- Canada

- /

- Electronic Equipment and Components

- /

- CNSX:WIFI

Positive Sentiment Still Eludes American Aires Inc. (CSE:WIFI) Following 33% Share Price Slump

To the annoyance of some shareholders, American Aires Inc. (CSE:WIFI) shares are down a considerable 33% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

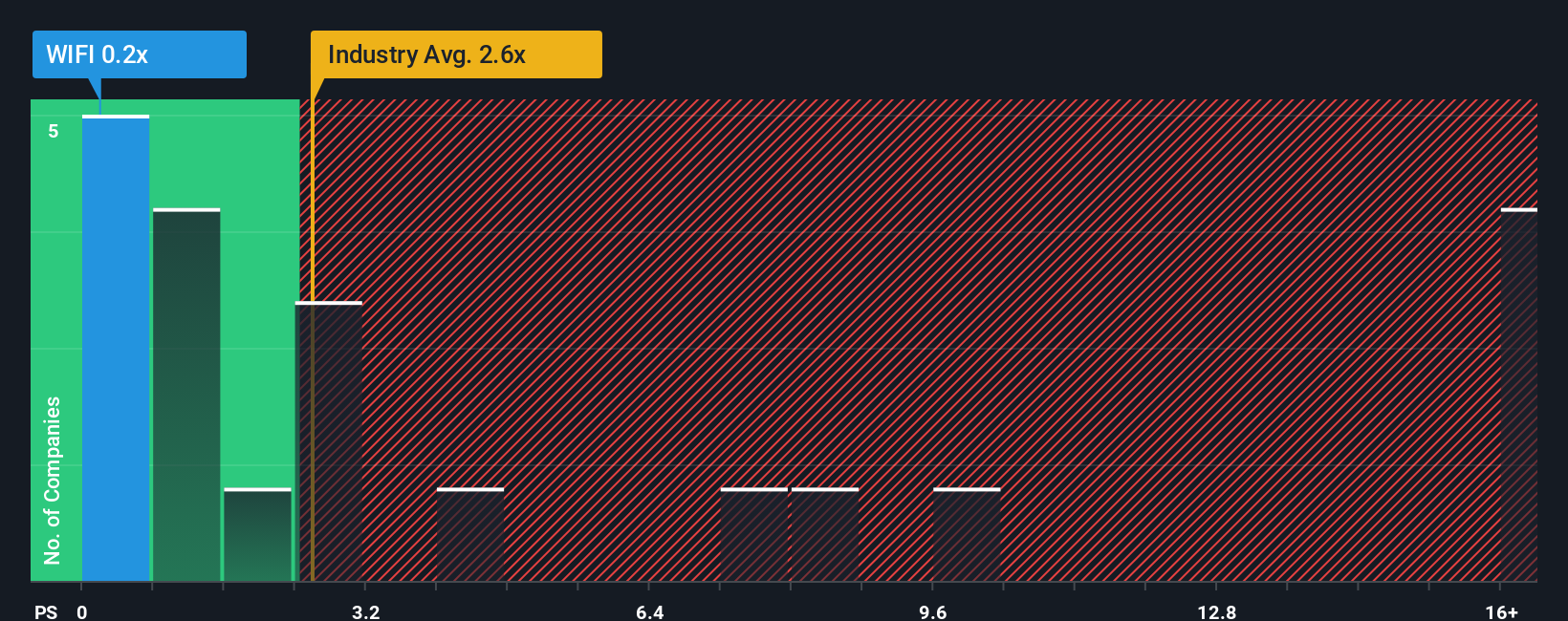

Following the heavy fall in price, American Aires' price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Electronic industry in Canada, where around half of the companies have P/S ratios above 4.2x and even P/S above 17x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for American Aires

How Has American Aires Performed Recently?

Recent times have been quite advantageous for American Aires as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for American Aires, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is American Aires' Revenue Growth Trending?

American Aires' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 182% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 35% shows it's noticeably more attractive.

In light of this, it's peculiar that American Aires' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does American Aires' P/S Mean For Investors?

Shares in American Aires have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see American Aires currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 5 warning signs for American Aires (4 make us uncomfortable!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:WIFI

American Aires

A nanotechnology company, engages in the production, sales, and distribution of electromagnetic protection devices in Canada and internationally.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026