HIVE Digital Technologies (TSXV:HIVE) Is Up 22.3% After Surpassing 20 Exahash With Paraguay Expansion – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- HIVE Digital Technologies recently announced it has surpassed 20 Exahash per second of global Bitcoin mining capacity after completing the third phase of its hydroelectric-powered facility in Paraguay.

- This milestone positions HIVE as a sustainable leader in the Bitcoin mining industry, now responsible for approximately 2% of the Bitcoin network’s current capacity.

- Let's examine how HIVE’s major hashrate expansion and commitment to green energy influence the company’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is HIVE Digital Technologies' Investment Narrative?

For anyone considering HIVE Digital Technologies, the big picture relies on conviction around continued growth in Bitcoin mining and the company’s ability to capitalize through efficiency and sustainability. The recent leap to 20 Exahash per second, backed by hydroelectric power, stands out as a transformative short-term catalyst, significantly boosting daily Bitcoin production and driving home HIVE’s green energy credentials. While this milestone reduces some operational risks and differentiates HIVE from peers on the environmental front, it also heightens exposure to the volatility of Bitcoin prices and competition among miners aiming for similar scale. Previous analysis highlighted rapid earnings growth, strong relative valuation, and stable power costs, but rising production levels could either amplify profits or operating stress if network difficulties or Bitcoin prices shift. This recent expansion could meaningfully alter the company’s risk profile and short-term priorities. On the other hand, investors should not ignore the risk of sharp changes in Bitcoin economics.

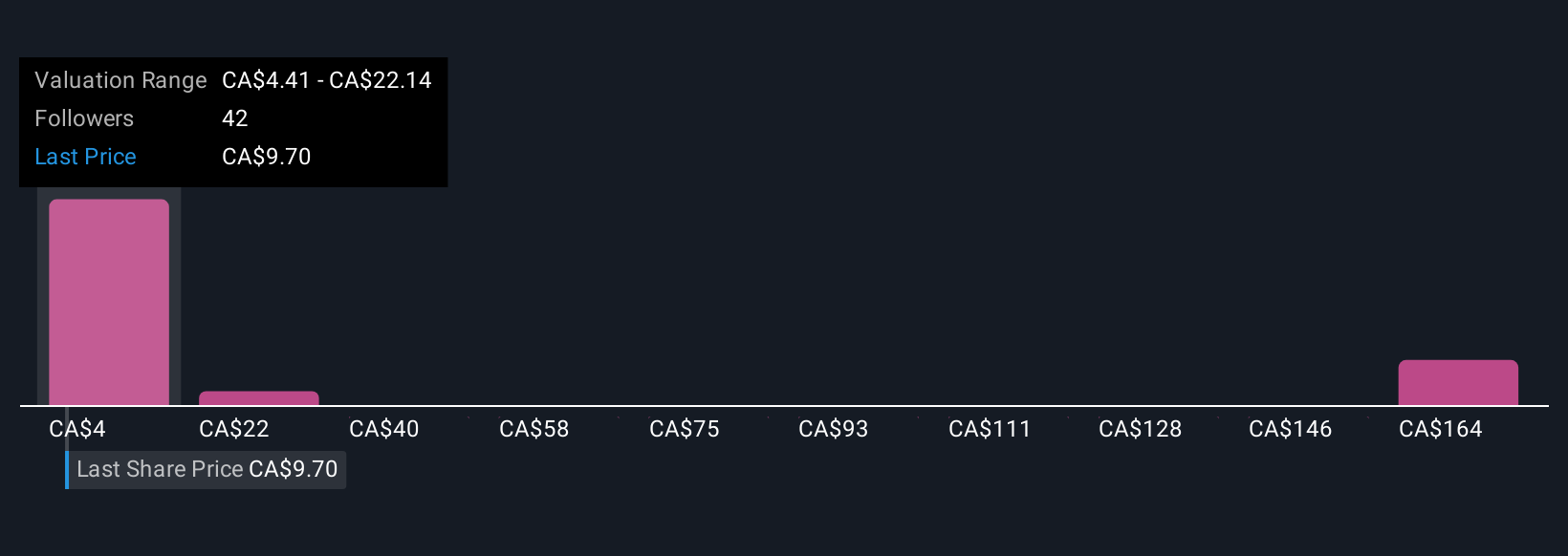

Our comprehensive valuation report raises the possibility that HIVE Digital Technologies is priced lower than what may be justified by its financials.Exploring Other Perspectives

Explore 8 other fair value estimates on HIVE Digital Technologies - why the stock might be worth 28% less than the current price!

Build Your Own HIVE Digital Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HIVE Digital Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free HIVE Digital Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HIVE Digital Technologies' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives