While the backup in bond yields over the past few months has impacted bond prices, it also sets the stage for stronger performance ahead as yields are typically the key driver of fixed-income returns. In such a shifting landscape, identifying stocks with solid financials becomes crucial for investors seeking stability and growth. Penny stocks, though often associated with speculative trading, can still offer significant opportunities when backed by strong fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$116.93M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$913.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$368.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$12.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$33.85M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$113.26M | ★★★★☆☆ |

Click here to see the full list of 950 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Jaguar Mining (TSX:JAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on acquiring, exploring, developing, and operating gold mineral properties in Brazil with a market cap of CA$177.65 million.

Operations: The company's revenue is derived entirely from its activities in the acquisition, exploration, development, and operation of gold-producing properties, amounting to $152.14 million.

Market Cap: CA$177.65M

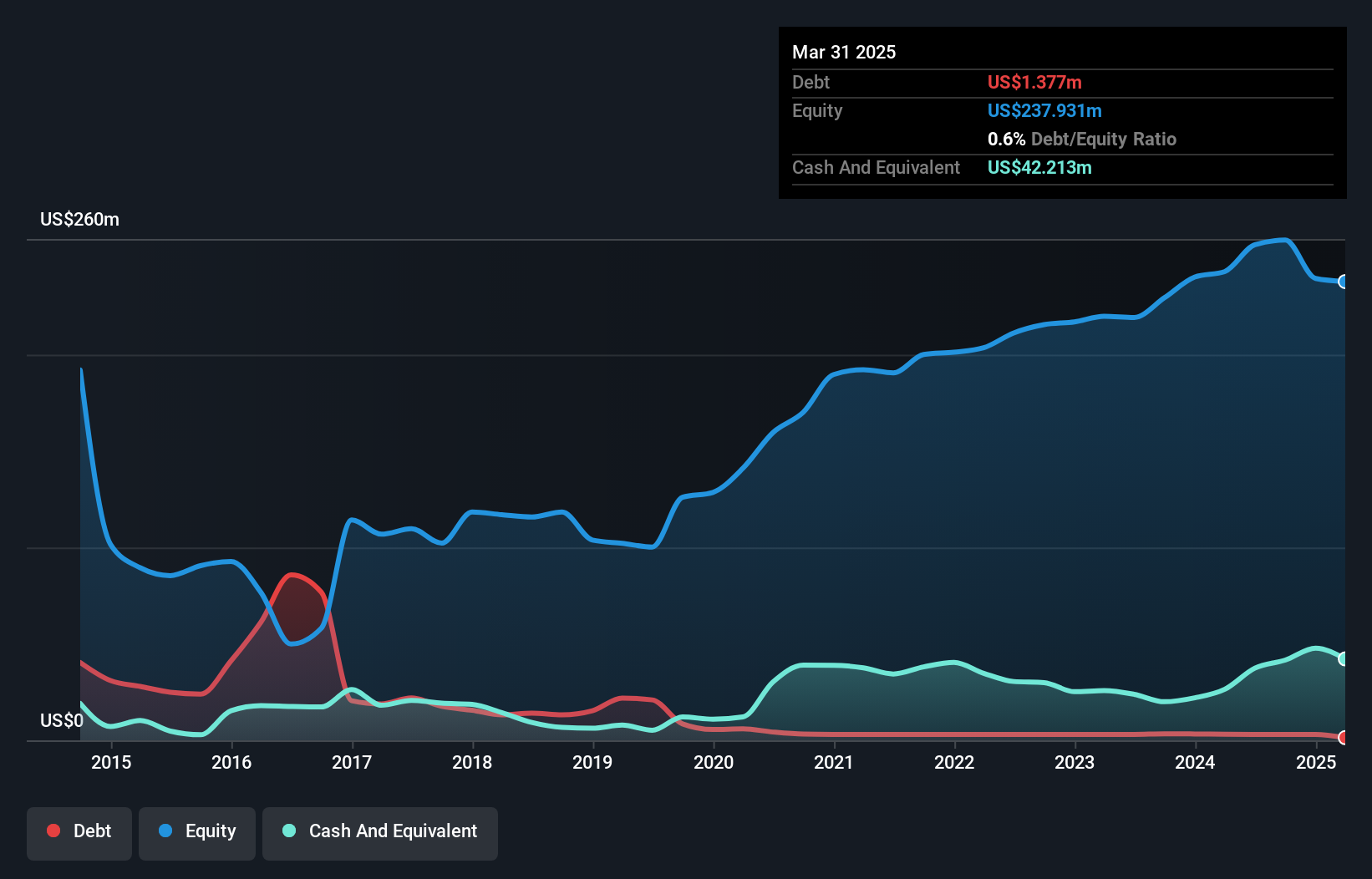

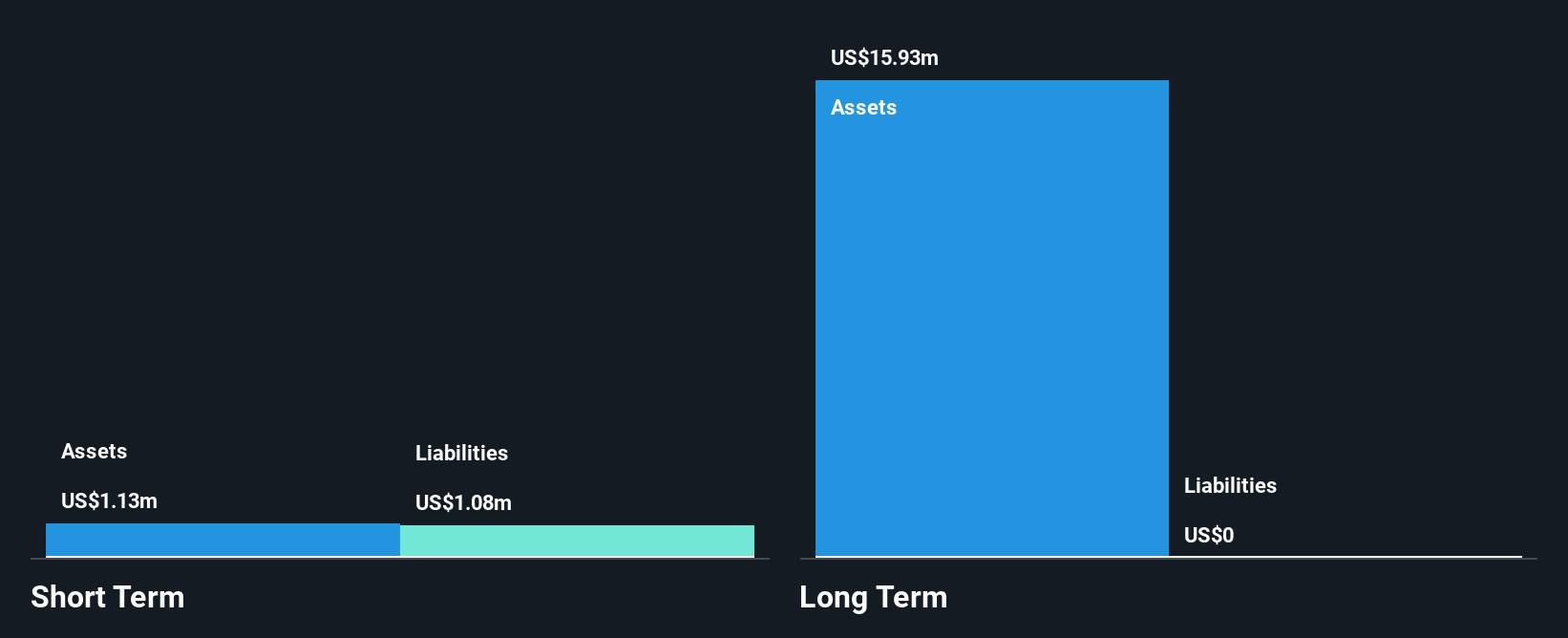

Jaguar Mining Inc. has shown resilience despite recent operational challenges at its Turmalina mine in Brazil, which remains temporarily suspended due to a tailings pile slump. The company has taken significant steps to manage the situation, including community support and infrastructure repair plans. Financially, Jaguar maintains strong liquidity with short-term assets exceeding liabilities and more cash than total debt. Its earnings growth of 75.7% over the past year surpasses industry averages, supported by high-quality earnings and improved profit margins from last year. Additionally, Jaguar's share repurchase program aims to enhance shareholder value amidst these developments.

