Firan Technology Group (TSX:FTG) Margin Expansion Reinforces Bullish Narratives on Growth and Valuation Discount

Reviewed by Simply Wall St

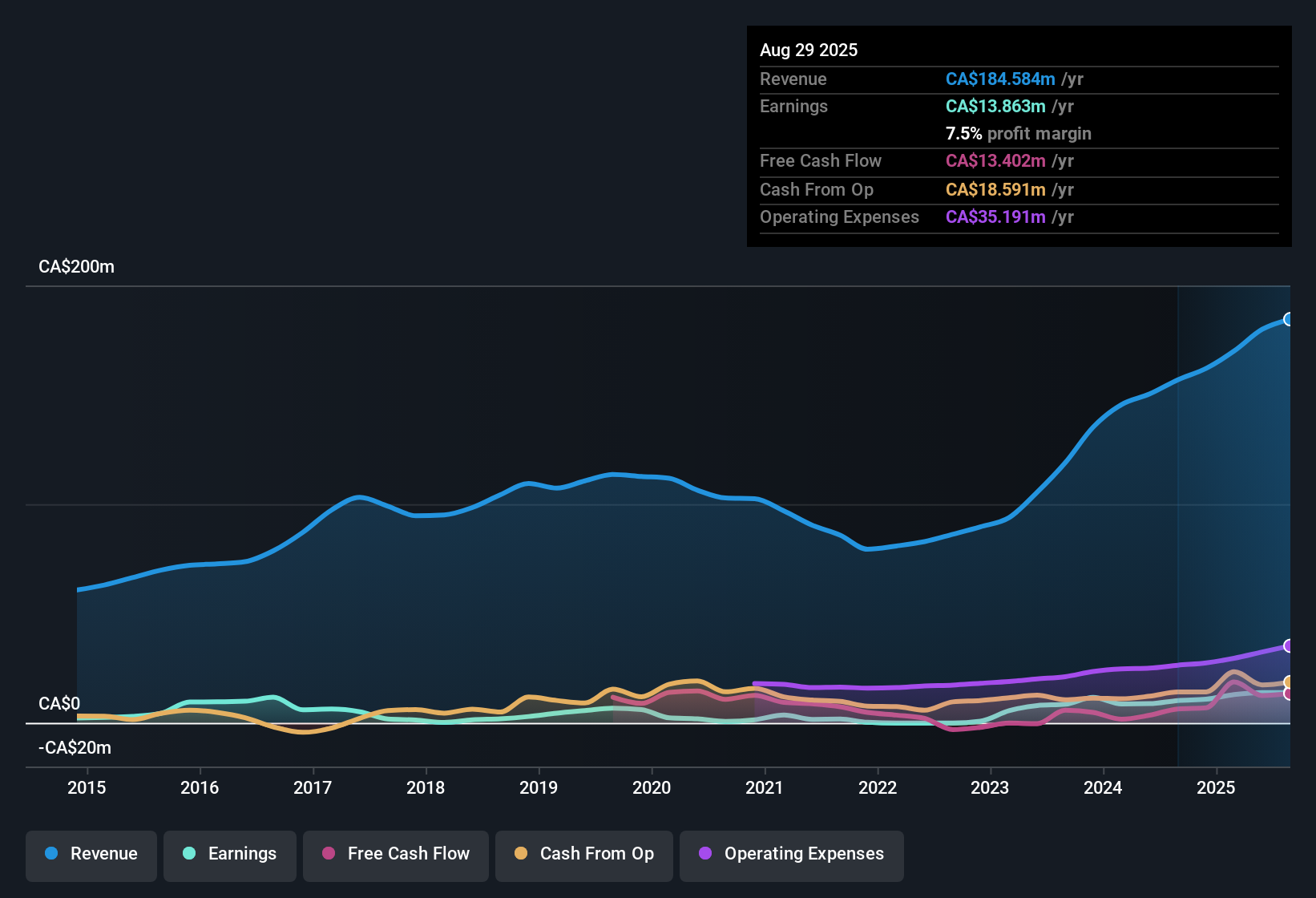

Firan Technology Group (TSX:FTG) reported net profit margins of 7.5%, exceeding last year’s 6.5%, while delivering annual earnings growth of 36.2% for the most recent year. Over the last five years, earnings have surged at a remarkable 50.9% rate per annum. Future forecasts point to continued earnings growth of 23.2% per year and revenue growth of 10.1% per year, both outpacing the broader Canadian market. Alongside these robust growth rates, FTG’s valuation multiples and current trading discount help reinforce positive investor sentiment around its financial results.

See our full analysis for Firan Technology Group.Next, we will see how these headline numbers stack up against the most widely followed market narratives. This will highlight exactly where expectations match the reality and where they do not.

See what the community is saying about Firan Technology Group

Margins Strengthen as Market Diversifies

- Net profit margins have improved from 6.5% last year to 7.5%, with analysts projecting a further rise to 8.9% over the next 3 years as FTG diversifies its revenue base.

- Consensus narrative points out that margin gains are expected to come from new international facilities and expanded Airbus opportunities,

- FTG's move into India and more Airbus-related work is targeting cost-effective production and reduced reliance on US markets,

- These strategic shifts may counterbalance tariff pressures and boost net margins, lending credibility to margin expansion guidance.

Growth Targets Outpace Peers

- Earnings are forecast to grow at a 23.2% annual pace, significantly outstripping the Canadian market’s projected rate of 11.3%. Revenue is also expected to grow at nearly double the broader market rate.

- Analysts' consensus view notes that catalyst deals such as the FLYHT acquisition and increased aftermarket sales are set to accelerate FTG’s revenue run-rate,

- Additional growth from new contracts and cost synergies is seen as a lever to sustain superior growth versus peers,

- However, execution on integration and expansion outside legacy US markets will be key to realizing these bullish expectations.

Valuation Still Shows Major Discount

- Despite these growth rates, FTG trades at a price-to-earnings ratio of 19.5x, which is meaningfully below both the industry’s 25.2x average and a peer average of 72.5x. The current share price of CA$10.75 sits well beneath its analyst target of CA$15.33, and is discounted even further compared to a DCF fair value of CA$41.23.

- The consensus narrative emphasizes that in order for FTG to reach the target price,

- Revenue will need to hit CA$246.5 million and earnings CA$21.8 million by 2028, which does set a high bar, but the current trading discount suggests expectations are already cautious,

- Investors are encouraged to sense-check analyst assumptions and weigh whether FTG’s projected growth justifies its sizable valuation gap to peers and modeled DCF fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Firan Technology Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on FTG’s results? Share your perspective and build a fresh narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Firan Technology Group.

See What Else Is Out There

While Firan Technology Group’s growth outlook is robust, analysts highlight that meeting ambitious revenue and earnings milestones will require flawless execution and carries inherent uncertainty.

If you want more confidence in consistent outperformance year after year, focus your search on companies with steadier track records by using our stable growth stocks screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FTG

Firan Technology Group

Manufactures and sells aerospace and defense electronic products and subsystems in Canada, the United States, and China.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.