- Canada

- /

- Metals and Mining

- /

- TSX:QRC

Undervalued Small Caps With Insider Buying On TSX In January 2025

Reviewed by Simply Wall St

As the Canadian market navigates the early days of 2025, investors are closely watching interest rate movements and their impact on stock valuations, particularly in the small-cap sector. With recent fluctuations in bond yields and a backdrop of solid economic growth, identifying promising small-cap stocks with insider buying can provide valuable insights into potential opportunities amidst these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 11.9x | 3.2x | 46.03% | ★★★★★★ |

| Boston Pizza Royalties Income Fund | 11.7x | 7.3x | 47.84% | ★★★★★☆ |

| Nexus Industrial REIT | 12.2x | 3.1x | 28.24% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.1x | -82.14% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 20.52% | ★★★★☆☆ |

| Savaria | 30.7x | 1.6x | 28.10% | ★★★☆☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -112.37% | ★★★☆☆☆ |

| Parex Resources | 3.9x | 0.9x | -13.72% | ★★★☆☆☆ |

| Calfrac Well Services | 12.1x | 0.2x | 47.59% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.2x | 0.6x | -91.38% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

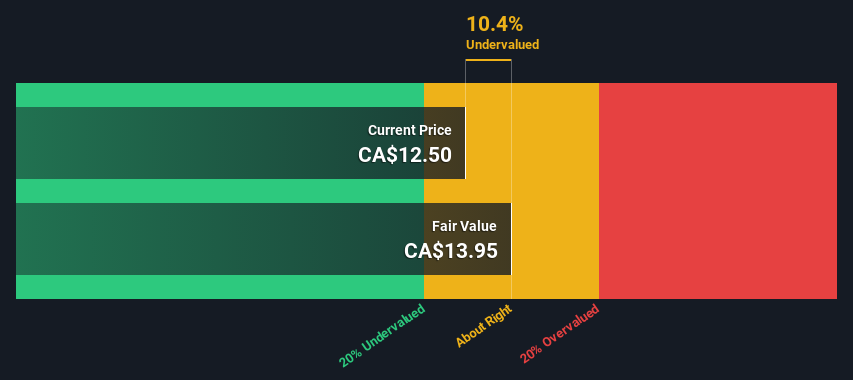

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Evertz Technologies is a company specializing in the design and manufacture of television broadcast equipment, with a market capitalization of CA$1.22 billion.

Operations: The company generates revenue primarily from the television broadcast equipment market, with recent figures showing CA$494.95 million in revenue. Over time, its gross profit margin has shown a slight upward trend, reaching 59.18% as of October 2024. Operating expenses have increased alongside revenues, with research and development being a significant component of these costs.

PE: 16.9x

Evertz Technologies

- Get an in-depth perspective on Evertz Technologies' performance by reading our valuation report here.

Assess Evertz Technologies' past performance with our detailed historical performance reports.

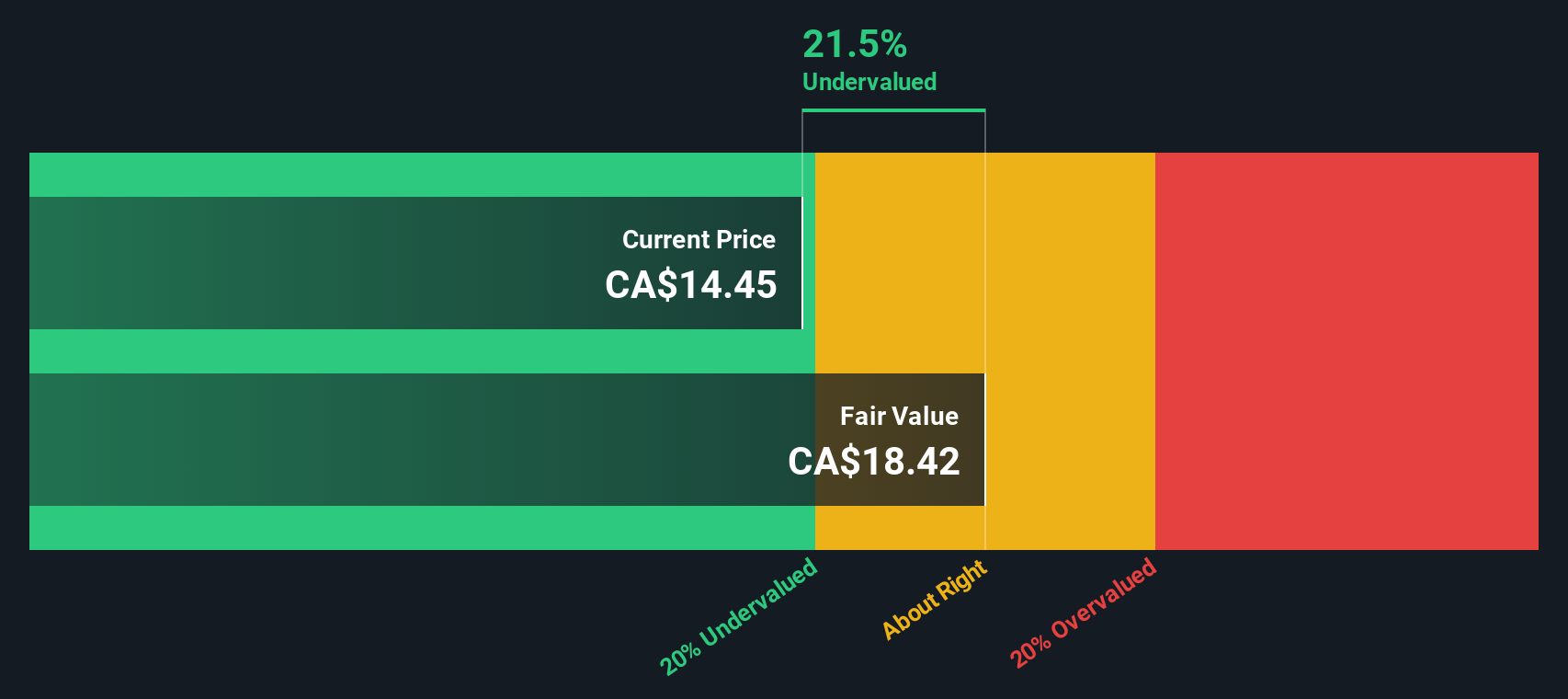

Minto Apartment Real Estate Investment Trust (TSX:MI.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Minto Apartment Real Estate Investment Trust is a Canadian company focused on owning and operating a portfolio of high-quality, multi-residential rental properties with a market capitalization of CA$1.16 billion.

Operations: The company generates revenue primarily from its residential REIT segment, with a recent quarterly revenue of CA$157.94 million. Over time, the gross profit margin has shown an upward trend, reaching 64.42% in the latest period. Operating expenses have varied but recently stood at CA$11.582 million, while non-operating expenses have significantly impacted net income results in recent quarters.

PE: -8.1x

Minto Apartment Real Estate Investment Trust, a smaller Canadian player, shows potential value with recent insider confidence as Allan Kimberley purchased 18,000 shares for C$239,940 in late 2024. Despite facing a net loss of C$41.85 million in Q3 2024 and relying solely on external borrowing for funding—considered higher risk—the trust maintains regular monthly dividends of C$0.04333 per unit. These factors suggest both challenges and opportunities for investors eyeing small-cap stocks in Canada.

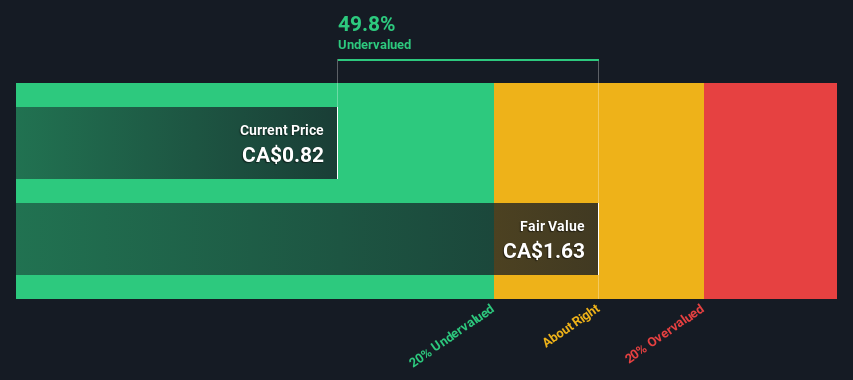

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Queen's Road Capital Investment focuses on the selection, acquisition, and management of investments, with a market capitalization of approximately CAD 0.39 billion.

Operations: Queen's Road Capital Investment generates revenue primarily through the selection, acquisition, and management of investments. The company has consistently achieved a gross profit margin of 100%, indicating that its revenue equals its gross profit. Operating expenses have varied over time, with general and administrative expenses being a significant component. Net income margins have fluctuated significantly, reflecting changes in non-operating expenses and other financial factors.

PE: 5.2x

Queen's Road Capital Investment, a smaller Canadian company, recently showcased significant growth with first-quarter revenue of US$61.82 million, nearly doubling from the previous year. Their net income also surged to US$60.48 million. Despite relying solely on external borrowing for funding, which carries higher risk than customer deposits, insider confidence is evident through recent share repurchases totaling 1.67 million shares by November 2024. The company's stock split on January 15 may enhance liquidity and attract more investors as it navigates future opportunities.

Make It Happen

- Click this link to deep-dive into the 28 companies within our Undervalued TSX Small Caps With Insider Buying screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Queen's Road Capital Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QRC

Queen's Road Capital Investment

A resource focused investment company, invests in privately held and publicly traded resource companies.

Adequate balance sheet and fair value.