- Take a closer look at Jaguar Mining's potential here in our financial health report.

- Learn about Jaguar Mining's future growth trajectory here.

Alpha Exploration (TSXV:ALEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha Exploration Ltd. focuses on acquiring, exploring, and developing mineral resource properties with a market cap of CA$59.84 million.

Operations: Alpha Exploration Ltd. does not have any reported revenue segments at this time.

Market Cap: CA$59.84M

Alpha Exploration Ltd., with a market cap of CA$59.84 million, is currently pre-revenue and unprofitable but has been actively exploring its Kerkasha Project in Eritrea. Recent drilling results from the Aburna prospect have identified promising gold mineralization, extending over 650 meters and open in several directions. The experienced management team (3.6 years average tenure) is navigating financial constraints, including less than a year of cash runway and recent shareholder dilution. Despite these challenges, Alpha's strategic focus on high-grade gold zones could potentially enhance its exploration value if successful in further defining resources.

- Click here and access our complete financial health analysis report to understand the dynamics of Alpha Exploration.

- Examine Alpha Exploration's past performance report to understand how it has performed in prior years.

Quisitive Technology Solutions (TSXV:QUIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quisitive Technology Solutions, Inc. operates through its subsidiaries to provide Microsoft solutions primarily in North America and South Asia, with a market cap of CA$99.88 million.

