- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

How Investors Are Reacting To BCE (TSX:BCE) Expanding Remote Connectivity Through Satellite Technology

Reviewed by Sasha Jovanovic

- BCE Inc. held its Investor Day in Toronto on October 14, 2025, where senior executives shared the company's strategic priorities, capital markets strategy, and financial outlook, with a live webcast available to the public on BCE.ca.

- Separately, AST SpaceMobile announced the successful testing of space-based direct-to-cell 4G services in Canada with Bell Canada, advancing plans to bring wireless connectivity to previously underserved and remote areas.

- We'll explore how BCE's push for remote connectivity through its satellite partnership could influence its long-term growth narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BCE Investment Narrative Recap

To want to be a BCE shareholder, you have to believe the business remains essential for Canadian connectivity and that investments in infrastructure, like fiber and now satellite partnerships, can offset headwinds from tighter regulation and a highly competitive wireless market. The recent collaboration with AST SpaceMobile, while a promising move for future growth in remote communities, does not impact the most pressing catalyst right now: BCE’s ability to accelerate fiber expansion in the face of regulatory and capital constraints, nor does it materially change the biggest risk, which is persistent downward pressure on margins due to regulatory and competitive pressures.

Of BCE's latest announcements, the formation of Network FiberCo in partnership with the Public Sector Pension Investment Board stands out for its long-term relevance. While advancements in satellite technology highlight new ways to reach remote customers, the core opportunity and near-term challenge remain scaling BCE’s fiber footprint and capitalizing on increasing demand for high-speed broadband, a direct response to competitive and regulatory hurdles impacting profitability and future revenue potential.

By contrast, tightening regulation and expanded wholesale access bring considerations that investors should be aware of, especially when it comes to...

Read the full narrative on BCE (it's free!)

BCE's outlook calls for CA$26.0 billion in revenue and CA$2.8 billion in earnings by 2028. This is based on projected annual revenue growth of 2.2% and an increase in earnings of CA$2.37 billion from current earnings of CA$433.0 million.

Uncover how BCE's forecasts yield a CA$35.41 fair value, a 6% upside to its current price.

Exploring Other Perspectives

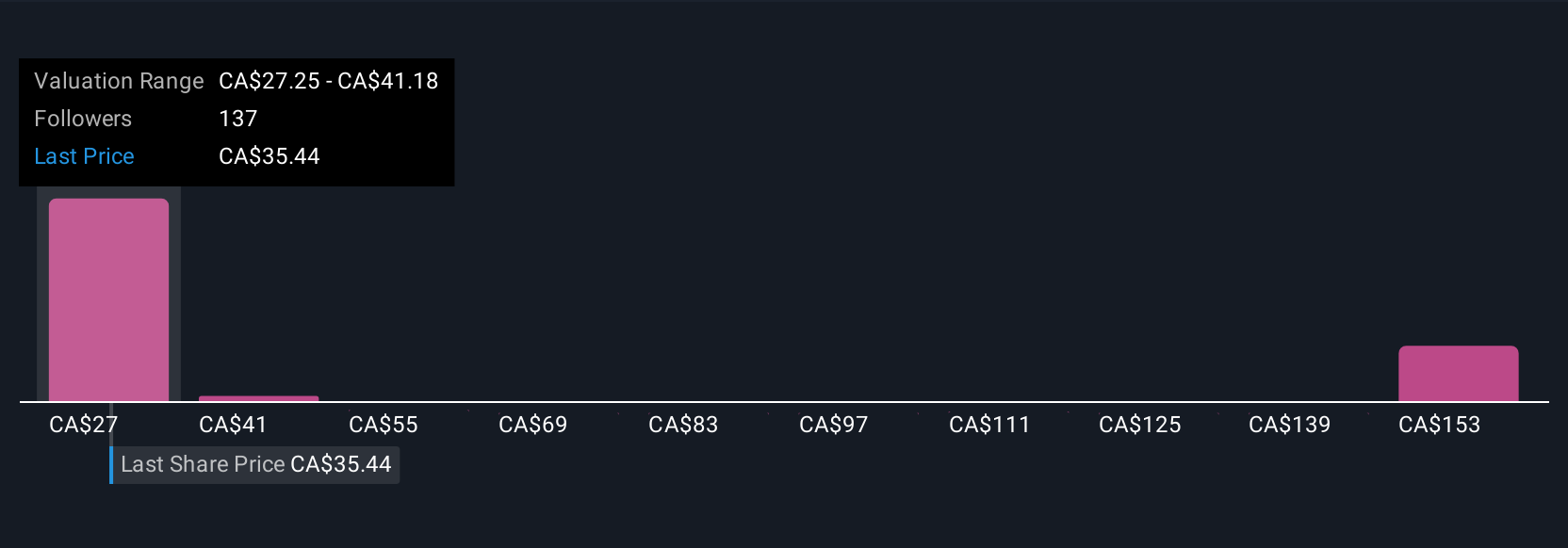

Sixteen members of the Simply Wall St Community estimated BCE’s fair value between CA$27.77 and CA$114.01. As you weigh these opinions, remember ongoing regulatory changes could directly influence both growth and profitability, so you might want to see a range of these perspectives for a fuller picture.

Explore 16 other fair value estimates on BCE - why the stock might be worth over 3x more than the current price!

Build Your Own BCE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BCE research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BCE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BCE's overall financial health at a glance.

No Opportunity In BCE?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives