Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Topicus.com (CVE:TOI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Topicus.com with the means to add long-term value to shareholders.

View our latest analysis for Topicus.com

How Fast Is Topicus.com Growing Its Earnings Per Share?

Topicus.com has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Topicus.com's EPS shot up from €0.68 to €0.92; a result that's bound to keep shareholders happy. That's a commendable gain of 34%.

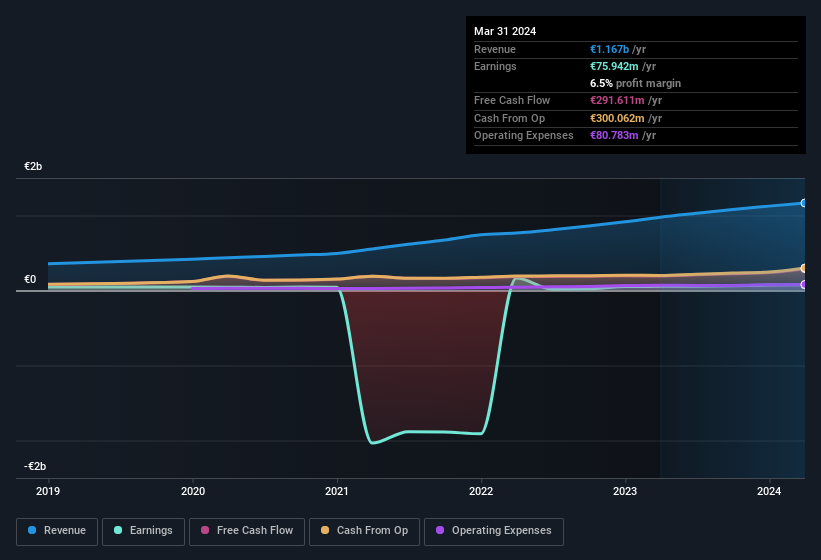

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Topicus.com remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to €1.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Topicus.com Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CA$9.6b company like Topicus.com. But we are reassured by the fact they have invested in the company. Holding €128m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between €3.7b and €11b, like Topicus.com, the median CEO pay is around €4.1m.

Topicus.com's CEO took home a total compensation package of €1.6m in the year prior to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Topicus.com Worth Keeping An Eye On?

For growth investors, Topicus.com's raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Topicus.com has underlying strengths that make it worth a look at. Of course, profit growth is one thing but it's even better if Topicus.com is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Topicus.com certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Canadian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Topicus.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TOI

Topicus.com

Provides vertical market software and vertical market platforms in the Netherlands and internationally.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)