Results: WeCommerce Holdings Ltd. Delivered A Surprise Loss And Now Analysts Have New Forecasts

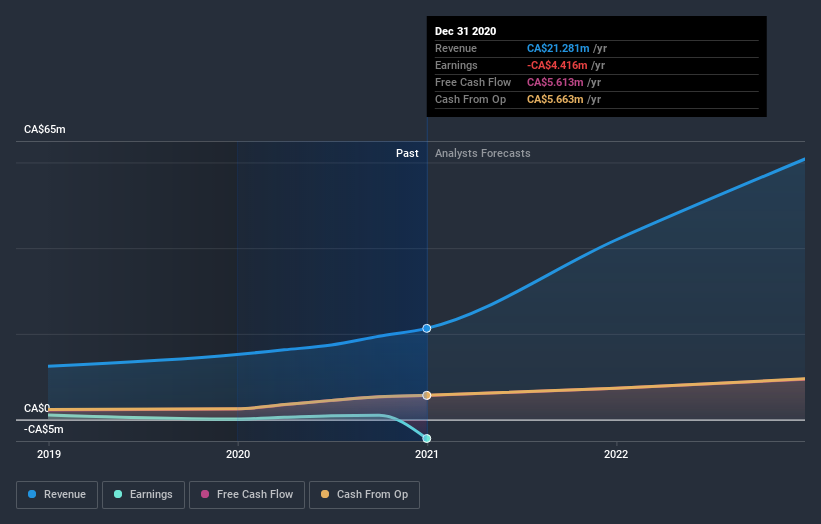

Last week saw the newest yearly earnings release from WeCommerce Holdings Ltd. (CVE:WE), an important milestone in the company's journey to build a stronger business. Things were not great overall, with a surprise (statutory) loss of CA$0.18 per share on revenues of CA$21m, even though the analyst had been expecting a profit. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

Check out our latest analysis for WeCommerce Holdings

Taking into account the latest results, the consensus forecast from WeCommerce Holdings' single analyst is for revenues of CA$41.9m in 2021, which would reflect a sizeable 97% improvement in sales compared to the last 12 months. Earnings are expected to improve, with WeCommerce Holdings forecast to report a statutory profit of CA$0.19 per share. In the lead-up to this report, the analyst had been modelling revenues of CA$42.8m and earnings per share (EPS) of CA$0.11 in 2021. While revenue forecasts have been revised downwards, the analyst looks to have become more optimistic on the company's cost base, given the sizeable expansion in to the earnings per share numbers.

The consensus price target fell 12% to CA$23.00, with the analyst signalling that the weaker revenue outlook was a more powerful indicator than the upgraded EPS forecasts.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analyst is definitely expecting WeCommerce Holdings' growth to accelerate, with the forecast 97% annualised growth to the end of 2021 ranking favourably alongside historical growth of 40% per annum over the past year. Compare this with other companies in the same industry, which are forecast to grow their revenue 21% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect WeCommerce Holdings to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around WeCommerce Holdings' earnings potential next year. They also downgraded their revenue estimates, although industry data suggests that WeCommerce Holdings' revenues are expected to grow faster than the wider industry. Still, earnings per share are more important to value creation for shareholders. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of WeCommerce Holdings' future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for WeCommerce Holdings that you should be aware of.

When trading WeCommerce Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WeCommerce Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WE

WeCommerce Holdings

WeCommerce Holdings Ltd. engages in development, sale, and support of website themes and applications.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives