While recent shifts in bond yields have influenced the Canadian market, they also present opportunities for stronger fixed-income returns as interest rates adjust. In this context, penny stocks—though a somewhat outdated term—remain a relevant investment area, especially when backed by solid financials. These smaller or newer companies can offer unique growth prospects and value that larger firms might overlook, making them intriguing options for investors seeking under-the-radar opportunities with potential long-term benefits.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$121.5M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$939.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$370M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$15.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$237.23M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 949 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Microbix Biosystems (TSX:MBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Microbix Biosystems Inc. is a life science company that develops and commercializes proprietary biological and technological solutions for human health across North America, Europe, and internationally, with a market cap of CA$55.59 million.

Operations: The company's revenue is primarily derived from its Antigens, QAPs, and DxTM segment, which generated CA$21.31 million.

Market Cap: CA$55.59M

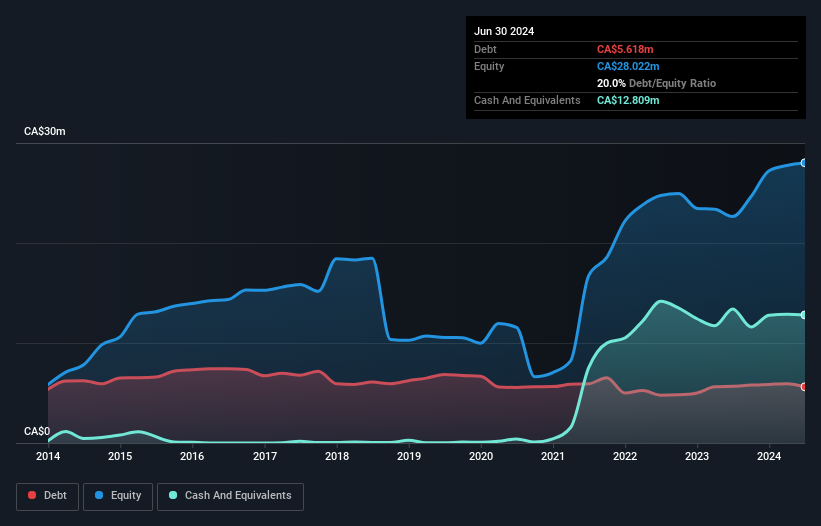

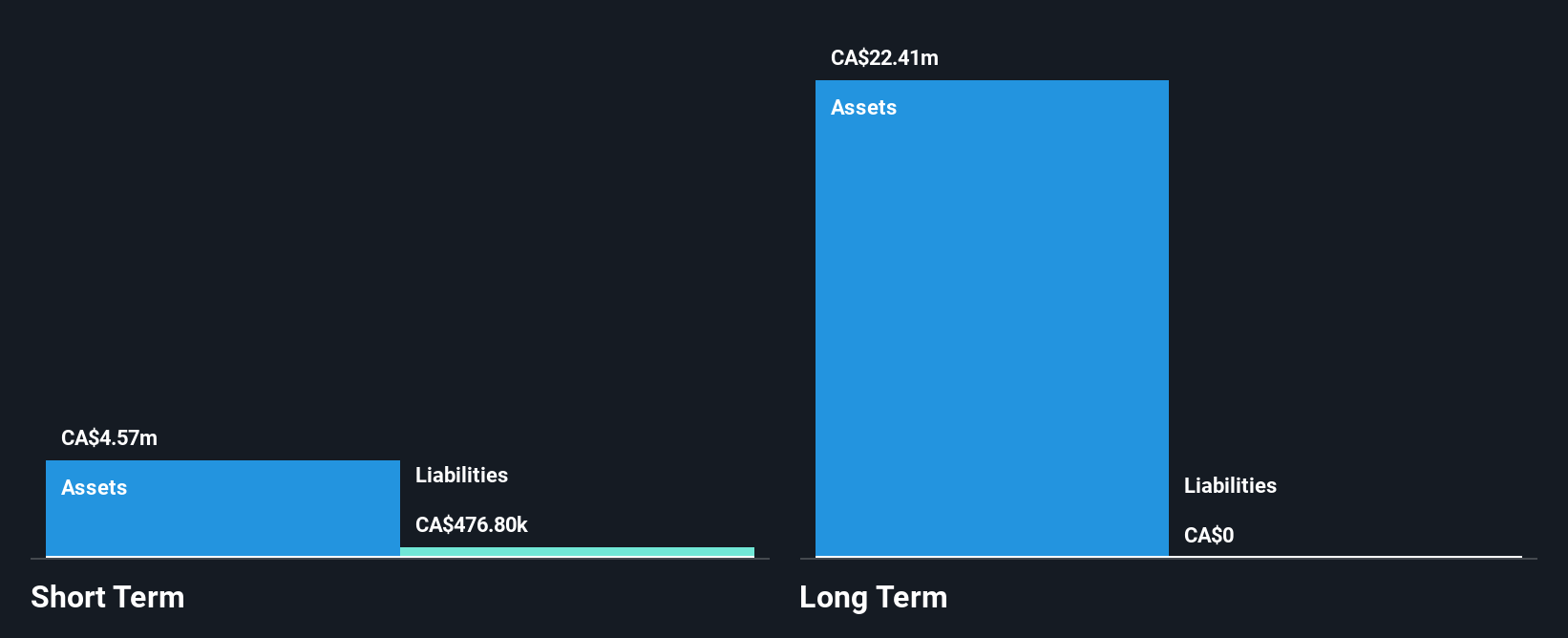

Microbix Biosystems Inc., with a market cap of CA$55.59 million, has demonstrated significant revenue growth, reporting CA$25.39 million for the fiscal year ended September 2024, up from CA$16.51 million the previous year. The company has become profitable, posting a net income of CA$3.52 million compared to a loss in the prior year. Its financial health is bolstered by short-term assets exceeding liabilities and more cash than debt, with interest well covered by EBIT (16.7x). Recent strategic alliances and regulatory achievements in Europe further position Microbix for continued growth across its business lines.

- Jump into the full analysis health report here for a deeper understanding of Microbix Biosystems.

- Examine Microbix Biosystems' earnings growth report to understand how analysts expect it to perform.

Altamira Gold (TSXV:ALTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Altamira Gold Corp. is involved in the acquisition, exploration, development, and mining of mineral properties in Brazil and Canada, with a market cap of CA$27.56 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$27.56M

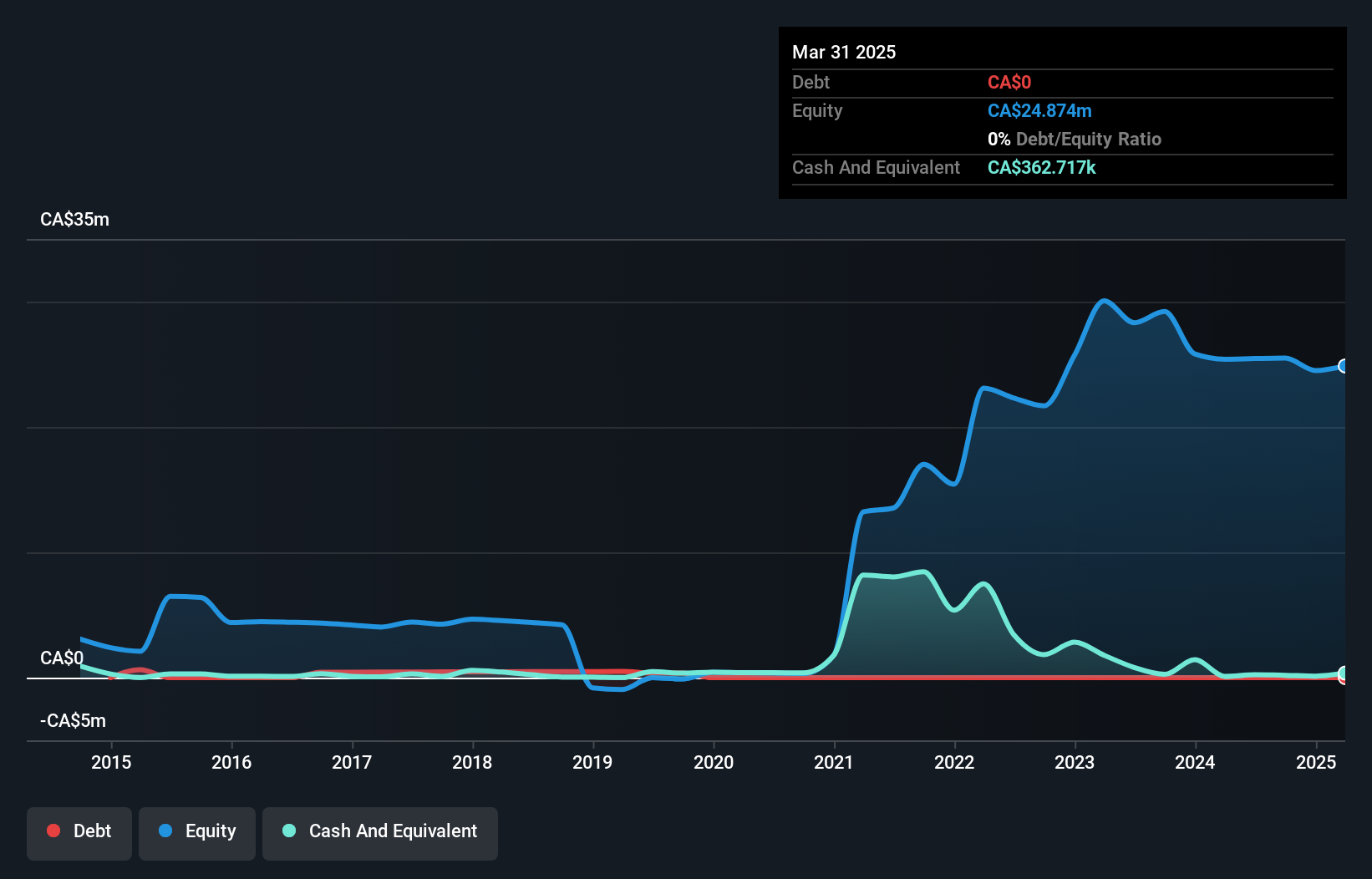

Altamira Gold Corp., with a market cap of CA$27.56 million, is pre-revenue and focused on exploring mineral properties in Brazil. Recent discoveries at the Cajueiro project, including the Guillermo target, highlight potential district-scale gold mineralization. However, the company faces financial constraints with less than a year of cash runway and increased volatility in its stock price. Despite being debt-free and having short-term assets exceeding liabilities, Altamira remains unprofitable with growing losses over five years. The exploration progress suggests promising prospects but underscores inherent risks typical for early-stage mining ventures without revenue streams.

- Unlock comprehensive insights into our analysis of Altamira Gold stock in this financial health report.

- Examine Altamira Gold's past performance report to understand how it has performed in prior years.

Avanti Helium (TSXV:AVN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Avanti Helium Corp. focuses on acquiring, exploring, and evaluating helium properties in Canada and the United States, with a market cap of CA$10.65 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$10.65M

Avanti Helium Corp., with a market cap of CA$10.65 million, is pre-revenue and focused on helium exploration in North America. The company recently completed a private placement, raising nearly CA$500,000 to support its operations. Despite being debt-free, Avanti faces financial challenges as its short-term assets do not cover liabilities and it lacks a cash runway based on free cash flow estimates. The management team is experienced with an average tenure of 2.9 years; however, the board's shorter tenure suggests recent changes. While volatility remains high, Avanti's revenue is projected to grow significantly in the future.

- Get an in-depth perspective on Avanti Helium's performance by reading our balance sheet health report here.

- Explore Avanti Helium's analyst forecasts in our growth report.

Summing It All Up

- Investigate our full lineup of 949 TSX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MBX

Microbix Biosystems

A life science company, develops and commercializes proprietary biological and technological solutions for human health and wellbeing in North America, Europe, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives