- Canada

- /

- Electronic Equipment and Components

- /

- CNSX:WIFI

Slammed 32% American Aires Inc. (CSE:WIFI) Screens Well Here But There Might Be A Catch

American Aires Inc. (CSE:WIFI) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

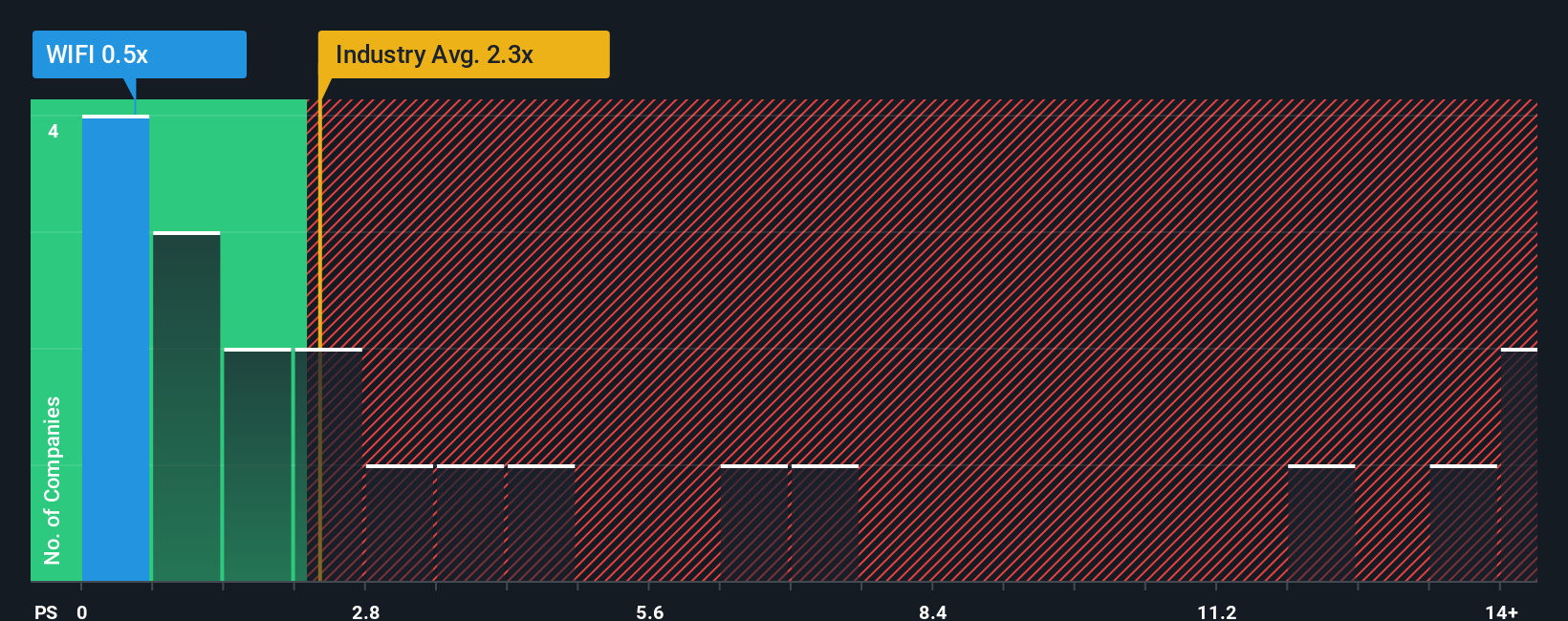

Following the heavy fall in price, American Aires' price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Electronic industry in Canada, where around half of the companies have P/S ratios above 2.2x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for American Aires

What Does American Aires' P/S Mean For Shareholders?

Recent times have been quite advantageous for American Aires as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for American Aires, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is American Aires' Revenue Growth Trending?

American Aires' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 238% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 20%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that American Aires is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

The southerly movements of American Aires' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of American Aires revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - American Aires has 4 warning signs (and 3 which are significant) we think you should know about.

If you're unsure about the strength of American Aires' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:WIFI

American Aires

A nanotechnology company, engages in the production, sales, and distribution of electromagnetic protection devices in Canada and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success