High Growth Tech Stocks Including NSFOCUS Technologies Group And Two Others

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields, small-cap stocks have faced increased pressure compared to their large-cap counterparts, with growth stocks showing resilience amidst these shifts. In this environment, identifying high-growth tech companies like NSFOCUS Technologies Group can be compelling due to their potential for innovation and adaptability in dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.32% | 70.79% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1247 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market capitalization of CN¥7.01 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥1.77 billion.

NSFOCUS Technologies Group, while currently unprofitable, is poised for significant growth with expected revenue increases of 16.8% annually, outpacing the broader Chinese market's 13.7%. This tech firm is also on track to swing to profitability within three years, a turnaround highlighted by an anticipated explosive earnings growth rate of 127.2% per year. Despite recent volatility and being dropped from the FTSE All-World Index, NSFOCUS's commitment to innovation is evident in its substantial R&D investments which align well with its strategic focus areas in cybersecurity solutions. The company’s recent financial performance reflects a narrowing net loss from CNY 414.97 million to CNY 254.64 million year-over-year for the first half of 2024, demonstrating effective cost management and operational improvements. With these adjustments and a robust R&D strategy that ensures NSFOCUS remains at the forefront of technological advancements in cybersecurity, the company’s future prospects look promising as it aims to capitalize on growing demand within this critical sector.

Kraken Robotics (TSXV:PNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$464.04 million.

Operations: Kraken Robotics generates revenue through the sale of products and services, with CA$72.06 million from products and CA$19.92 million from services. The company operates in various regions including Canada, the Asia Pacific, Europe, the Middle East, Africa, and North America.

Kraken Robotics has demonstrated robust growth, with a notable 17.1% annual increase in revenue, outpacing the Canadian market's 7.2%. This surge is underpinned by strategic client acquisitions and innovative offerings like the SeaPower subsea batteries, which significantly enhance energy efficiency in maritime operations. Furthermore, Kraken's commitment to R&D is evident from its recent earnings report showing a substantial investment in this area, aligning with its revenue growth and reinforcing its competitive edge in high-tech underwater technology. With earnings expected to climb by 22% annually, Kraken is not just capitalizing on current trends but is also strategically positioned for sustained future growth.

- Delve into the full analysis health report here for a deeper understanding of Kraken Robotics.

Review our historical performance report to gain insights into Kraken Robotics''s past performance.

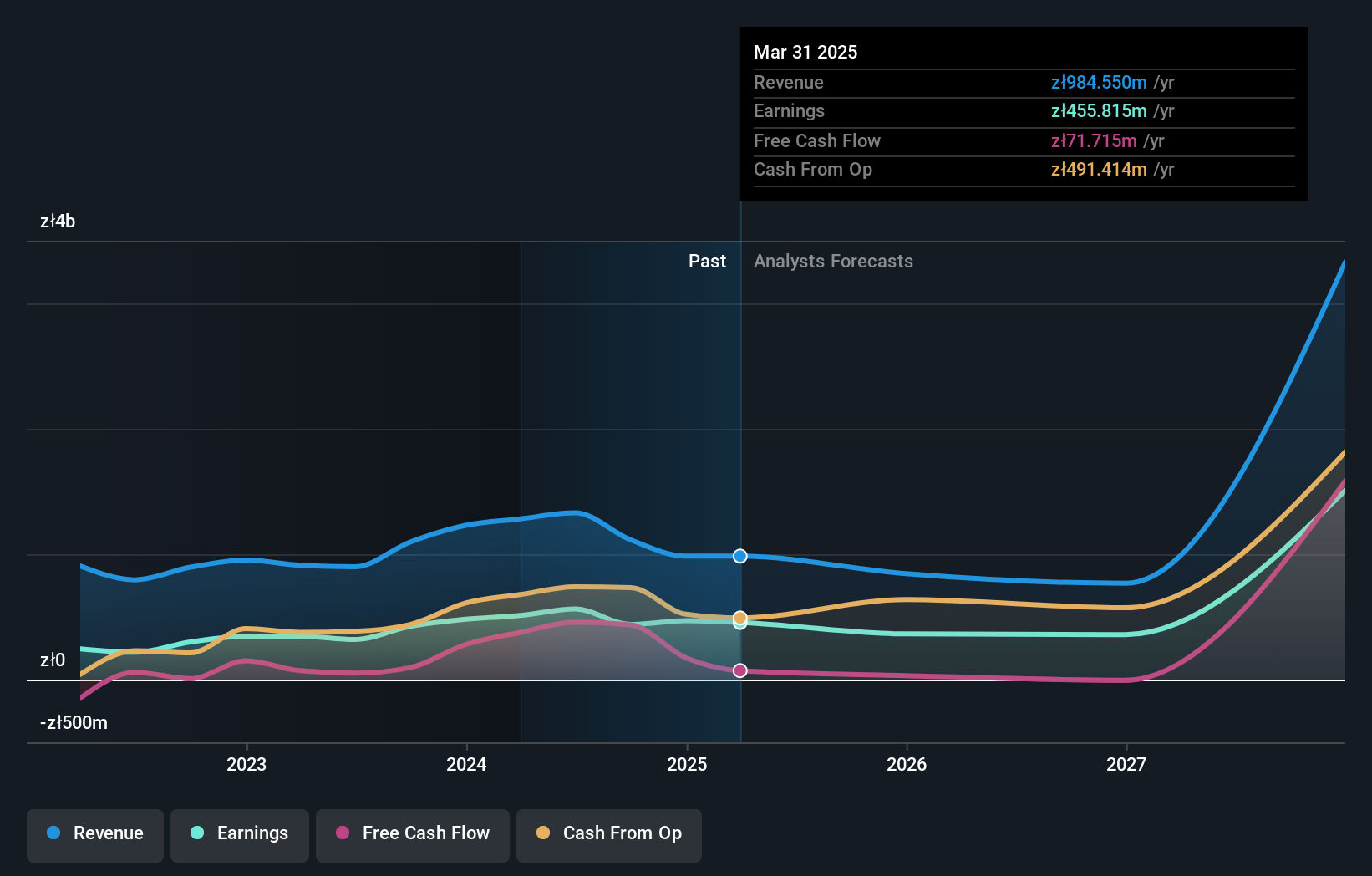

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and distributing video games for PCs and consoles in Poland, with a market cap of PLN16.27 billion.

Operations: CD Projekt generates revenue primarily through its CD PROJEKT RED segment, contributing PLN1.14 billion, and GOG.Com, adding PLN238.12 million. The company is involved in the development and digital distribution of video games for PCs and consoles in Poland.

CD Projekt has demonstrated a remarkable ability to innovate and capture market interest, evidenced by its 30.7% revenue growth to PLN 424.81 million in the first half of 2024 from PLN 325.21 million in the previous year, significantly outperforming its industry peers. This financial uplift is supported by a robust R&D commitment, which is crucial for sustaining its competitive edge in the gaming sector. Notably, the company's earnings have surged by an impressive 73.7% over the past year, reflecting high-quality earnings and operational efficiency that are likely to propel future growth trajectories above regional averages with an expected annual profit growth of 17.1%. With recent presentations at major investor conferences highlighting strategic initiatives and leadership insights, CD Projekt is well-positioned to leverage its innovative capabilities for continued market relevance and financial performance.

- Take a closer look at CD Projekt's potential here in our health report.

Explore historical data to track CD Projekt's performance over time in our Past section.

Key Takeaways

- Discover the full array of 1247 High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

Reasonable growth potential with proven track record.