paying out a bit over half its earnings, which suggests the company is striking a balance between reinvesting in growth, and paying dividends. This is a reasonable combination that could hint at some further dividend increases in the future.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. BCE has seen its dividend decline 3.9% per annum on average over the past 10 years, which is not great to see. BCE is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

Final Takeaway

Is BCE an attractive dividend stock, or better left on the shelf? Earnings per share have grown at a nice rate in recent times and over the last year, BCE paid out less than half its earnings and a bit over half its free cash flow. BCE looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

While it's tempting to invest in BCE for the dividends alone, you should always be mindful of the risks involved. To that end, you should learn about the 4 warning signs we've spotted with BCE (including 2 which are a bit concerning).

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026