Operations: The company generates revenue of $118.65 million from its Global Cloud Solutions segment.

Market Cap: CA$99.88M

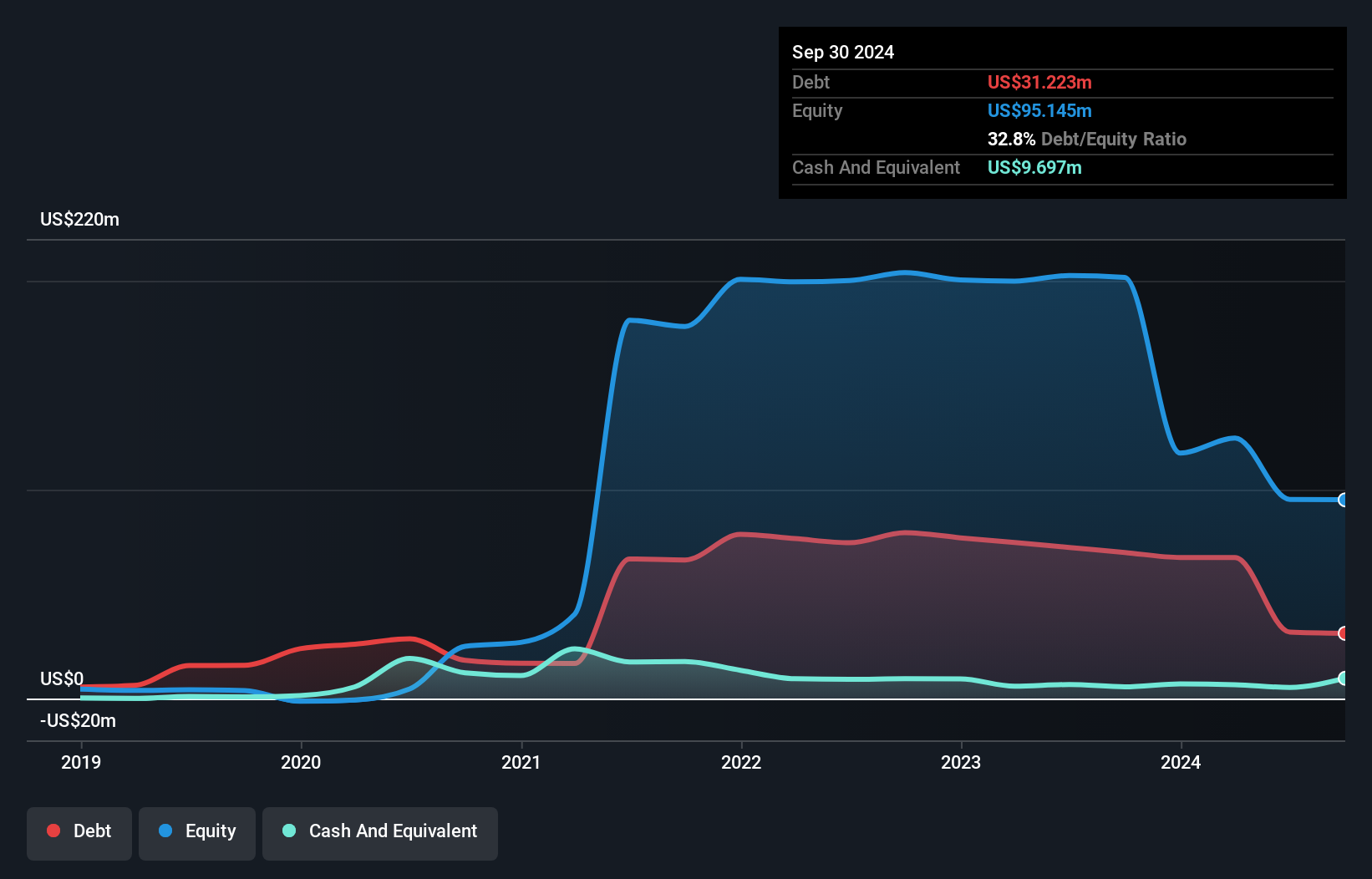

Quisitive Technology Solutions, with a market cap of CA$99.88 million, reported improved financial performance in 2024, achieving net income of US$0.285 million for Q3 compared to a loss the previous year. Despite being unprofitable historically, the company has shown positive free cash flow and maintains a sufficient cash runway for over three years. Trading at good value relative to peers and industry standards, it benefits from stable weekly volatility and satisfactory debt levels. However, challenges remain as losses have increased over five years despite revenue growth in its Global Cloud Solutions segment reaching US$118.65 million annually.

- Click here to discover the nuances of Quisitive Technology Solutions with our detailed analytical financial health report.

- Examine Quisitive Technology Solutions' earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Unlock our comprehensive list of 950 TSX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quisitive Technology Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:QUIS

Quisitive Technology Solutions

Through its subsidiaries, provides Microsoft solutions primarily in North America and South Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)