Quisitive Technology Solutions (CVE:QUIS) delivers shareholders solid 25% CAGR over 5 years, surging 16% in the last week alone

Quisitive Technology Solutions, Inc. (CVE:QUIS) shareholders might be concerned after seeing the share price drop 16% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 205% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 79% decline over the last three years: that's a long time to wait for profits.

The past week has proven to be lucrative for Quisitive Technology Solutions investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Quisitive Technology Solutions

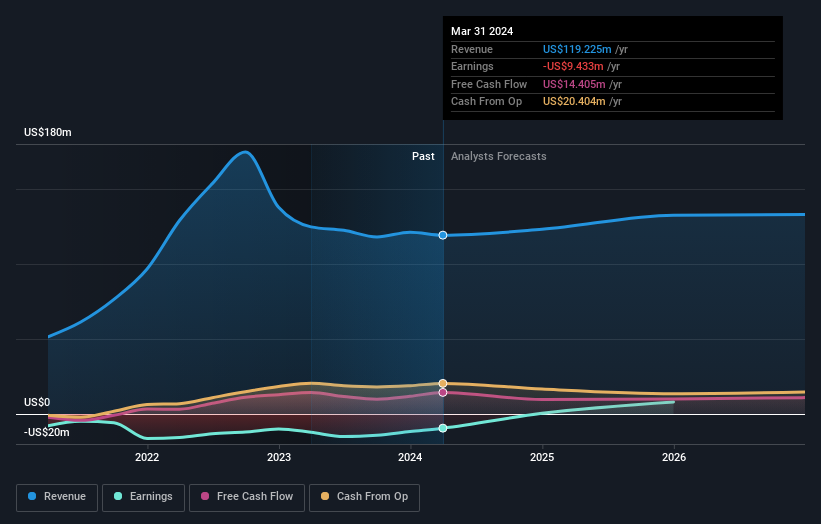

Given that Quisitive Technology Solutions didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Quisitive Technology Solutions saw its revenue grow at 36% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 25% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Quisitive Technology Solutions worth investigating - it may have its best days ahead.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Quisitive Technology Solutions provided a TSR of 3.2% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 25% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Quisitive Technology Solutions you should be aware of.

But note: Quisitive Technology Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

If you're looking to trade Quisitive Technology Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quisitive Technology Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:QUIS

Quisitive Technology Solutions

Through its subsidiaries, provides Microsoft solutions primarily in North America and South Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives