- Canada

- /

- Telecom Services and Carriers

- /

- CNSX:TO

Imagine Owning Tower One Wireless (CSE:TO) And Trying To Stomach The 88% Share Price Drop

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Tower One Wireless Corp. (CSE:TO), who have seen the share price tank a massive 88% over a three year period. That would be a disturbing experience. And over the last year the share price fell 47%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Tower One Wireless

Because Tower One Wireless made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Tower One Wireless saw its revenue grow by 134% per year, compound. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 51% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

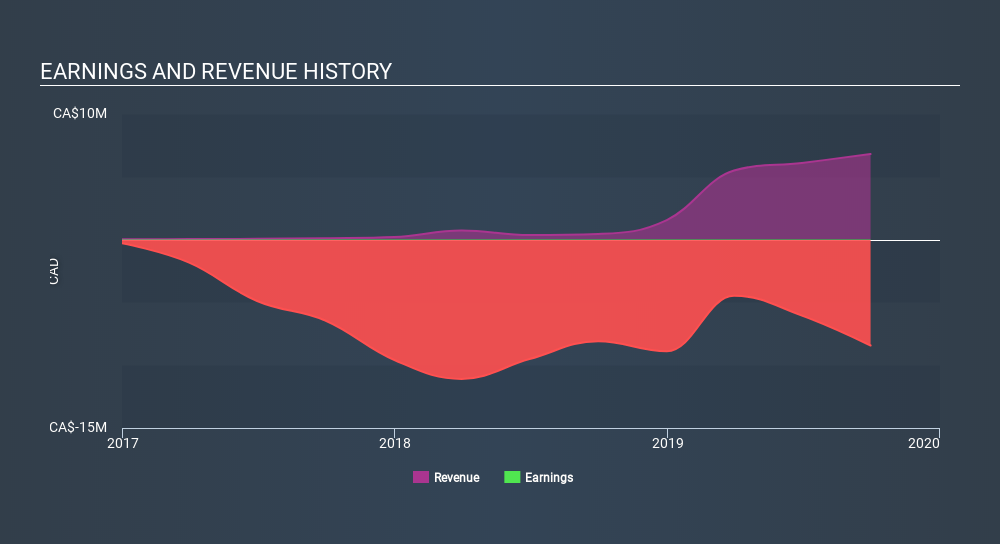

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for Tower One Wireless shares, which performed worse than the market, costing holders 47%. The market shed around 9.9%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 51% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Tower One Wireless (including 2 which is are a bit concerning) .

We will like Tower One Wireless better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About CNSX:TO

Tower One Wireless

Owns, develops, and operates build-to-suit multitenant communications towers in Argentina, Colombia, Mexico, the United States, and internationally.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)