Kraken Robotics (TSXV:PNG) Valuation in Focus After Defense Contract Win and Earnings Beat

Reviewed by Kshitija Bhandaru

Kraken Robotics (TSXV:PNG) shares climbed after the company revealed a new multi-million dollar defense contract. This development joins strong quarterly earnings that beat expectations and underlines Kraken’s expanding presence in underwater robotics for defense applications.

See our latest analysis for Kraken Robotics.

Momentum is clearly building for Kraken Robotics, as its share price has soared over 80% in the past month. The one-year total shareholder return stands at an impressive 253%. Recent contract wins and earnings surprises have fueled this rally, encouraging investors who see long-term growth potential in the company’s expanding defense portfolio.

If you’re interested in uncovering more companies innovating in defense and related sectors, now’s a great time to explore See the full list for free.

With shares up dramatically and expectations running high, the key question now is whether Kraken Robotics is trading at a bargain given its growth prospects, or if the market has already accounted for the company’s future success in its current price.

Price-to-Earnings of 129.2x: Is it justified?

Kraken Robotics trades at a hefty price-to-earnings ratio of 129.2, placing it far above the typical levels seen both within its peer group and the wider industry. With the last close at CA$6.25, this premium price sets high expectations for future profit growth.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. It is a key tool for evaluating companies in fast-growing sectors, where market participants might price in aggressive earnings trajectories or unique business qualities.

In Kraken's case, the P/E far exceeds both the peer average of 28.1 and the North American Electronic industry average of 24.5. This suggests investors are exceptionally optimistic. However, this level is also more than double the estimated fair price-to-earnings ratio of 58.2. The market may be pricing in rapid, sustained growth, but such a high premium leaves little room for disappointment.

Explore the SWS fair ratio for Kraken Robotics

Result: Price-to-Earnings of 129.2x (OVERVALUED)

However, investors should remain cautious because a premium valuation may amplify downside risk if contract growth slows or earnings fall short of expectations.

Find out about the key risks to this Kraken Robotics narrative.

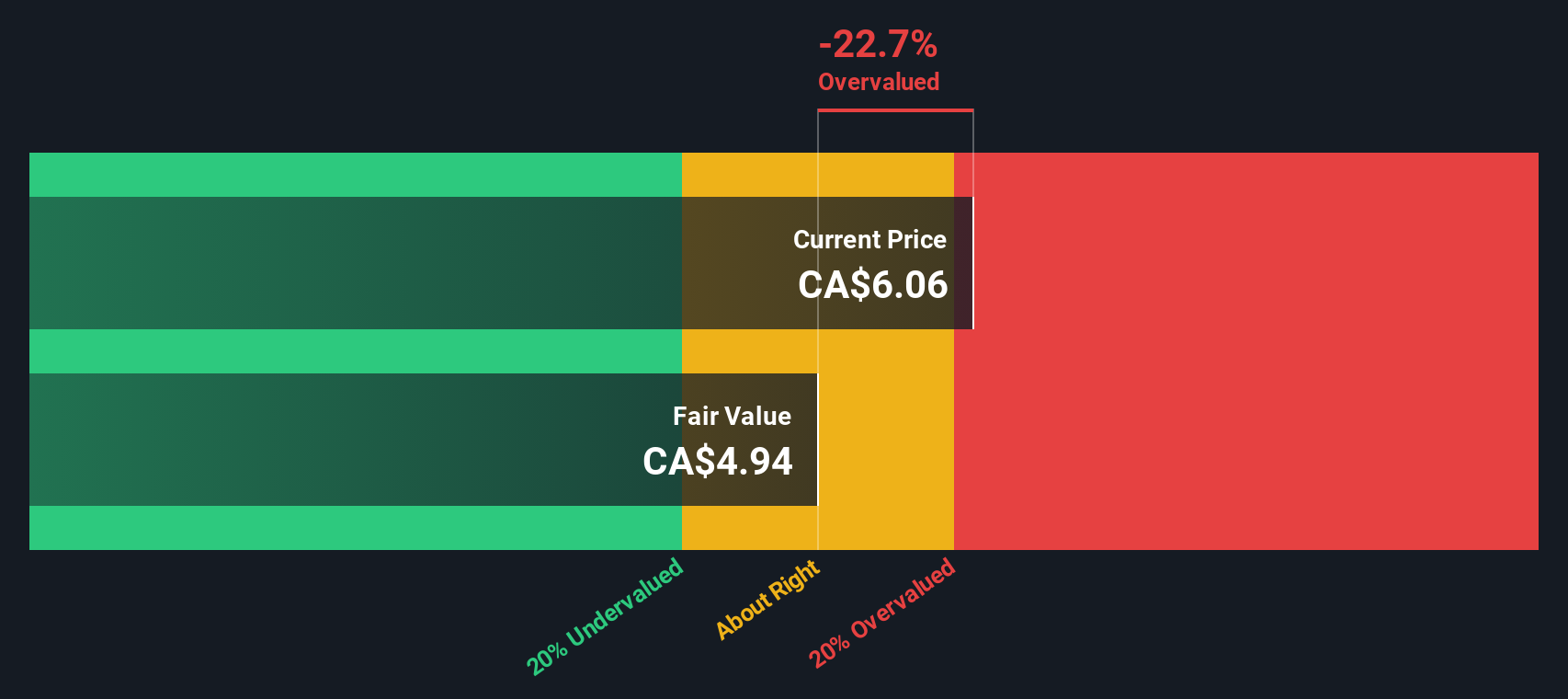

Another View: The DCF Model Perspective

While Kraken Robotics appears pricey using the earnings ratio, our SWS DCF model provides a different picture. This approach estimates the stock's fair value at CA$4.94, which is below the recent share price. This suggests Kraken could be trading above its long-term intrinsic value. Is the market too optimistic or is there more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kraken Robotics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kraken Robotics Narrative

If you have a different perspective or want to explore additional details, you can dive into the data and shape your own view in just a few minutes with Do it your way.

A great starting point for your Kraken Robotics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Smart investors always keep an eye out for fresh trends, and there’s a world of potential waiting in these handpicked stock screens.

- Uncover tomorrow’s market movers by targeting these 3573 penny stocks with strong financials with strong financials and serious breakout potential.

- Benefit from powerful income streams when you evaluate these 19 dividend stocks with yields > 3% that pay consistent yields above 3%.

- Get ahead of disruption by focusing on these 25 AI penny stocks leading innovation in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives