- Canada

- /

- Commercial Services

- /

- TSX:ANRG

Anaergia Inc.'s (TSE:ANRG) 52% Jump Shows Its Popularity With Investors

Anaergia Inc. (TSE:ANRG) shareholders would be excited to see that the share price has had a great month, posting a 52% gain and recovering from prior weakness. The last 30 days were the cherry on top of the stock's 443% gain in the last year, which is nothing short of spectacular.

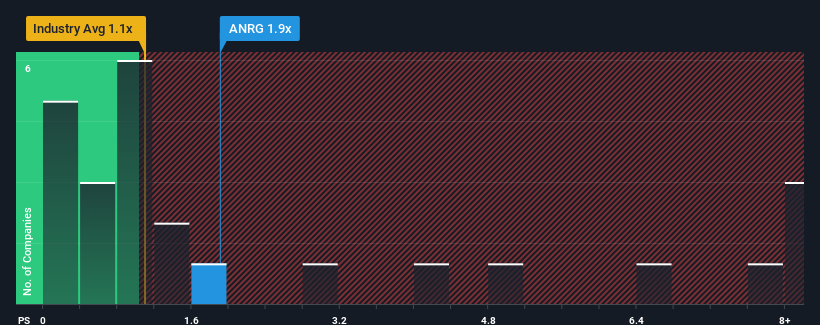

Following the firm bounce in price, given close to half the companies operating in Canada's Commercial Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Anaergia as a stock to potentially avoid with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Anaergia

What Does Anaergia's P/S Mean For Shareholders?

Anaergia hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anaergia.How Is Anaergia's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Anaergia's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.2% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 16% as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to contract by 3.3%, which would indicate the company is doing very well.

With this information, we can see why Anaergia is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What We Can Learn From Anaergia's P/S?

Anaergia shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Anaergia's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Anaergia (3 don't sit too well with us) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ANRG

Anaergia

Provides solutions for the generation of renewable energy and conversion of waste to resources in Italy, North America, Europe, the Middle East and Africa, and the Asia Pacific.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026