Analysts Just Shaved Their mCloud Technologies Corp. (CVE:MCLD) Forecasts Dramatically

The latest analyst coverage could presage a bad day for mCloud Technologies Corp. (CVE:MCLD), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

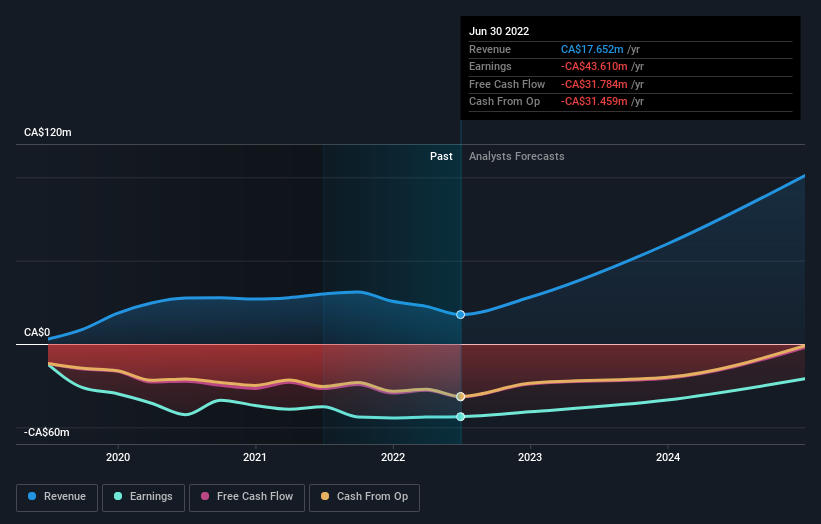

After the downgrade, the three analysts covering mCloud Technologies are now predicting revenues of CA$27m in 2022. If met, this would reflect a substantial 53% improvement in sales compared to the last 12 months. Losses are forecast to narrow 5.2% to CA$2.56 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of CA$35m and losses of CA$2.16 per share in 2022. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for mCloud Technologies

The consensus price target fell 14% to CA$5.33, implicitly signalling that lower earnings per share are a leading indicator for mCloud Technologies' valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on mCloud Technologies, with the most bullish analyst valuing it at CA$8.00 and the most bearish at CA$4.00 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the mCloud Technologies' past performance and to peers in the same industry. It's clear from the latest estimates that mCloud Technologies' rate of growth is expected to accelerate meaningfully, with the forecast 134% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 21% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 18% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect mCloud Technologies to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at mCloud Technologies. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

There might be good reason for analyst bearishness towards mCloud Technologies, like a short cash runway. Learn more, and discover the 4 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MCLD.H

mCloud Technologies

Provides asset management platform solutions combining IoT, artificial intelligence (AI), and cloud in North America, the Asia-Pacific, Europe, the Middle East, Africa, Australia, and China.

Low with limited growth.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Great dividend but share numbers have increased 100% in last 12 months!!

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.